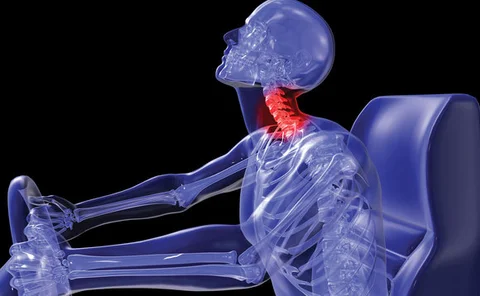

Whiplash

Campaign group slams ABI personal injury survey as 'worthless propaganda'

Exclusive: Access to Justice has unleashed a barrage of criticism over a survey commissioned by the Association of British Insurers, claiming it is “worthless propaganda”.

Survey: Majority of public back personal injury reforms

Two-thirds of people feel “positive” about the proposed changes to personal injury compensation, a Consumer Intelligence survey commissioned by the Association of British Insurers shows.

CMC regulatory burden should fall on insurers too, argues legal sector

Claimant lawyers have slammed the financial watchdog’s proposal to regulate claims management companies, arguing it unfairly penalises practicing firms and that insurers should be made to take a share of the burden too.

Four family members sentenced for ‘crash for cash’ claims worth over £40,000

Four men have been sentenced for carrying out a series of ‘crash for cash’ frauds, and then claiming against fraudulent insurance policies.

Regulation of CMCs to cost £16.8m

The cost of regulating claims management companies could be £16.8m with the bill falling on the firms themselves, according to the Financial Conduct Authority.

Ageas' Andy Watson on pushing for a realistic Brexit plan

Insurers need to keep pushing their priorities now for an effective Brexit plan, writes Andy Watson, CEO of Ageas UK, urging the industry to work with the government to achieve a realistic negotiating strategy.

Whiplash rethink urged as motor claims fall

The number of road accident claims fell in the first half of the year, compared to the same period last year.

This Week in Post: Data, dissuasion and dirty toddlers

When my two-year-old licked the sole of her shoe, I tried not to laugh as that might encourage her. But she caught my badly repressed smile and… licked the second shoe. So much for deterrence.

Mass’s Simon Stanfield on how whiplash reform sacrifices legitimate claims

The government's whiplash reforms discriminate against legitimate claimants, whose rights need to be protected, argues Simon Stanfield, chair of the Motor Accident Solicitors Society.

Motor market ‘rational’ amid uncertain pricing and whiplash reform: Geddes

The motor insurance market has kept a ‘rational’ head amidst uncertain pricing and changing whiplash reform, Direct Line Group’s CEO Paul Geddes said.

Blog: Whiplash reforms will present operational challenges for insurers, warns a claimant lawyer

Alan Hayes, chief legal officer of Carpenters Group, argues the delayed whiplash reforms will likely bring unintended consequences.

This week in Post: Insurance industry captures the heart and mind of at least one Millennial

Two years ago, when I told my friends that I got a job as an insurance journalist, they were baffled. They still are.

Government delays whiplash reforms until 2020

Hotly anticipated personal injury reforms have been delayed a year, the government has confirmed.

Analysis: Beauty fraud: No pain, no gain

In an era of Instagram brows and duck lip selfies, the beauty industry is thriving. While most customers visit their hairdresser, nail bar or tanning salon to look smoking hot, others see a beauty treatment as a route to a windfall, via a fraudulent…

Whiplash reforms encounter further delays

The second reading of the Civil Liability Bill may be pushed back to September, once parliament has held its summer recess.

Motor market back in the money with best results for over 20 years

The motor insurance market has reported its best underwriting result in over 20 years, according to EY.

Ex-Quindell firm to target 10% of med reporting market

Former Quindell business Mobile Doctors has laid out plans to capture 10% of the medical report market by 2021.

This week in Post: Bullying, Brexit and big predictions

This week in Post, the government said that it is considering plans to exclude cyclists and vulnerable road users from the proposed £5000 limit on fast track claims.

Cyclists could be excluded from rise in small claims limit

The government is considering plans to exclude cyclists and other vulnerable road users from the proposed £5000 limit on the small claims track.

Analysis: Is Scotland emerging as a heartland for personal injury claims?

The proposed Civil Liability Bill is set to introduce sweeping changes to the way soft tissue injury claims are paid out in England and Wales. In Scotland though, it would seem as though the effect of the whiplash reforms south of the border could…

This week: The power of the collective

The Post team is feeling proud this week, having not just reached our fundraising target of £500 for our charity run through mud but having exceeded it well before deadline date. Thanks to all that have supported us so far.

Aviva rejects one in eight whiplash claims

Aviva now rejects one in eight whiplash claims as suspect or fraudulent, the company said, as it revealed a 5.6% growth in fraud last year.

Rising star: Claire Tyler, Allianz

Claire Tyler cut her teeth in insurance during the management trainee graduate programme at Enterprise Rent-A-Car. From there, she entered the Allianz claims graduate scheme and worked her way up to become a senior claims handler