Property

Subsidence surge sees claims up 300% in 2018

It has been predicted that 2018 won’t be just a subsidence surge year, but one that will see the greatest upsurge in claims over a two year period.

Relaunched insurer Folgate to write £35m in first year

Exclusive: Folgate will write £35m in premium in its first year of operations following its relaunch as an insurer, the company said.

California wildfire losses expected to hit record levels

The losses from the continuing 8 November California wildfires are expected to reach record levels, according to ratings agencies.

RSA pulls out of three London market lines

RSA is withdrawing from three of its business lines as part of a restructure of its specialty and wholesale business.

Analysis: Renovation fires - Learning from history

When extensive renovations are carried out on properties fire poses a risk. Rachel Gordon investigates what insurers are doing to mitigate this happening.

Barbican syndicate takes ‘hard decision’ to withdraw from multiple lines

Barbican’s syndicate will withdraw from property, marine cargo and hull, and professional indemnity insurance.

Michael Rea says there are more acquisitions to come for Gallagher's retail arm

Gallagher’s purchase of a controlling stake in UK specialist property broker, Vasek, is the third acquisition made by the company’s UK retail arm this year, but it shows no signs of stopping just yet.

Gallagher continues acquisition spree with the addition of specialist property broker

Gallagher has acquired a controlling interest in Purple Bridge Group, the holding company of UK specialist property broker Vasek Insurance Services.

Analysis: Are cavity wall insulation claims the new PPI?

Insurers are seeing a spike in people claiming improper installation of cavity wall insulation. Is this the new money spinner for CMCs?

Axa signs £30m capacity deal with SME MGA

Axa has agreed a £30m three-year capacity deal with SME managing general agent Origin UW.

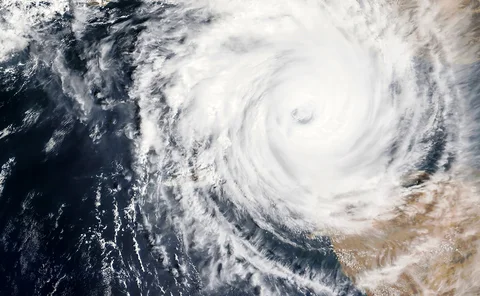

Cost of Hurricane Michael could hit $21bn including up to $10bn of insured losses

A week on from Hurricane Michael making landfall in Florida, estimates of the cost of the are beginning to emerge, running to as much as $21bn (£16.25bn).

Ex-Validus director of strategy John Hendrickson appointed Starstone CEO

Global specialty insurer, Starstone have announced that they have appointed John Hendrickson as group CEO.

Cincinnati acquires Lloyd’s syndicate from Munich Re

Cincinnati Financial has reached an agreement to acquire Munich Re subsidiary MSP Underwriting for £102m – a deal that we see them enter the Lloyd’s market for the first time.

Top 100 UK insurers 2018

In 2017, the combined underwriting results of the largest 100 UK non-life insurers improved but remained in the red. How well did insurers perform under pressure from strong competition and unfavourable claims trends?

Analysis: Application interrogation

People who want to insure their home can’t always answer technical questions about their property. Insurers are calling on digital technologies to overhaul the whole application process

Dog attacks: Liability bites

Injuries and damage potentially caused by dogs can be covered by pet or household policies. But there is a market for liability products, if not for owners, definitely for canine businesses

Claims II: Victims of Nice terrorist truck attack receive €37m

Two years after the truck attack in Nice, southern France, the terror compensation fund has paid out €37m (£33m) to 2135 victims, who were either injured in the attack or are relatives of casualties.

Commercial insurance fraud: Where future priorities lie

Closing the gap between the commercial and personal lines insurance sectors in the battle against fraud is a growing priority. Sara Costantini, director at Crif Decision Solutions, looks at what can be done now and where might the future priorities lie.

Reinsurers turn to M&A to stay relevant as challenging market forces bite

Global reinsurers have turned to mergers and acquisition deals over the last year in order to remain relevant in the face of challenging market conditions, but S&P maintains a neutral view on this trend.

Construction industry to assess insurance access post-Grenfell

The Construction Industry Council has launched a survey to assess the impact of the Grenfell fire on insurance cover for the construction sector.

Losses expected as Hawaii bunkers down for cat 4 Hurricane

The insurance and reinsurance industry is braced for losses as category 4 Hurricane Lane continues to track towards the islands of Hawaii.

One insurance scam seen every minute in 2017

Over half a million attempts at insurance fraud were detected in 2017, equivalent to one fraud every minute.

2018 H1 insured disaster losses below average at $20bn

Global insured losses from natural catastrophes and man-made disasters during the first half of 2018 were $20bn, 33% below the ten-year average of $35bn, according to Swiss Re Institute's preliminary sigma report.

Top 30 European insurers 2018: A year of steady growth for insurers

Overall, top-line growth for the 30 largest European insurers has been steady, reflecting the underlying economic conditions throughout Europe, explain Tim Prince and Yvette Essen, director of analytics and director of research at AM Best