Product

Ageas reveals AI has saved business more than £4m

Ageas has saved more than £4m due to the use of artificial intelligence, with £2m of the savings coming from AI-enhanced fraud models.

Consumers want Amazon and Tesla embedded insurance products

Four out of 10 consumers would be comfortable with the idea of buying insurance from companies such as Ikea, Amazon, or Tesla when making purchases from those brands, according to Guidewire’s Insurance Consumer Survey 2024.

Axa and Zego reject generative AI for pricing

Axa and Zego have ruled out using generative artificial intelligence for pricing due to compliance concerns.

Is insurer service really that bad?

News Editor View: After comments from Jensten’s Alistair Hardie earlier this week saying no insurer gets service right and that we should “rip up the service rule book and start again”, Scott McGee asks: Is it really that bad?

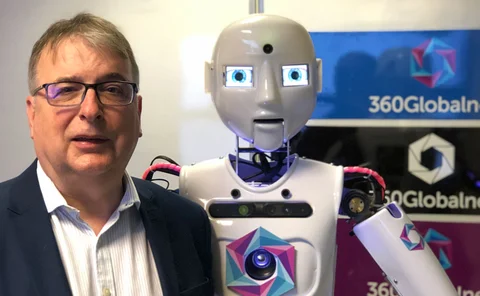

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

Big Interview: Alistair Hardie, Jensten Group

Alistair Hardie, CEO of Jensten Group, updates Scott McGee on the broker’s anticipated sale, its “radical overhaul”, and where it may shift its M&A focus to in the future.

Mounting dissatisfaction with home insurance as premiums increase

Data analysis: NFU Mutual, Bank of Scotland, Nationwide, Saga, and Co-operative Insurance have the most satisfied home insurance customers, according to research by Fairer Finance.

Allianz launches three-tier home insurance product

Allianz has launched a three-tier home insurance product in order to “provide more choice” for customers.

Q&A: Richard Clarkson, WTW

Richard Clarkson, global market leader, global specialty for insurance consulting and technology at WTW, explains how the business is working to help global specialty carriers reduce costs across underwriting, trading, and technical actuarial processes.

How is insurance stepping up amid election uncertainty?

With a record number of elections in 2024 set to introduce substantial unpredictability into an already volatile risk environment, Edmund Tirbutt examines how insurance is engendering resilience amidst unrelenting geoeconomic uncertainty.

Labour repeats call for premium investigations

Shadow transport secretary Louise Haigh has promised to call on the Financial Conduct Authority and Competition and Markets Authority to investigate the cost of motor insurance.

How Covid changed travel insurance laid bare

Anna-Marie Duthie, insight consultant for general insurance at Defaqto, examines how the Covid-19 pandemic and price comparison websites have transformed travel insurance and explains why some providers are feeling the pressure of the Consumer Duty rules.

Diary of an Insurer: Starpeak’s Andy Brownsell

Andy Brownsell, commercial director of Starpeak, discusses data privacy, catches up with insurers to discuss sign-off for binder renewal and meets with a prospective new capacity provider.

NSM buys AllClear owner; Axa’s Uefa partnership; Brown & Brown’s UK retail CEO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Is premium finance still a tax on the poor?

News Editor’s View: Scott McGee considers whether recent steps taken by trade bodies to address premium finance will reassure the Financial Conduct Authority that this payment method is no longer a ‘tax on being poor’ that needs to be tackled.

Applied building momentum as it enters pilot with Aviva

After increasing the number of brokers on its Epic platform in 2023, Applied Systems Europe CEO Tom Needs said he expects to match that growth again this year.

Aon’s carbon offering; Arch’s events cover; WTW’s war facility

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Sobering reading for those with a Biba hangover

Editor’s View: If you are nursing a hangover after going to this year’s British Insurance Brokers’ Association conference then Emma Ann Hughes reckons you missed the point of attending the annual gathering in Manchester.

First Central cautiously enters home insurance market

First Central has launched a home insurance product line, with the firm planning to take a “cautious approach” to building its book.

Online HNW insurance options not ‘fit for purpose’

The founder and CEO of Rivr, a newly launched firm focussing on HNW home insurance, has told Insurance Post that online options for high to mid net worth customers are “not fit for purpose”.

Insurtechs outpacing large insurers in using cloud cyber risk data

Big insurers in the cyber insurance space need to emulate insurtechs in adopting technology that can integrate cybersecurity-enhancing data from cloud providers, according to Monica Shokrai, Google Cloud’s head of business risk and insurance.

Ageas’ sustainability workshop; Addept acquires Policywise; Co-op’s renters insurance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Q&A: Matt Hicks, Recorder

Matt Hicks, chief commercial officer and co-founder of Recorder, a new London-based insurtech from the creators of Codat, explains how he has built a platform and artificial intelligence co-pilot for brokers.

EV manufacturers to face competition from China

Allianz chief claims officer Graham Gibson has told Insurance Post that electric vehicle OEMs "have their work cut out for them" ahead of stiff competition from Chinese firms entering the market.