Personal

Ageas sees profits fall on back of summer storm damage

Ageas has seen profits of £43m in the third quarter, a fall 8% from £46.9m in the same period last year.

Post November 2016: Start-ups, autonomous cars, future claims, and broker gossip

They look like rock stars but they're insurtech entrepreneurs.

Editor's Comment: Shout out to the start-ups

Several times in my life I've stopped and taken stock and upon realising things weren't quite as they should be, I've chosen a new path.

Women entrepreneurs: Insurance start-ups

Five female insurance entrepreneurs give Jonathan Swift the lowdown on the start-up sector

Top 30 Asia insurers: Asia remains in a stable condition

There has been little change in the rankings of the top 30 Asia insurers since 2014, with China still dominating the rankings, despite a decreasing growth rate

State of the Broker Nation: Professionalism and staff

Michèle Bacchus finds out how David Beckham’s legs can help make broking more enticing and attract talent to the sector

State of the Broker Nation: Regulation

In the second part of Post’s research, brokers talk candidly to Michèle Bacchus about the British Insurance Brokers’ Association, the Financial Conduct Authority, the government and the European Union

Aston Scott's Peter Blanc on challenging assumptions on client needs

What brokers believe clients want can be far from the reality

Why the government was aiming its arrows in the wrong direction on whiplash

News broke recently that the Ministry of Justice has no appetite to go ahead with proposed whiplash reforms at the moment.

Bluefin's Kenny Hogg on why drones can't replace human contact

In the uniquely information-obsessed world we now inhabit, the personal transactional nature of an insurance broker has never been more in the spotlight.

Hurricane Matthew could cost insurers $8.8bn

Hurricane Matthew may cost insurers as much as $8.8bn, according to AIR Worldwide.

Hurricane Matthew loss scenario tops $8bn as death toll rises

Total losses in the US from Hurricane Matthew could be up to $8bn (£6.5bn), according to modelled storm loss scenarios from RMS.

Insurers struggling to adapt to digital channels, leaving millennials in the dark

UK insurers are struggling to adapt to digital channels of customer engagement, research has revealed.

Hurricane Matthew likely to be a significant claims event as death toll rises

Hurricane Matthew is expected to be a significant claims event as it continues to progress through the Bahamas, following the news of hundreds of deaths in Haiti.

Top 100 UK Insurers 2016

How have the top 100 insurers fared over the past year? What have been the highs and lows faced by the market?

Brexit: 100 days on and counting

Three months on from the Brexit vote, what are the likely implications for the insurance market in the UK?

In the September issue of Post

The London Fire Brigade, the anniversary of the great Fire of London and the Top 30 European insurer ranking are in the September issue of Post.

Top 30 European insurers 2016: At the top of their game

A lack of large natural disasters, favourable exchange rates and a number of sizeable mergers have seen many of the top 30 European insurers weather the tough environment and climb the rankings

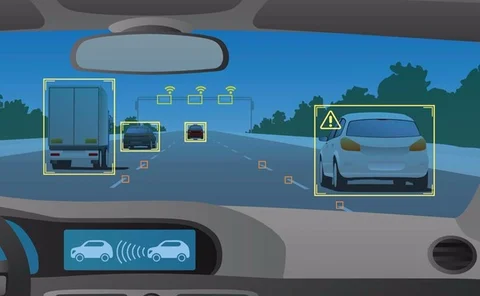

Roundtable: Autonomous driving systems need standards

Can insurers keep up with the pace of change powered by Advanced Driver Assistance Systems – especially when it comes to repairs? Post, in association with Autoglass, hosted an industry roundtable to find out

Week in Post: trampolining, brokers in the dark and cake

I was reminded of the insurance industry this surprising sunny bank holiday weekend when I was required to sign a waiver to accept and acknowledge my participation in Gravity Force trampolining could entail "known and unknown risks that could result in…

Blog: Insurance for autonomous cars - from concept to reality

It has now been 11 years since a team from Stamford University won a $2m (£1.5m) prize for developing ‘Stanley’, a fully self-driving car.

State of the Nation: Lloyd's and the London Market: Deepening the talent pool

The second part of the research asks what diversity means to Lloyd’s and the London Market and how can it attract young talent and people from outside the profession into insurance?

Blog: 10 years of collaboration with the Insurance Fraud Bureau

In 2006, insurers were alert to the threat of organised criminal groups targeting them in an attempt to defraud millions of pounds.

Esure's Stuart Vann on why whiplash reforms need to stay on the government agenda

With parliamentarians heading back to work in the next couple of weeks and the Brexit decision two months behind us, attention now needs to turn to the deliverables the government signed up to in advance of the referendum and the subsequent change of…