Property

Analysis: Supply chains: Pruning supply risks

With supply chains entwined through businesses like ivy, disruption risks are climbing. Under-utilised policy wordings and little-known specialist covers haven’t weeded them out

Peter Cullum-backed Lexicon targets growth with Oasis buy

Peter Cullum-backed Lexicon Property has acquired Oasis Property Insurance Services.

Interview: Faizal Karbani, CEO, Insure Halal

Halal Insure has recently launched sharia-compliant household insurance covers. Its CEO Faizal Karbani speaks to David Worsfold about his hopes for takaful insurance in the UK.

Blog: Why brokers remain relevant

Ahead of the Biba conference, Adrian Ewington, underwriting and markets director at Home & Legacy, explains why brokers remain relevant, especially in the high-net-worth market.

Analysis: Tracking rail risks

Railways are travelling through a changing landscape of severe weather risks and terror perils, but perhaps none so arresting as the cyber threats raised by their new reliance on digital connectivity

Lancashire profit jumps 48% in Q1

Property and casualty insurer Lancashire Holdings saw a 48% jump in pre-tax profit for the first-quarter.

Analysis: Covering collapses - Trade credit claims are rising

Last year, trade credit insurance payouts hit their highest level in nearly a decade, with claims costs running at the equivalent of £4.3m every week.

Blog: I(nsured), robot

It is unlikely that all robots will require cover, Victor Fornasier and Kathryn Mycock, partner and associate at Hogan Lovells, examine the rationale for compulsory insurance.

Analysis: Liability war rages over Grenfell-style cladding replacement claims

A battle is raging over who is liable for costs to replace cladding on high-rise residential buildings across the country

Post-Grenfell research lays bare fire safety test failures

Research conducted on behalf of the insurance industry in the wake of the Grenfell Tower fire has exposed the scale of fire safety testing failures.

Month in Post: He’s back and will bite at your ankles

There is always something troubling about a disembodied head. More so, when it is Arnie’s head and it is shouting at people at the bus stop.

Brokers informed Q&A: Chubb's Karen Strong and Dan Atkinson

Chubb’s Karen Strong and Dan Atkinson talk to Jonathan Swift about why Chubb reviewed its real estate offering and how it intends to take this to the ‘next level’ with hires and delivering a ‘complete solution’ to clients

Brokers informed: W&I for bricks and mortar

Warranty and indemnity insurance has seen significant growth in the real estate sector over the last few years. And, with the cover offering significant advantages to those involved in real estate deals, many expect it to become a standard part of any…

Blog: The five peril categories to better manage cyber risks

There needs to be a significant shift in how cyber risk is understood and managed to help boards have a more accurate view of potential losses, as well as opportunities. Robert Vescio, chief analytics officer, SSIC, explains how using five peril…

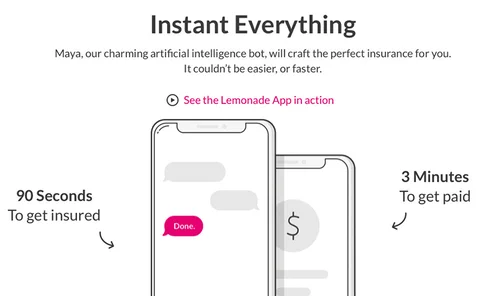

Roundtable: Using data to defend your territory

Insurers have been exploiting data for decades to underwrite risks. Could they use that know-how to market their products better - and stop tech giants from taking their customers?

Analysis: What happened to CBL Insurance?

Last month once again saw a passported insurer placed into liquidation, with the collapse of CBL causing ripples throughout Europe

Analysis: Risks, challenges and opportunities of commercial use of listed buildings

Underinsurance casts a long shadow across the world of listed properties, especially when owners are constantly expanding commercial activities. Experts warn that there can be many traps for the unwary or naïve, many of which do not come to light until…

Blog: 'Beast from the East' hits farms hard

The 'Beast from the East' has killed sheep, stopped milk collections and destroyed farm buildings. Graham Plaister, loss adjuster at Agrical, describes the tempest of claims blowing through the sector.

Blog: Beast from the East opens the valves for escape of water claims

The 'Beast from the East' and storm Emma have caused a surge in escape of water claims, notes Clive Nicholls, UK and Ireland CEO of Crawford & Company, urging the insurance industry to unite to promote preventative measures.

Blog: Letting agents, beware of an energy shake-up

No stone is being left unturned by the government in its aim to make renting fair and reasonable. Marc Brewer, underwriting manager for professional risks, Tokio Marine HCC, says it could prove a tough year for the letting industry.

Blog: Non-damage business interruption comes ashore

Non-damage business interruption has long existed in the maritime sector and could come ashore for companies looking to protect themselves, especially from cyber risk, explains David Williams, underwriter at The Strike Club.

Axa-XL deal puts both insurers' ratings under review

The major rating agencies have unanimously taken rating actions on both Axa and XL Group following the recent announcement that the French insurance giant is looking to acquire 100% of the specialty insurer.