Claims

Spotlight on Economy and Society: Run for cover

Underinsurance is an on-going issue for the industry and, without a concerted effort to tackle the problem, the effects of the financial storms may continue to strike.

Thailand floods: Back in business

The scale of the Thailand floods was not the only element to hamper recovery - they exposed a lack of loss mitigation and recovery knowledge in Asia.

Spotlight on Economy and Society: Insurance to the rescue

From the development of new technology to innovations in micro insurance, the insurance industry can play a major part in stimulating global economic growth.

Libor scandal: Coping with financial fallout

The Libor scandal has rocked public confidence in the financial services sector, but what impact will it ultimately have on the insurance industry?

Post magazine - 25 October 2012

The latest issue of Post is now available to subscribers as a digital and interactive e-book.

Interview: Kevin Wood - creating a silver lining

Taking over the reins at the Chartered Institute of Loss Adjusters just as Merlin went into administration, Kevin Wood is determined to continue the trade body's promising work.

ILGS ignores what claimants do with damages, says Kennedys

The current use of index-linked government stock ignores the reality of what claimants do with their damages, according to law firm Kennedys.

RMS heralds Insurance Institute of China appointment

RMS Beijing has been appointed as a member of the Insurance Institute of China by the eighth board of directors, with RMS' Dr Hang Gao serving as a new director.

Kennedys finance staff at risk of redundancy

Kennedys law firm has started a redundancy consultation with 70 staff in its finance department as part of plans to consolidate the non-legal department.

Car insurance at two-year low but young driver rates rising

Car insurance premiums have shrunk to their lowest level in more than two years, according to price comparison site Tiger.

Barclays ringfences a further £700m for PPI compensation

Barclays is to set aside another £700m to compensate customers who were mis-sold payment protection insurance.

Fraud 2012: Fraud register will be extended to loss adjusters

The Insurance Fraud Register could be used as a template by the Home Office to roll out a UK-wide anti-fraud checking service.

Fraud 2012: False hearing loss claims 'easy to disprove'

The insurance industry faces an increase in fraud relating to hearing loss, pet and gadget insurance and arson over the next two years, and has been urged to challenge these threats in a post-Jackson world.

Fraud 2012: IFED courts Lloyd's players

Nine Lloyd's syndicates are in talks with the Association of British Insurers with a view to signing up to use the Insurance Fraud Enforcement Department.

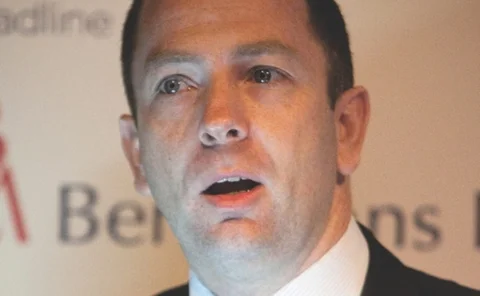

Interview: Dominic Clayden - not shaken or stirred

Aviva's UK GI claims director Dominic Clayden has been at the forefront of many claims battles over the past 15 years. He talks to Post about the upcoming civil justice reforms and the issues currently affecting the insurance industry.

Penny speed meets... Chris Shaw, commercial director, Ai Claims Solutions

Being an insatiable socialite, Penny Black is always eager to probe the personalities behind the professional veneer of her industry friends. What better way to squeeze in and share as many intimate revelations as possible than her very own ‘speed…

Household insurance roundtable: Providing clarity over questions

The Consumer Insurance (Disclosure and Representations) Act will bring fresh rigour to household insurance underwriting. Post gathered a group of experts to debate what the incoming legislation means for the market.

Claims Event: Loss adjusters claim logistics hinder further collaboration in surge events

Three loss adjuster chief executives have jointly defended any lack of collaboration on surge events compared with other sections of the insurance industry on claims issues.

Legal experts call for transparency following revised Simmons judgment

Legal experts are calling for more clarity in the implementation of government reforms, stating that "lessons must be learnt" following the Court of Appeal's revised judgment in the Simmons v Castle case.

Claims Event: Ecclesiastical calls for metal theft action

Ecclesiastical's technical claims consultant has called for insurers and the Association of British Insurers, as well as clients and government, to step up their collective efforts in tackling metal theft.

Claims Event: ABI admits final riot claims may end up in court

The Association of British Insurers has confirmed that it is embroiled in meetings with police in a bid to conclude outstanding riot claims, and conceded that some cases may end up in court.

Claims Event: OFT director deems GTA an inadequate solution

The general terms of agreement between insurers and credit hire organisations "is not an adequate solution to the problem" of motor market "dysfunctionality", according to a director at the Office of Fair Trading.

Disease claims: Cure or curse?

Will Lord Justice Jackson's cost reforms, set to be implemented in less than six months, have a positive or negative impact on the disease claims market?

Editor's comment: In the line of fire and flood

Industry reaction to surge events is never far from the debating arena when it comes to learning lessons from catastrophic floods or fires, and loss adjusters frequently find themselves in the line of fire.