Home insurance

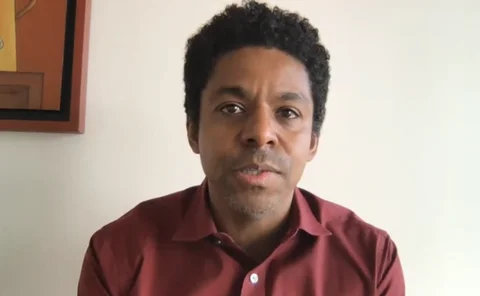

Big Interview: Nadia Côté and Serge Raffard, Allianz

After being named managing directors of Allianz Commercial and Allianz Personal, respectively, Nadia Côté and Serge Raffard met with Scott McGee to discuss their respective markets, how they have settled in, and where they see their businesses growing in…

Admiral tipped as preferred bidder for RSA home and pet books

Admiral is the preferred bidder for the RSA household and pet insurance books, Insurance Post can reveal.

Axa and Synectics partner; Tesco to offer non-standard home; Markerstudy's three NEDs

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Atec Group chief reveals plan to grow business

Brendan Devine, CEO of Atec Group, has told Insurance Post the foundations are in place to achieve £25m in turnover in 2024 with growth coming from non-standard home insurance.

PL insurers continue to face rising material and labour costs

Both home and motor insurers are continuing to feel the effects of the rising costs of labour and materials, according to reports from Verisk and the Association of British Insurers.

Insurers risk being ‘left behind’ if they don’t share data

Insurers that don’t share claims data with the wider market risk being “left behind”, LexisNexis Risk Solutions’ James Burton has told Insurance Post.

Why cannabis farms are a growing problem for property insurers

Analysis: Fiona Nicolson examines why the illegal cultivation of cannabis is a growing problem for both residential and commercial landlords as well as the wider community.

Home insurance costs continue to rise following ‘worst year on record’

Analysis by Ernst & Young has revealed that home insurance suffered its worst year on record in 2022, and fortunes aren’t about to change.

Five brokers to scrap third-party leasehold commissions

Five insurance broking groups have pledged to stop sharing buildings insurance commissions with landlords and to cap their own fees.

CII young brokers turn to TikTok to fight talent war

The Chartered Insurance Institute’s New Generation Broking Group is turning to TikTok and Instagram to attract fresh talent to the industry.

60 Seconds With... Liz Tytler, Movo Partnership

Liz Tytler, head of claims at Movo Partnership, is the reason you have cow signs with horns and udders, plus she is a Dancing Queen - so long as she has had a drink.

EE to offer consumer electronic insurance

EE is branching out of its smartphone and broadband contract roots by now offering insurance.

Amazon ramping up as the Insurance Store turns one

One year on from the launch of the Amazon Insurance Store, Scott McGee catches up with the world's largest online retailer to discuss progress to date and what the industry can expect going forward.

PL insurers to face ‘double whammy’ to margins in 2024

A report from Bloomberg Intelligence has warned that the margins of UK insurers such as Admiral and Direct Line face a “double whammy” of claims inflation and regulation in 2024.

Essential policy providers accused of price walking practices

Regulatory experts have urged insurers to check whether their pushing of “essential” home and motor policies isn’t replicating the price walking sales practices that have been banned by the Financial Conduct Authority.

Motor and home premiums at ‘peak of the pricing cycle’

Figures released by Pearson Ham have revealed that home and motor premiums have further increased in the third quarter, as we reach ‘the peak of the pricing cycle’.

FCA promises action against overcharging brokers

The Financial Conduct Authority has warned brokers it will “take action” against those charging inflated commissions for arranging cladding cover, with some charging up to 62%.

Top 75 MGAs: Avantia

Avantia, the investment company behind Homeprotect, a direct-to-consumer brand for home insurance, appears in this year’s Insurance Post Top 75 MGAs list.

Top 75 MGAs: Policy Expert

Policy Expert’s more than one million UK customers has secured the business a place at the top of this year’s Insurance Post Top 75 MGAs list.

Top 75 MGAs: EGV Holdings

EGV Holdings is continually developing a stable of MGAs, earning the business a place in this year’s Top 75 MGAs list.

Top 75 MGAs: Prestige Underwriting

Prestige Underwriting celebrated its 25th year in 2022 and 20% above plan growth helped the business achieve a place in this year’s Top 75 MGAs list.

Top 75 MGAs: Brown & Brown

Brown & Brown's main MGA-MGU activities dealing in UK-based non-life risks in 2022 earning the business a place on the Top 75 MGAs list were Camberford Underwriting, Decus, Mithras Underwriting and Plum Underwriting.

Top 75 MGAs 2023: Markerstudy

Markerstudy was named one of the country’s two biggest MGAs after achieving revenues of between £80m and £100m for UK-based non-life risks in 2022.

Property claim times to benefit from migrant construction worker influx

The government’s decision to relax the rules for construction workers to enter the UK from abroad, should increase the pool of skilled workers available for property repairs, said Verisk’s head of property Ben Blain, following the release of Verisk’s…