Association of British Insurers (ABI)

SMEs at risk of underinsurance if IPT rises next week

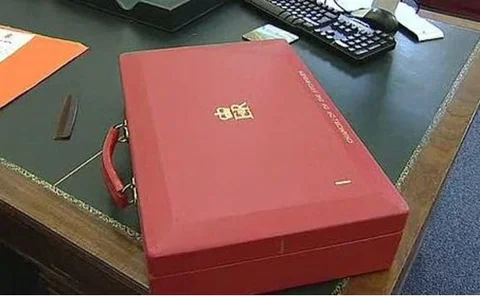

SME businesses could be forced to scale back insurance cover leaving them at risk of underinsurance, if the government increases insurance premium tax in the Budget next week.

Ecclesiastical and CFG call for IPT charity exemption to be included in this month's budget

Specialist insurer, Ecclesiastical and the Charity Finance Group have called on the chancellor to make charities exempt from paying insurance premium tax.

Dual pricing: Dual pricing hitting loyal home insurance customers

Loyal customers are being penalised for staying with an insurance provider, leaving thousands paying excessive home insurance premiums, according to Which?

Dual pricing: Industry agrees to tackle dual pricing with sweeping guidelines

Industry bodies for brokers and insurers have agreed guidelines to halt the controversial practice of dual pricing.

Regulators consult on impact of climate change on insurers

The Prudential Regulation Authority and Financial Conduct Authority have both invited insurers to respond to consultation papers on the impact of climate change on their operations and investments.

Insurance industry better equipped to deal with Storm Callum claims after 'significant effort' to implement resilient repairs

As the clean up operation starts following Storm Callum this weekend experts have said the insurance industry is better equipped to deal with flood claims than previous years due resilient repairs and better communication.

Analysis: Subsidence surge

Insurers and loss adjusters are using digital technologies to handle this autumn’s surge in subsidence claims but they are not forgetting the human touch is the best way to get to the root of the problem

Theresa May pledges to take action against dual pricing

Prime Minister Theresa May has vowed to take action against companies that impose a “loyalty penalty” on customers.

Travel insurance: Transforming and challenging through digital technology

The insurance market and the tourism industry have not always had reputations for embracing the latest technology. But things are changing and digital advances such as geo-location and data analytics will only help accelerate the pace of change

Analysis: How regulation could clip the wings of CMCs

In six months’ time, claims management companies will fall under the umbrella of the Financial Conduct Authority.

Insurers warn of red tape burden from EU green cards

Insurers have warned of an extra layer of bureaucracy for drivers in the form of ‘green card’ permissions to drive in Europe, if a no deal Brexit occurs.

Amanda Blanc makes first appearance as ABI chair

Amanda Blanc made her first appearance as the Association of British Insurers’ chair, as the insurer body debuted new research.

Blog: Loss adjusters are developing new skills to tackle escape of water claims

As insurers are trying to tackle rising escape of water claims costs, loss adjusters are developing increasingly specialised skills, explains Darren Francis, escape of water project manager at Crawford & Company.

RSA's Carolyn Mackenzie on the delicate balance struck by whiplash reforms

Carolyn Mackenzie, director of complex claims at RSA, argues that whiplash reforms are striking a delicate balance well.

Axa sees huge spike in cavity wall installation claims - updated

Cavity wall insulation claims exploded last year, with Axa Insurance alone reporting a dramatic increase in the space of seven months.

2018 Insurance Marketing & PR Awards: Full list of winners

LV was acclaimed as the Insurance Brand of the Year at last night’s Insurance Marketing and PR Awards

Blog: Technology - right or wrong for claims (or both)?

Insurers building the new claims portal must be careful not to force clients down a path they don’t wish to go argues Minster Law director of claims Marcus Taylor, who points to public concerns over technology as a major obstacle to overcome

Insurers will not be forced to pass on whiplash savings

Insurers will not be required to pass on savings from whiplash reform to customers, but they will have to report what those savings are.

Insurers welcome government crackdown on 'cold call sharks'

Insurers have welcomed rules aimed at limiting claims management companies from calling vast swathes of the population.

This month in Post: A way through the whiplash quagmire?

The controversy over the proposed Civil Liability Bill has centred on whether the changes represent a good deal for consumers or for the insurers.

Insurers to be held to account over whiplash savings

A government amendment to planned personal injury reforms could see insurers have to prove to the regulator that they are passing on savings to customers.

Government goes ‘full steam ahead’ on whiplash reforms

Insurers have welcomed the progression of hotly anticipated personal injury reforms through Parliament, however yesterday’s events in Westminster have whipped up fresh disapproval from the legal sector.

Editor's comment: A trip to the museum

This year at the football World Cup we heard more female commentators voicing their opinions on the beautiful game than ever before. A woman sat on the Croatian bench at England’s losing semi-final match and many women came out and admitted to not only…

Analysis: Whiplash bill faces bumpy ride through parliament

Vocal opposition to the Civil Liability Bill is ramping up as MPs prepare to debate it in its second reading.