Personal

Why home insurers must cut to the chase

Editor’s View: Emma Ann Hughes is annoyed by home insurers’ waffling attempts to explain what is pushing up premiums.

Aviva sees 65% increase in non-whiplash injury claims

Non-whiplash-related injury claims have jumped by nearly two-thirds since the whiplash reforms, Aviva’s head of counter-fraud Pete Ward has told Insurance Post.

How travel insurance is going green

As summer approaches, Laura Miller examines how travel insurers are promoting responsible travel that respects wildlife, local communities, and the environment while also avoiding accusations of greenwashing.

‘Stripped-back’ policies may lead to consumer confusion

Fairer Finance has warned that ‘stripped-back’ motor insurance policies may lead to greater consumer misunderstanding unless insurers begin to communicate clearer.

Direct Line raids Aviva again for another exec hire

Direct Line Group has raided Aviva once again, this time for its new group chief risk officer.

Atec aims to ‘accelerate’ growth after being bought by Perwyn

Atec’s growth ambitions were given a boost today (24 June) after European private equity investor Perwyn bought the business from Kester Capital.

Digital Bar Quarterly: Could AI help deliver “out of the insurance world customer experience”?

Insurance companies need to get out of the digital innovation slow lane and look beyond incremental change if they are to reap the full benefits of AI, according to Altus general insurance director Mark McDonald.

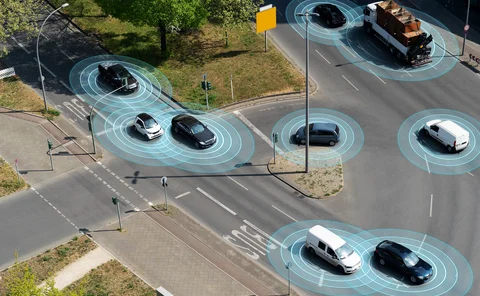

‘A lot of gaps’ to fill in Automated Vehicles Bill

There are still gaps left to fill regarding the use of automated vehicles, according to the Association of British Insurers’ manager for general insurance policy, Jonathan Fong.

One in four don’t declare all medical conditions for travel insurance

One in four people do not declare all of their medical conditions when buying travel insurance, according to a survey from AllClear.

How generative AI is everything, everywhere in insurance all at once

How insurers have been able to swiftly pilot generative artificial intelligence, prove the value of embracing this technology and roll it out across the wider business is examined by Insurance Post Editor Emma Ann Hughes.

Winners of British Insurance Technology Awards 2024 revealed

The winners of the inaugural British Insurance Technology Awards were unveiled last night (18 June) at a glitzy bash at the London Marriot Hotel, Grosvenor Square.

Cifas sees false insurance claims increase by a fifth

Opportunistic drivers submitting false ‘no claims’ documents are raising concerns for insurers, with filings to the National Fraud Database increasing in 2023, according to Cifas.

Consumers want Amazon and Tesla embedded insurance products

Four out of 10 consumers would be comfortable with the idea of buying insurance from companies such as Ikea, Amazon, or Tesla when making purchases from those brands, according to Guidewire’s Insurance Consumer Survey 2024.

Who is liable if AI in healthcare fails and causes harm?

Law firm DAC Beachcroft’s Simon Perkins and Stuart Wallace reveal what could happen if a claim is made against a healthcare provider that relies on artificial intelligence to spot diseases.

AllClear to grow international presence following sale

Chris Rolland, group CEO of AllClear and InsureandGo, has revealed the travel broker’s plans to expand the international business following the sale of owner InsurEvo.

Labour outlines plan to make car insurance prices plummet

Labour has pledged to hand cash to councils to repair up to a million potholes a year in England and announced it will make the regulator crack down on the causes of soaring motor insurance prices.

How insurers can up their claims game

Insurers love to talk about claims exaggeration, but David Worsfold asks: are they guilty of some exaggeration of their own?

Paddy Power pulls mention of Aviva from ‘fantasy’ Euro 2024 story

Paddy Power has amended a "news" story that claimed footballer Luke Shaw was cut from the Euro 2024 squad after being refused travel insurance by Aviva.

Mounting dissatisfaction with home insurance as premiums increase

Data analysis: NFU Mutual, Bank of Scotland, Nationwide, Saga, and Co-operative Insurance have the most satisfied home insurance customers, according to research by Fairer Finance.

Diary of an Insurer: Clear Group’s Neil Grimes

Neil Grimes, claims director of Clear Group, gets out on the track to experience a demonstration of autonomous driving and catches up with the claims team of a recent acquisition.

Vehicle damage claims drop following Welsh speed limit law

Wales has seen a 20% drop in vehicle damage claims since the implementation of a nationwide 20mph speed limit, according to Esure.

Direct Line’s ex-CEO James speaks out about facing flack

Direct Line’s former CEO Penny James has challenged the ‘flack’ the press directs at female industry leaders.

What does Winslow’s hiring splurge say about DLG’s future?

Content Director’s View: Jonathan Swift takes stock of Direct Line Group CEO Adam Winslow’s new look executive team and asks whether it has the attributes to succeed.

Allianz launches three-tier home insurance product

Allianz has launched a three-tier home insurance product in order to “provide more choice” for customers.