Personal

The Post Power List 2016 is revealed

Post is delighted to reveal its 2016 Power List, a carefully (wine) crafted list of movers and shakers both within and without the insurance industry who we at Post Towers – with our experience, knowledge and independent view – believe will either have…

Director of Content’s Comment: Is the timing for listing right?

The news that BGL is looking at a prospective initial public offering has raised a number of questions.

Fraud Focus: Looking to the future

Insurance Fraud Taskforce recommendations will ensure government stays focused on fighting fraud.

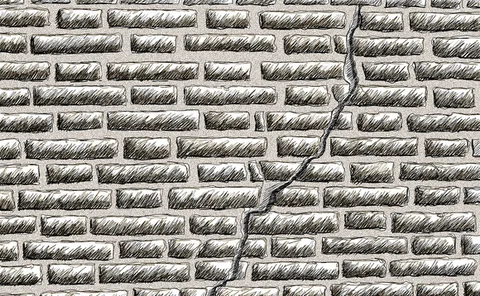

Subsidence: A close call with cracks

While subsidence claims have been insignificant of late, some subsidence experts believe another event year could be around the corner.

Editor's Comment: 2015: A year in review

Christmas is a time for reflection on the past year and to think about what 2016 might bring.

Editor's comment: Man on the moon

This week John Lewis released its Christmas advertisement – the Man on the Moon – causing even the most stiff-upper-lipped Brit to shed a tear.

Blog: How insurers can harness 'Big Data'

The amount of data out there is astronomical, with as many digital bits as there are stars in our universe - and it's rapidly expanding.

Blog: Lay executors of wills unaware of liability risks

Increasingly people are being asked to take on the role of executor following the death of a friend or relative. In the past, it was common practice to name a solicitor or bank in a will as the main executor. But a Censuswide survey shows 75% of people…

Editor's comment: Great Scott!

Last week was Back to the Future day – 21 October 2015 – the date film character Marty McFly travels to in the second instalment of the sci-fi trilogy.

UK startup Cuvva launches first hourly insurance cover

UK start-up broker Cuvva has launched what it claims is the first motor insurance cover to be offered by the hour.

Over half would only consider telematics policy with £100 plus premium saving

Saving money is still the biggest factor in people taking out telematics and data-based insurance motor policies, according to new research from Consumer Intelligence. Although for over half (55%) the saving would have to be over a £100 for them to…

Editor's Comment: Don't mention the whiplash

The Oxford Dictionary shows the definition of collaboration as the action of working with someone to produce something and I’m sure that this is what the Association of Personal Injury Lawyers’ president was encouraging when he wrote an open letter to…

Claims Club: Insurers must act to help shape the future of CMC regulation

Insurers have been given a “three to four month” window to shape the future of claims management company regulation, Claims Club members have been told.

BLP Insurance responds to regional growth with two senior appointments

BLP Insurance has announced two senior additions to its business development executive team in response to increasing regional demand for its building insurance products in the Midlands and South West of England.

Axa halts 'significant' personal injury claims with fundamental dishonesty defence

Two fraudsters have withdrawn fake but financially significant personal injury claims after Axa used the fundamental dishonesty defence.

Career Development: Endsleigh celebrates Golden Jubilee

Endsleigh has begun its Golden Jubilee year, celebrating 50 years of insuring students and young professionals.

Blog: The Sonae group action and the compensation culture

The judgment handed down last month in Saunderson & Others v Sonae makes for uncomfortable reading. Dismissing over 16,000 personal injury claims, a High Court judge criticised the conduct of the solicitors who had brought induced, exaggerated and…

Stepping up data sharing against fraudulent travel claims

As travel insurance fraud is becoming more frequent, the industry needs to step up monitoring and information-sharing, just like it has been doing to tackle motor and household fraudulent claims, says Mathew Crawford-Thomas.

Dishonest motor insurance applications exceeded 4000 weekly in 2014

Insurers uncovered 212,000 attempted dishonest applications for motor insurance in 2014 - up 18% on 2013 and the equivalent to over 4000 every week, according to the Association of British Insurers.

Aviva signs seven-year distribution agreement with TSB

Aviva has signed an exclusive seven-year distribution agreement with TSB covering the distribution of Aviva’s core general insurance products including home, travel, motor, pet, and commercial insurance through TSB’s branch network, online and via…

Blog: Why £200m Nationwide household loss might not be a big deal for DLG

Direct Line Group CEO Paul Geddes was bullish today when the insurance group released its half year results.

Hurricane Katrina: 10 years on

A decade after Hurricane Katrina hit New Orleans, what lessons has the insurance industry learned –and how has the city recovered?

Editor's comment: Swinging from high to low

Last Wednesday was a day of extreme highs and lows for the insurance industry. The sector celebrated successes of the past year with the Oscars of the industry, the British Insurance Awards, with over 2000 insurance professionals letting their hair down…

Editor's comment: A very expensive meal

While the Swiss are well known for their wealth and their thriftiness, the London and UK insurance market is probably the worst place to attempt to keep a secret.