Blog: Lloyd's predicts the World Cup winner

Need to know

- In 2014, Lloyd’s reviewed the insurable value of each team to estimate its ‘football firepower’, correctly predicting Germany would win the World Cup

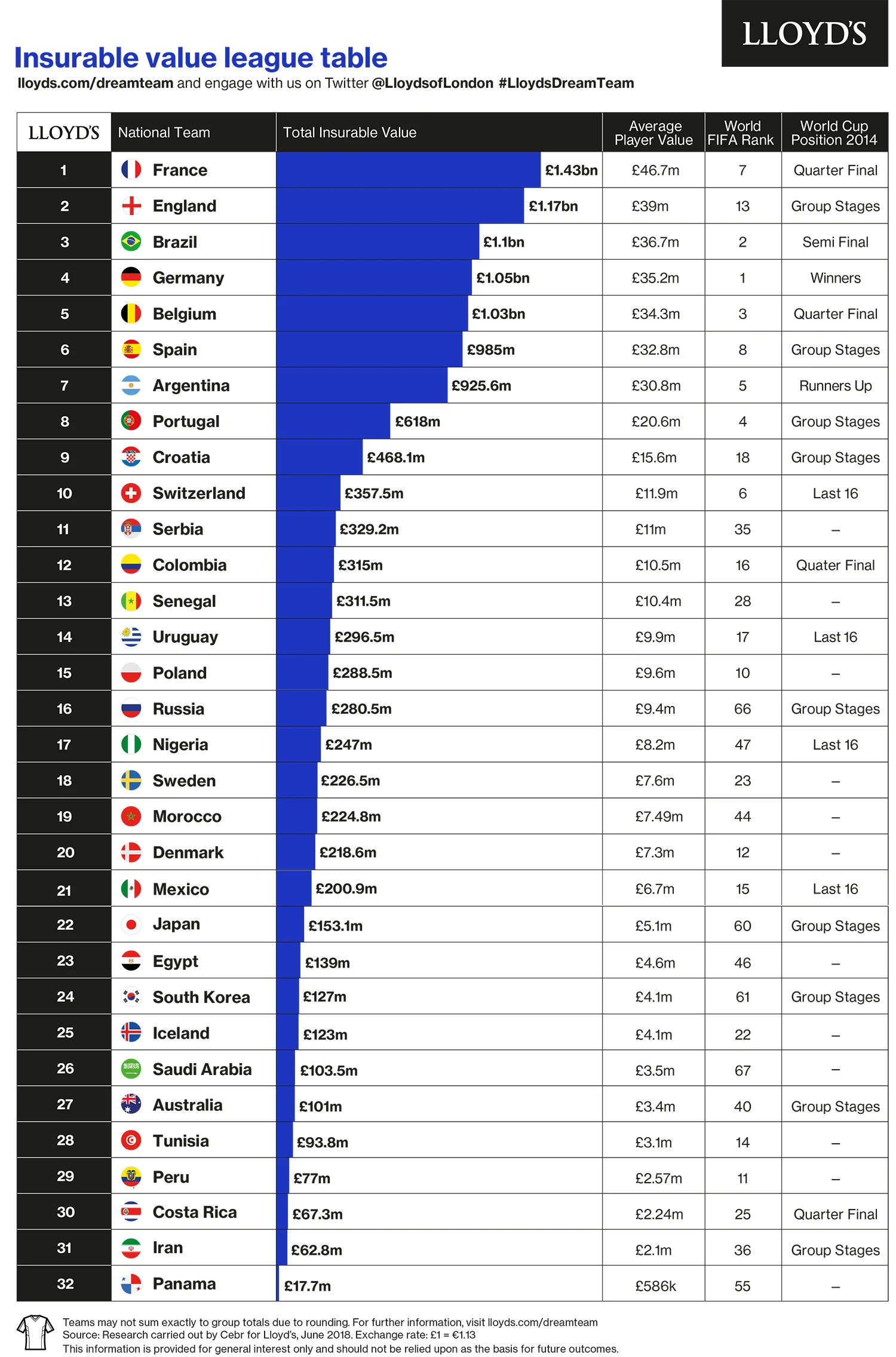

- In 2018, France, England and Brazil have the three most expensive teams

Lloyd's of London predicts which country will win the 2018 World Cup, based on the insurable value of the 32 football teams that start battling it out this week in Russia.

This week marks the start of the world’s most viewed sporting event – the 2018 World Cup taking place in Russia. Some 32 nations will contest 64 football matches over the course of 32 days, culminating in the final on 15 July at the Luzhniki Stadium in Moscow, where the champions will be crowned.

Around the globe, people of all nationalities, ages and professions have contracted football fever and the insurance industry is no different.

We know that in football money matters. While passion, teamwork and pure luck can play a part, it stands to reason – as is often the case in the beautiful game – that the most valuable teams are often the most successful.

Ahead of the 2014 Fifa World Cup in South Africa, Lloyd’s created its ‘dream team’ concept, a piece of analysis reviewing the insurable value of each team in the tournament. Utilising this metric, Lloyd’s can estimate the success and ‘football firepower’ of the competing teams, meaning a team’s path through the tournament can be plotted and ultimately the winner can be predicted. This approach correctly identified Germany as the winner last time. Fast-forward four years, Lloyd’s has decided to put this metric to the test once again.

To calculate the insurable values, Lloyd’s used footballer salary data for each of the 32 teams participating in the 2018 Fifa World Cup, based upon an indicative 30-man squad for each nation. Players’ wages and endorsement incomes, alongside a collection of additional indicators, were also used to construct an economic model that estimates players’ incomes until retirement.

It’s a results business, so here is what we uncovered from the analysis. The total collective value of all 32 teams is estimated to be £13.1bn. France (£1.4bn), England (£1.2bn), and Brazil (£1.1bn) have the three most expensive teams in terms of insurable value.

Click here for the League Table

Having plotted the teams’ paths right through to the final, Lloyd’s predicts that France will be crowned champions, beating the top ranked team and reigning world champions Germany in the final. Believe it or not, England is predicted third place ahead of Spain by virtue of their more youthful, and, therefore, more valuable, squad. Other quarter finalists based on insurable value will be Argentina, Belgium, Brazil and Portugal.

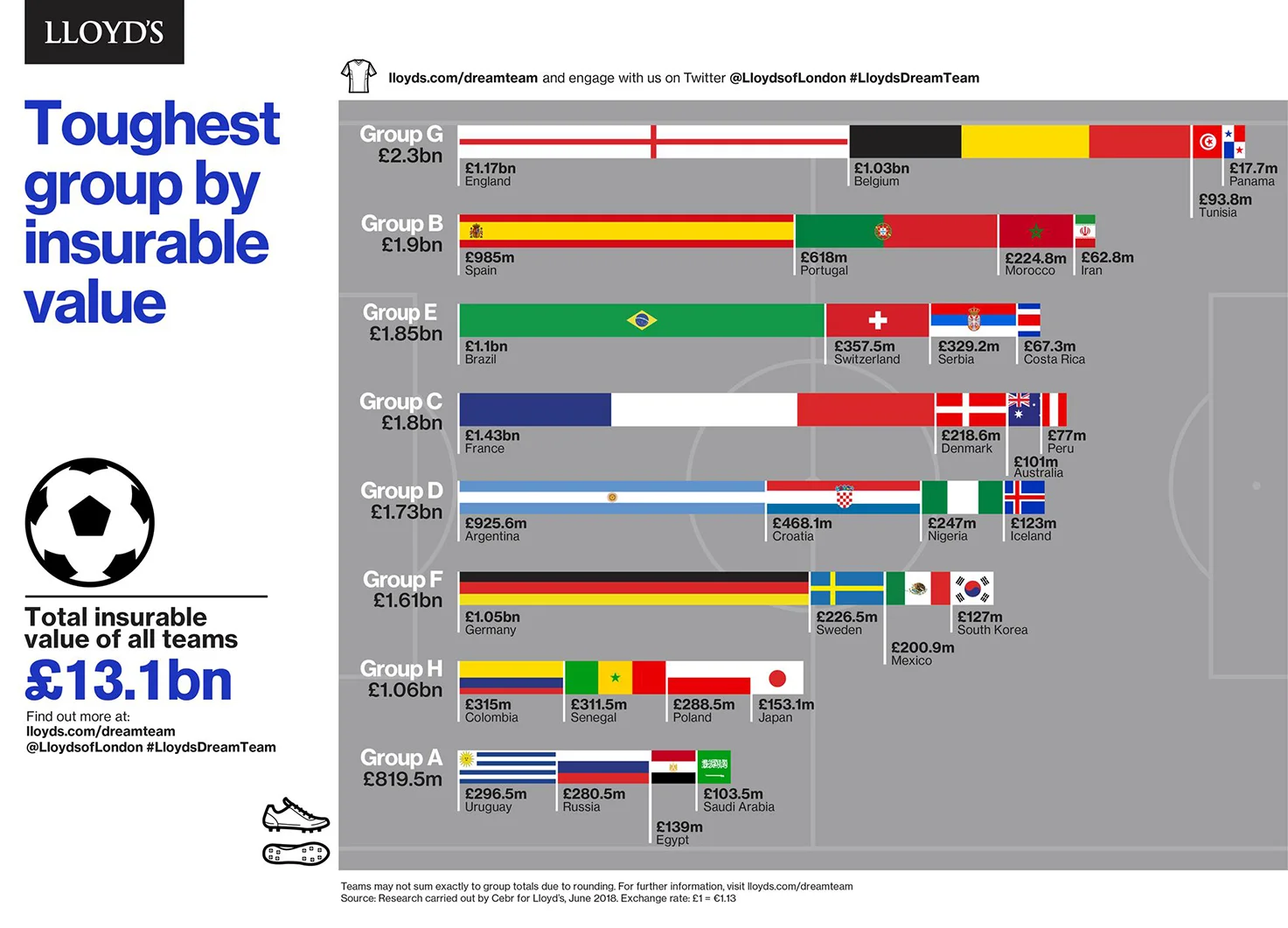

According to the analysis, England’s Group (Group G) has the highest insurable value at over £2.2bn. Conversely, Group A has the lowest collective value and the only group not to pass the £1bn mark (£819m). Colombia, Poland and Senegal will battle it out in the ‘Group of Death’ for a place in the knockout stages. With just £26.5m separating the three teams in terms of valuation, Group H will be the most competitive in the tournament.

The research also provides insights into the average insurable values based on positions and age of players. For example, forwards are the most valuable players, with their legs being worth £19.2m on average, although midfielders have the largest share of total squad insurable value (38%). Players aged between 18 and 24 have on average the highest insurable value at £20m.

There is huge global disparity in player values. The average insurable value of one England player is more than the entire Panamanian squad (£17.7m). In fact, England’s earning potential dwarfs the majority of those in the tournament this year and is partly due to the financial power of the Premier League.

Meanwhile, France has by far the highest insurable value of any team in the tournament, and are our favourites to be crowned champions this year. Despite only placing seventh in the world rankings, France has a relatively young squad and an abundance of talent playing in Europe’s top leagues.

The contrast between the teams at the top and bottom in terms of insurable value is marked, with the top six national teams worth more than the other 26 combined.

Click here for the group stages

While providing a novel way to predict the outcome of the competition, the results also take on greater significance for the insurance industry. Football teams fortunate to have several top players in their squad will inevitably need to invest in insurance to a higher degree than those with just one or perhaps none and underwriters will closely consider many factors such as loss of player income and asset transfer values when providing insurance. Age, therefore, is a key factor when pricing these risks, because younger players have more earning potential that is put at risk if they sustain a career-limiting injury at a tournament while on international duty.

Over the coming weeks, we will be looking ahead to future match-ups and making our predictions. We will also be reviewing our performance in a weekly column in Post and providing other interesting insights. Ultimately, we will be proven right or wrong very soon.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk