Commercial

Analysis: Whiplash bill faces bumpy ride through parliament

Vocal opposition to the Civil Liability Bill is ramping up as MPs prepare to debate it in its second reading.

Markel snaps up Nephila in insurance-linked securities deal

Markel is to buy the world’s largest manager of insurance-linked securities, Nephila Holdings.

Analysis: Diversity - how far have we really come?

Insurance has talked the diversity talk for several years now. And yet, the industry still displays all-male or all-pale panels. How can it become truly inclusive?

Vandendael to leave Lloyd’s and take up CEO role at Everest

Lloyd’s chief commercial officer, Vincent Vandendael, is to leave the Corporation after almost six years, moving to Everest Insurance as CEO of International Insurance in early 2019.

This week in Post: Do you know who's on the other end of the phone?

We have all experienced that heart-stopping moment when our phone rings and our eyes are greeted with the dreaded: "No caller ID."

Canopius teams up with Anvil on credit and political risk

Canopius has signed a partnership with credit and political risk managing general agent Anvil Underwriting.

Trans Re snaps up Maiden renewal rights as reinsurer plans to sell US arm

TransRe, the reinsurance arm of Transatlantic Holdings has acquired the exclusive renewal rights to all of Maiden Re's US treaty reinsurance underwriting business.

A museum of insurance: opening up the past to attract the future

When the Chartered Insurance Institute leaves Aldermanbury this month for a new home in the City, it will not be able to bring along many of the artifacts it has in storage. Post spoke to former president Reg Brown about how these could be rehoused in a…

Axa's Sonia Wolsey-Cooper on doing serious social good

Large insurers have the expertise to prepare for the future, writes Sonia Wolsey-Cooper, chief corporate responsibility officer at Axa UK and Ireland, urging them to fund research and strike partnerships for the common good.

THB courts UK retail brokers with MD appointment

Declan Durkan has been appointed manging director of THB UK Risk Solutions, in a move the firm says signals the group’s “renewed focus” on UK retail brokers.

Allianz Partners launches three new 'innovation centres'

Following the launch of its Automotive Innovation Centre in 2014, Allianz Partners has created three further 'innovation centres'.

LMA names Navigators’ Cameron as CEO

The Lloyd’s Market Association has named Sheila Cameron, currently head of International Operations at Navigators Underwriting, as CEO.

Apollo snaps up Aspen in $2.6bn deal

Aspen Insurance has entered an agreement with investment manager Apollo that will see it sell all remaining shares in the business for $42.75 (£33.15) per share, a total of $2.6bn (£2bn).

Analysis: Insuring musical instruments, striking the right notes

Musical instruments require insurance cover that's in tune with their tumultuous lives.

Driverless experts: Autonomy to lead to ‘brutal’ insurer consolidation

Autonomy experts expect the advent of driverless cars to result in massive amounts of consolidation and change in the motor market, with mid-size personal lines players most at risk.

This week in Post: One every minute

For those of us back in the office while the holiday season continues it might seem like time is moving slowly but the Association of British Insurers revealed this week that for every minute we count down until silly season is over and the out of office…

Reinsurers turn to M&A to stay relevant as challenging market forces bite

Global reinsurers have turned to mergers and acquisition deals over the last year in order to remain relevant in the face of challenging market conditions, but S&P maintains a neutral view on this trend.

Beat Capital snaps up Paraline syndicate

Venture capital firm Beat Capital Partners and Bermuda-based insurance holding company Paraline are to merge.

Construction industry to assess insurance access post-Grenfell

The Construction Industry Council has launched a survey to assess the impact of the Grenfell fire on insurance cover for the construction sector.

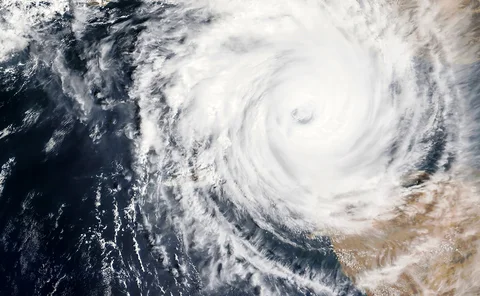

Losses expected as Hawaii bunkers down for cat 4 Hurricane

The insurance and reinsurance industry is braced for losses as category 4 Hurricane Lane continues to track towards the islands of Hawaii.

Ardonagh Group reports income boost of 9.1% at H1

The Ardonagh Group has reported income growth of 9.1% as both income and profit climb in the first six months of 2018.

Analysis: How Amazon could make waves in claims

With talk abound of a possible Amazon entry into insurance distribution, what could an Amazon entry into claims look like?

Analysis: Pricing climate risks

As climate change becomes tangible, insurers are feeling the heat. Their understanding of the risks could inform not just their underwriting but also their investment strategies.

Ecclesiastical sees premium up at H1 but profit and COR take a hit

Ecclesiastical saw strong premium growth in the first half of 2018 but pre-tax profit took a 54% nose dive.