Claims

Torrance backs clarity over burglar confrontation

Chris Grayling, pictured, plans to change the law to ensure householders who "over-react" when confronted by burglars will not face prosecution.

Large power industry claims on upward annual curve, says Marsh

The number of claims above $25m (£15.6m) emanating from the global power industry continues to rise annually, according to a Marsh report published today.

MP faces ban after driving without insurance

Jon Cruddas, the Labour MP for Dagenham and Rainham, was arrested on suspicion of driving without insurance and valid MoT.

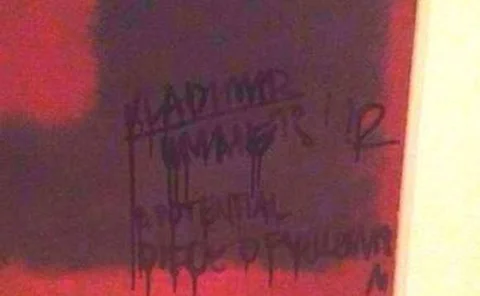

Vandalised Rothko painting can be restored

The Mark Rothko painting that was defaced at the Tate Modern on Sunday can be restored, according to Robert Read, head of art and private client at Hiscox.

UK FSCS in talks over Lemma liquidation

The Financial Services Compensation Scheme is stepping in to help customers of Lemma Europe Insurance Company Ltd after declaring the firm in default.

Travelers claims head joins Liberty

Commercial lines insurer Liberty Mutual Insurance has appointed Nikki Barrett-Browne as commercial casualty claims manager.

Cooper Gay offers free RM and BC service to terrorism clients

Intermediary Cooper Gay & Co is offering a free crisis management and business continuity consultation to its terrorism and political risks policyholders.

ALC Health launches claims monitoring service for customers

International private medical insurance provider ALC Health has launched an online member service that allows policyholders to check details as well as submit, manage and monitor claims 24 hours a day.

Kalista offers parametric catastrophe trigger for property

Bermuda-based Kalista Global has launched a property insurance product ahead of the January renewals with specific parametric catastrophe triggers to ensure savings.

Covéa fears surge in motor subrogation practices after RSA ruling

Covéa has warned that some insurance businesses may adopt motor repair subrogation cost structures similar to RSA's after a high court found in favour of the insurer.

Allianz could appeal against RSA motor subrogration judgment

Allianz may appeal against a high court judgment which found RSA's motor repair subrogation costs to be legal, despite being told that an appeal is likely to fail.

Motor subrogration appeal against RSA likely to fail, says top judge

A High Court judge has ruled in favour of the motor repair subrogration costs RSA charged Allianz and Provident, stating that the charges were reasonable even if the insurer had used its own repair network.

Post Blog: Stopping desktopping

Should loss adjusters stick to complex claims and leave the desktopping to specialists? Steve Jackson investigates.

BLM appoints head of fraud intelligence

Berrymans Lace Mawer has promoted fraud intelligence analyst Ben Fitzhugh to national head of intelligence.

Zurich scoops trio of Insurance Fraud Awards

Zurich was the main winner at the Insurance Fraud Awards last night, picking up three gongs.

The rise of pet insurance fraud

Shocking stories of claimants deliberately harming pets are guaranteed to grab headlines, but what is the truth behind the increasing level of fraud detected in a sector predicted to be worth £900m by 2015?

View from the top: Rooting out the rogues

As scrutiny of the market deepens, bad apples in the industry must be tackled from within, says Mark Cliff.

Insurance Strategy 2012: Young customers think truth won't pay

The new generation of insurance customers believes it is acceptable to be "economical with the truth" when it comes to getting insurance or making a claim, according to a report published by Consumer Intelligence.

William Russell alters Hong Kong claims process

International expatriate insurance provider William Russell has changed its out-patient claims procedure for Hong Kong-based clients.

RSA and Groupama sign motor claims agreement

RSA and Groupama Insurances have signed a bilateral agreement to help tackle the industry issue of subrogated motor repair costs.

Post magazine - 4 October 2012

The latest issue of Post is now available to subscribers as a digital and interactive e-book.

Ex-Capita boss joins price comparison site

The former chief executive of Capita Insurance Services and Minster Law, Matthew Briggs, has joined legal price comparison website Wigster.

Subrogated motor repair costs in the firing line for RSA and Groupama

RSA and Groupama have come together to sign a bilateral agreement designed to speed up the subrogated motor repair payment process and remove unnecessary costs.

Saga teams up with Parabis to offer legal services

Saga and Parabis have extended their partnership to offer a range of legal services, while Saga waits for the Solicitors Regulation Authority's decision on its own alternative business structure application.