Mergers & acquisitions (M&A)

CFC's focus remains on organic growth following its first acquisition in 20 years

CFC Underwriting made its first acquisition in its 20 year history yesterday when it bought Solis Security, but the purchase will not mark a change in its acquisitive appetite, CFC chief innovation officer Graeme Newman told Post.

CFC makes first acquisition in 20 years as it buys Solis Security

CFC Underwriting has bought Texas-based incident response provider Solis Security, marking the company’s first acquisition in 20 years.

Allianz and LV wrap up transfer of commercial business

Exclusive: The transfer of commercial and personal lines business between LV and Allianz has been completed, with the exception of a “small number” of schemes policies.

PE house swoops for Charles Taylor in £261m deal

Private equity firm Lovell Minnick Partners has made a £261m offer to buy Charles Taylor, with an aim to de-list it.

Blog: No more hard and soft - are corporate flip-flops the new insurance cycle you CAN rely on?

Content director Jonathan Swift reflects on RSA's decision to create one commercial division and gets a sense of Deja-Vu that he's been here before

Claims Consortium completes acquisition of Stream

Claims Consortium Group has completed its acquisition of Stream Claims Services.

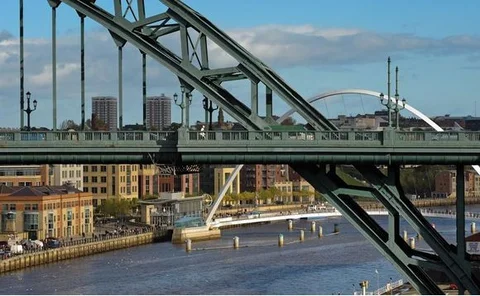

Keoghs swoops for Newcastle firm’s insurance practice

Keoghs has bought Newcastle-based Sintons’ defendant insurance business.

This week in Post: Culture vultures

At the Monte Carlo annual rendezvous this week, Lloyd’s chairman Bruce Carnegie-Brown said the corporation was ready to “hang” perpetrators of bad behaviour after its culture survey revealed some “sobering” results.

Clear Insurance acquires Morrison Insurance Solutions

Clear Insurance Management has acquired Alcester-based Morrison Insurance Solutions, its largest acquisition to date.

Hyperion to merge RKH and Howden

Hyperion will bring Howden and RKH together under a single management structure.

RSA merges commercial businesses

RSA UK & International has merged its Commercial Risk Solutions and Global Risk Solutions businesses to create a single business unit focused on commercial lines, as it seeks to regain profitability.

Charles Taylor to sell managing agency as it posts £2.1m loss

Charles Taylor saw a pre-tax loss of £2.1m as the group announced the sale of its managing agency to Premia Holdings.

Jelf to rebrand as Marsh Commercial amid restructure

Marsh will rename its Jelf business Marsh Commercial in the first quarter of 2020, with potential branch closures as a result of an organisational restructure.

From Bolton to Palace; Gretna to Argyle - when insurance personalities invest time and money in football

As former Sabre CEO Keith Morris backs the Bolton Wanderers FC buyout, Post content director Jonathan Swift looks at other insurance individuals who have been closely involved in football over the last two decades.

Gallagher acquires lettings and landlord specialists RGA Group

Gallagher has acquired RGA Group, a lettings and landlord broker based in Brentford, marking a return to acquisitions eight months on from its acquisition of Stackhouse Poland.

Sedgwick completes acquisition of York Risk Services

Sedgwick has completed its third acquisition of the year with the purchase of York Risk Services.

Finch group completes its biggest acquisition to date

Finch group has completed the acquisition of Bridle Insurance, bringing £10m in gross written premium to the company.

Goldman Sachs' acquisition of Aston Lark completes

Goldman Sachs’ merchant banking division’s purchase of majority stake in Aston Lark has completed.

Aston Lark buys first Manchester broker

Aston Lark has bought Manchester-based commercial lines broker Buckland Harvester.

Ardonagh reveals future plan for Swinton as all branches close

Ardonagh group has confirmed the closure of all Swinton branches as the integration of the business is almost complete.

Ardonagh posts loss of £44.5m for the first half of the year

Ardonagh Group has posted a loss of £44.5m for the first six months of 2019, an increase of £11.7m on the £32.8m loss reported for the same period last year.

PIB u-turns on pledge to keep childcare broker brand

PIB will now integrate childcare broker Albany Childcare into Morton Michel, despite pledging at the time of purchase it would keep the brand.

GRP acquires online enterprise risk management firm

Essex-based risk management specialist Health and Safety Click has been bought by consolidator GRP.