Sponsored

Why buildings sums insured should be 82% higher

Blog: With inflation driving a significant widening of the underinsurance gap, RebuildCostASSESSMENT.com’s Ewan Sandison highlights the urgent need for brokers and insurers to reassess building sums insured.

Spotlight: Do insurers dream of electric fleets?

Time is running out for insurers to seize the initiative in support of electric vehicles and zero-emission motoring, says James Roberts, head of insurance sales at Europcar.

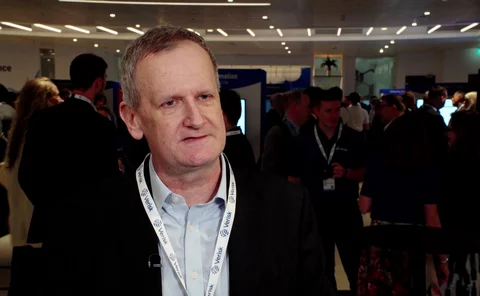

Video Q&A: Europcar head of insurance sales James Roberts

In the latest Insurance Post video, Europcar head of insurance sales James Roberts addresses the key trends that will shape the automotive and motor insurance sectors in 2025 and beyond.

Digitalise and conquer: Mastering insurance modernisation strategies

In today’s rapidly evolving insurance landscape, digitalisation is no longer optional – it’s imperative. Insurers are grappling with the challenges posed by inflexible legacy systems, heightened customer expectations, and stringent compliance demands.

Spotlight: Better terms for the GTA?

Industry guidelines and protocols covering replacement vehicles and repairs haven’t always met with consensus from insurers and credit hire firms. So how will the new General Terms of Agreement fare? asks Saxon East

Spotlight: Buildings underinsurance

This Insurance Post Spotlight series explores the widespread problem of buildings underinsurance, its impact on business owners and individuals, and how insurers and brokers can help customers address the issue.

Blog: What impact will construction costs have on underinsurance?

After a relatively stable 2024 compared with recent years, RebuildCostASSESSMENT.com’s Ben Richmond explores what 2025 could look like for construction inflation and material costs, and the likely impact on buildings underinsurance.

Video Q&A: A smarter approach to home insurance claims

In the latest Insurance Post video, Ryan Macdonald, principal product manager, CoreLogic, explains how it developed Claims Engage to help insurers address gaps in property claims management.

Spotlight: Electric vehicles charge ahead

Electric vehicles continue to make major inroads in the car market. Saxon East assesses the prospect of accelerated EV growth in 2025 and what it means for the insurance industry

Eight key takeaways from Post’s motor insurance profitability roundtable

At the end of 2024, Insurance Post in association with CRIF, held a roundtable that posed the question: How can motor insurers make the return to profitability stick? Jonathan Swift summarises the main takeaways.

Spotlight: The emerging risks in property and business

This Insurance Post Spotlight series explores some of the new and emerging risks affecting business premises and the workplace, and how insurers and brokers can help customers stay prepared.

Martyn’s Law highlights how risk management has the power to protect lives

RiskSTOP’s Johnny Thomson reflects on how a recent conversation with two people deeply affected by acts of terrorism, brought to light the positive impact insurance driven risk management is capable of having on all our lives.

Spotlight: Buildings underinsurance – a hybrid solution?

The issue of underinsurance has created a dynamic landscape of both opportunity and challenge in the field of buildings insurance valuations. Johnny Thomson explains how the current period calls for innovative solutions that align with technological…

Spotlight: Buildings underinsurance – what can be done?

While tackling underinsurance can lead to greater levels of trust between an insurer and the policyholder, failure to take action can have significant downsides including reputational damage and even legal action, writes Tim Evershed

Spotlight: Why buildings underinsurance is bad for business

Based on current statistics, the insurance industry has some way to go in tackling buildings underinsurance. But for brokers that make a concerted effort to address this issue, client loyalty is a potential reward that cannot be ignored, as Tim Evershed…

Blog: Vacant properties – don’t let the risks move in

With empty homes up 10% in five years and the proportion of high street retail premises left vacant hitting a one in seven all-time high, RiskSTOP’s David Reynolds reminds us of the key steps in managing unoccupied buildings.

Verisk London 2024: Key takeaways

In the fourth and final video recorded at the Verisk Insurance Conference in London, Insurance Post content director Jonathan Swift spoke to delegates and speakers about the lessons they learned at this year’s event.

Verisk London 2024: Evolving fraud trends

In the third in a series of videos recorded at the Verisk Insurance Conference in London, Insurance Post editor Emma Ann Hughes met with industry experts to discuss fraud trends.

Verisk London 2024: Catastrophe modelling

In the second in a series of videos recorded at the Verisk Insurance Conference in London, Insurance Post content director Jonathan Swift met with industry experts to examine how the sector can get a better view of catastrophe risk.

AI-augmented application modernisation – the new frontier?

As many insurers are aware, IT application modernisation projects can be very time-consuming, expensive and risky, while offering benefits that are not readily appreciated by business stakeholders.

Could climate change drive an insurance availability crisis?

Climate change risk cannot be underestimated, neither can the insurance industry’s need to address the challenges it brings. CRIF’s Sara Costantini explains how the strong correlation between the use of ESG key indicators and improved loss ratios…

Spotlight: Inclusive payment options are a must in a digital world

As insurers pursue the path to smoother digital journeys and payments, they risk losing customers who find themselves ‘digitally excluded’, says Luke Gall, product and engineering director, Access PaySuite

Verisk London 2024: Experience the possible

In the first in a series of videos recorded at the Verisk Insurance Conference in London, Insurance Post editor Emma Ann Hughes interviewed speakers and delegates about the transformative power of data, analytics, and artificial intelligence.