Articles by Emma Ann Hughes

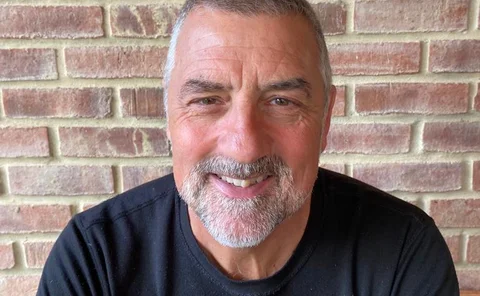

Jason Storah, Aviva UK

Jason Storah was appointed CEO of UK and Ireland general insurance in August 2023 and has swiftly managed to shake up the market with takeover talks.

Adam Winslow, Direct Line

Since becoming CEO of Direct Line Group, Adam Winslow has dealt with two rivals bidding for his business, produced a plan to return the insurer to profit, and launched new personal lines products.

Ant Middle, Ageas

Ant Middle became CEO at Ageas UK in June 2020 and launched a four-year strategy focused on personal lines insurance, accelerating the provider's profitable growth.

Jason Harris, QBE

Jason Harris is an underwriter by background who started his career in offshore energy and joined QBE as CEO for international in October 2020.

Nick Turner, NFU Mutual

Unlike Labour chancellor Rachel Reeves, NFU Mutual Group CEO Nick Turner understands what it takes to satisfy the farming community.

Hannah Gurga, ABI and Graeme Trudgill, Biba

In joint 21st place on Insurance Post's Power List 2025 is Hannah Gurga, director general of the Association of British Insurers, and Graeme Trudgill, CEO of the British Insurance Brokers’ Association, who have both fought tirelessly to slash the amount…

Steve Tooze, Extinction Rebellion

Steve Tooze, spokesperson for climate pressure group Extinction Rebellion, is a man with a plan for direct action against insurance companies. His approach has made the other movers and shakers on Insurance Post's Power List 2025 sit up and take notice.

Paul Morden, Munich Re

Paul Morden is CEO of Munich Re’s life reinsurance strategy in the UK and Ireland.

Neil Galjaard, Markel UK

Neil Galjaard, Markel’s managing director in the UK, leads its retail business across insurance, tax, and legal services, collaborating with brokers, accountants and lawyers.

Chris Lay, Marsh McLennan

Chris Lay, CEO of Marsh McLennan UK, isn’t afraid of taking the regulators to task over the disproportionate amount of red tape restricting the growth of broking businesses.

Paul Jewell, Bridgehaven

Bridgehaven CEO Paul Jewell launched the UK’s first hybrid fronting insurer in the summer of 2023 and his business is already on track to achieve £400m to £500m of gross written premium by the end of 2025.

Matthew Crummack, Domestic & General

Matthew Crummack was appointed CEO of the Domestic & General Group in October 2021 and is leading the transformation of the 113-year-old business.

Louise O’Shea, CFC

Louise O’Shea became group CEO of CFC in 2024 and is passionate about driving growth and cementing the business’s position as a leader in innovation, while creating an inclusive culture for all.

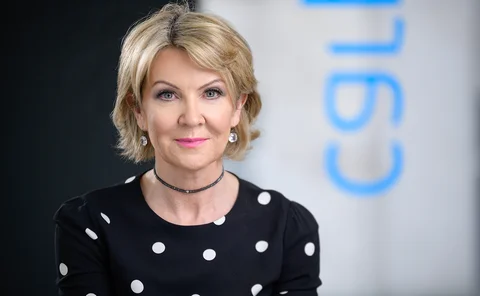

Donna Scully, Carpenters Group

Donna Scully is joint owner and director of insurance and legal services provider Carpenters Group and she isn't afraid of fearlessly tackling topics such as fraud and social mobility in the sector.

Dan Saulter, Davies

Dan Saulter, group CEO of Davies, has sauntered into Post’s Power List this year after stepping up the global business's ESG and EDI efforts in 2024.

Sam White, Stella Insurance

Sam White is the multi-award-winning founder of Freedom Services Group and Stella Insurance Australia who is making waves in female finance.

Steve Hardy, Policy Expert

By making the most of his quarter century of insurance industry experience, Steve Hardy has pushed Policy Expert to rapid growth in recent years.

Mark Roberts, Chubb

Mark Roberts is division president responsible for Chubb’s property and casualty, accident and health, high-net-worth, and consumer lines operations across the UK, Ireland and South Africa

Paul Lofkin, Crawford

With more than 20 years’ experience in the insurance sector, Crawford’s president for the UK and Ireland Paul Lofkin has a proven track record of driving strategic growth, encouraging innovation, and delivering effective results across the claims value…

Neil Gibson, Sedgwick

Neil Gibson leads Sedgwick’s loss adjusting and claims management business in the UK and is at the forefront of making this part of the sector more sustainable and inclusive.

Steven Wallace, McLarens

Steven Wallace is managing director of UK and EMEA for global claims services provider McLarens.

Stephanie Ogden, HDI Global

Stephanie Ogden, CEO of HDI Global, has risen up the sector’s ranks at breakneck speed.

Ajay Mistry, iCan

Ajay Mistry has consistently raised the bar for multicultural inclusion and career progression as co-founder and co-chair of iCan, the Insurance Cultural Awareness Network.

Stuart McMurdo, Accredited UK and Europe

Stuart McMurdo is president of Accredited UK and Europe, which has swiftly established itself as a leading specialty MGA insurer.