Lloyd’s/London

Aon's Katherine Conway: “As the insurance workforce evolves, so must company culture”

Katherine Conway, head of diversity and inclusion and community affairs at Aon, explains that D&I efforts must go beyond recruitment to now focus on company culture.

Reinsurers turn to M&A to stay relevant as challenging market forces bite

Global reinsurers have turned to mergers and acquisition deals over the last year in order to remain relevant in the face of challenging market conditions, but S&P maintains a neutral view on this trend.

Beat Capital snaps up Paraline syndicate

Venture capital firm Beat Capital Partners and Bermuda-based insurance holding company Paraline are to merge.

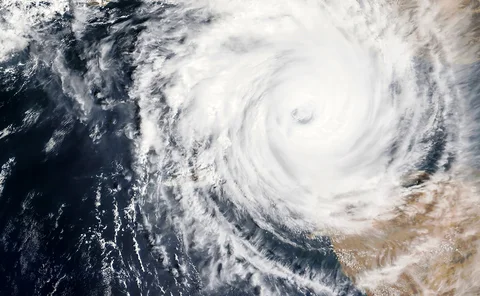

Losses expected as Hawaii bunkers down for cat 4 Hurricane

The insurance and reinsurance industry is braced for losses as category 4 Hurricane Lane continues to track towards the islands of Hawaii.

Analysis: Pricing climate risks

As climate change becomes tangible, insurers are feeling the heat. Their understanding of the risks could inform not just their underwriting but also their investment strategies.

Liiba urges Prime Minister to rethink post-Brexit equivalence regime for brokers

The London and International Insurance Brokers’ Association has written to the Prime Minister raising concerns over the government’s planned equivalence regime for brokers post-Brexit.

Japanese flood losses pegged at $4bn

Insured losses from the June and July flooding in western Japan could total up to $4bn (£3.2bn), according to catastrophe modelling firm Air Worldwide.

2018 H1 insured disaster losses below average at $20bn

Global insured losses from natural catastrophes and man-made disasters during the first half of 2018 were $20bn, 33% below the ten-year average of $35bn, according to Swiss Re Institute's preliminary sigma report.

Lloyd’s managing agents call for greater ILS use

Some 80% of Lloyd’s managing agents would like to see insurance-linked securities become a permanent fixture in the reinsurance and insurance market.

Top 30 European insurers 2018: A year of steady growth for insurers

Overall, top-line growth for the 30 largest European insurers has been steady, reflecting the underlying economic conditions throughout Europe, explain Tim Prince and Yvette Essen, director of analytics and director of research at AM Best

FSCS arranges alternative cover for Alpha policyholders

UK policyholders with failed Danish insurer Alpha have been provided alternative cover via the guarantee scheme.

This Week in Post: Data, dissuasion and dirty toddlers

When my two-year-old licked the sole of her shoe, I tried not to laugh as that might encourage her. But she caught my badly repressed smile and… licked the second shoe. So much for deterrence.

Two ex-ERS underwriters fined for misconduct

Two former ERS underwriters, including one who described himself as a ‘non-standard motor guru’ have been fined for misconduct by Lloyd’s.

Analysis: Military recruitment: A call to arms

As insurance tries to attract talent and adapt to emerging risks, the London market is increasingly turning towards the military for new recruits

LMG names Lebecq as CEO

The London Market Group has named JLT Speciality operation director Clare Lebecq as CEO.

Brit profit dives 87.5% at H1

Brit’s pre-tax profit nose-dived 87.5% in the first six months of 2018 on the back of poor investment returns.

Blog: MGAs need to know how secure their capacity is

Managing general agents are facing a capacity crunch and the 'decile 10' initiative by Lloyd's to remove underperforming business is increasing pressure, explains Chris Hardcastle, managing director of Capsicum Delegated Authority.

GRP-backed brokers Lonmar and Ropner to merge

Lloyd’s brokers Lonmar and Ropner will merge at the end of the month under the Lonmar brand.

Interview: Jonathan Davidson, Financial Conduct Authority

Insurance has come under fire for the way it prices policies. Jonathan Davidson, director of retail at the Financial Conduct Authority, discusses the problem with Martin Croucher

Market must use consortium model to attack expense base, says Hiscox chair

Carriers in the London market must work together in consortiums to spread risk, combat rising expenses ratios and mitigate underwriting pressures, Hiscox chairman Robert Childs said.

Primary and Arch back Q3 launch of McNamee's insurtech C-Quence

Insurance investment vehicle Primary Group has today been revealed as the backer for the new digital-enabled managing general agent to be launched by former AIG UK CEO Jacqueline McNamee in autumn this year.

Hiscox Retail helps drive 27% boost in group profit at H1

Hiscox saw pre-tax profit climb 27% to $164m (£125m) in the first half of 2018, with the insurer’s retail arm contributing more than half of that figure.

This week in Post: Insurance industry captures the heart and mind of at least one Millennial

Two years ago, when I told my friends that I got a job as an insurance journalist, they were baffled. They still are.

Video: Pauline Miller (Lloyd's), Jason Groves (Marsh) and Matthew Fosh (Axis) on Dive In 2018 and #time4inclusion

Time for inclusion is the theme of the fourth edition of the Dive In festival, which will take place in late September to encourage diversity in the insurance industry.