Claims: Spotlight on ADAS: Is everyone ready for ADAS?

Need to know

- Insurers rate by model and, when ADAS is fitted as an option and not as standard, they can’t reflect it in premiums

- They’d like manufacturers to disclose to the DVLA what systems are fitted to what vehicles

- Insurers don’t want to depend on manufacturer-owned repairers

- Thatcham is carrying out research that will challenge carmakers that insist on their ADAS being repaired and recalibrated by their own networks

- CPD Knowledge Centre learning outcomes for this article

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet.

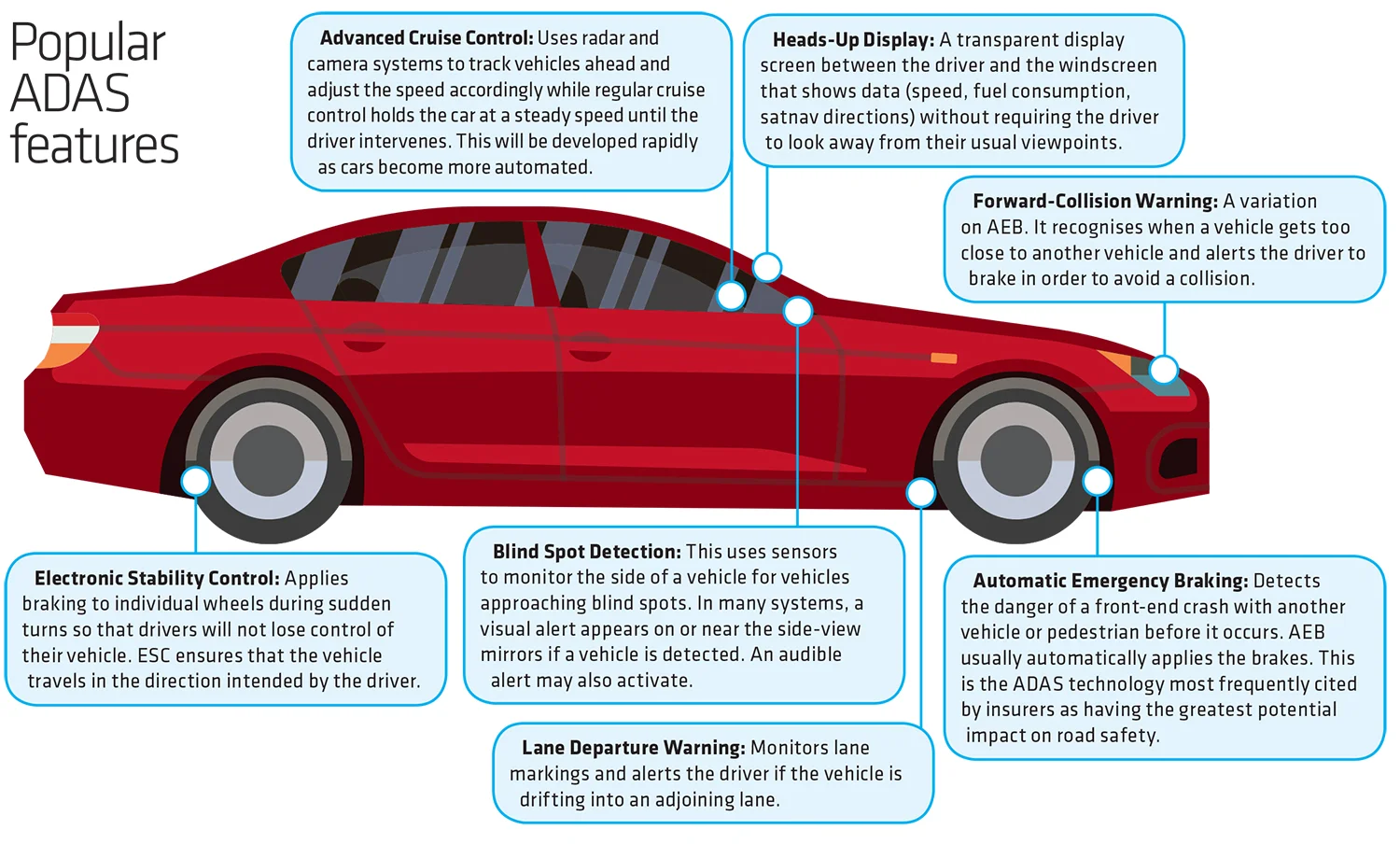

For many years, cars have been getting safer. First, the focus was largely on protecting the occupants with seatbelts, airbags and better resilience. Now, it is on making vehicles less likely to crash. The advent of Advanced Driver Assistance Systems is another major contribution to road safety.

However, the response to ADAS among car manufacturers and insurers is not the unanimous, unqualified enthusiasm you might expect.

The European New Car Assessment Programme tests vehicles sold in Europe, awarding them a rating from zero to five stars depending on their safety features. While the expectation might be that car manufacturers would be striving to achieve the highest rating, this is not the case.

The final Euro NCAP test results of 2017 showed some carmakers are still choosing not to fit potentially life-saving ADAS technologies to all new models. December’s release contained six three-star ratings and the first zero-star rating since testing began 20 years ago – the relaunched Fiat Punto.

Although the zero-star Euro NCAP rating for the Punto is eye-catching, it is the three-star ratings for carmakers that have delivered five-star cars in the recent past which are most surprising, says Matthew Avery, director of research at Thatcham Research and a Euro NCAP board member. “This is a tale of two Citroens. In November, the DS 7 Crossback achieved a five-star Euro NCAP rating – and came with standard-fit autonomous emergency braking and lane departure warnings. The DS is a premium brand, but Citroen has made a clear decision with the DS 3, offering AEB as an option only.”

The zero-star rating for the Punto, a re-release of the 2005 version, came because of low scores for its crash performance, combined with the absence of key technologies like AEB and lane support systems, giving it an unprecedented 0% ‘safety assist’ result. It is partially a victim of a significant raising of the standards since 2005 but also the starkest example of the trend towards offering ADAS features as options.

Squeezed margins

The cynics suggest this is because the margins on basic cars have been squeezed so tight that manufacturers are focusing on the sale of extras – including ADAS – to boost profits. This is a major problem for insurers wanting to encourage the fitting and use of safety systems through lower premiums. They rate by model and, without ADAS fitted as standard, it is impossible to reflect it in the premium.

What is a Euro NCAP rating?

The European New Car Assessment Programme is an independent crash test safety body. Since 1997 it has evaluated the crash safety of new cars and onboard car safety technology. Over the last 20 years it estimates that its certification regime has helped save 15,000 lives on UK roads.

It operates a five-star rating regime:

Five stars

Overall good performance in crash protection; well equipped with robust crash avoidance technology

Four stars

Overall good performance in crash protection; additional crash avoidance technology may be present

Three stars

Average to good occupant protection but lacking crash avoidance technology

Two stars

Nominal crash protection but lacking crash avoidance technology

One star

Marginal crash protection

The consequent hesitant response of insurers to ADAS shows through clearly in recent research carried out by Post in conjunction with National Windscreens. Only 46% of respondents said they expected premiums to decrease with the installation of ADAS technology, 38% felt premiums would stay the same and 6% even felt that would increase.

Fiat may be an outlier with its new Punto but the progress of ADAS is relatively modest with most projections suggesting just 40% of new cars will have multiple ADAS features as standard by 2020. Some manufacturers such as Volvo and Volkswagen say they are aiming for near 100%, so that leaves the rest with very patchy commitment to ADAS.

This presents insurers with a problem, says Tim Marlow, head of autonomous and connected vehicle research at Ageas: “We have a problem with optional fitting of ADAS. Where it is a standard fit, say with Volvo and VW, then we can reflect that in the rating group we put it in. When it is an optional fit, we are in the dark and often don’t know until there is a claim.”

The solution lies in the hands of the manufacturers, says Marlow: “We want the manufacturers to disclose what systems are fitted to what vehicles.”

He says this information should be passed to the Driver and Vehicle Licensing Agency and made available to insurers: “If there was a central database that could be looked up fast at proposal stage, we could offer an appropriate premium.”

David Williams, technical director at Axa, shares the frustration and believes insurers could help manufacturers keen to upsell ADAS features: “Wouldn’t it be great if we could help motor manufacturers to sell these extras by taking them into account? If we had a way of knowing exactly what was in each vehicle, we could do that.”

Lack of consistency

Another challenge for insurers wanting to take ADAS into account when setting premiums is the lack of consistency in terminology, says Andrew Lee, head of market intelligence and analysis for Octo Telematics: “They are called different things by different manufacturers. They all have different ways of describing AEB and a different way of packaging up ADAS options”.

Avery says it is not just insurers that find the terminology confusing but consumers too: “Vehicle manufacturers like to use unique technology names for safety systems to differentiate their products. This is very confusing for the consumer. There are 64 different names for autonomous emergency braking alone. Other safety systems such as lane support or blind spot monitoring also use a plethora of unique names. Euro NCAP translates these terms and classifies by functionality. Some consumer motoring magazines are now beginning to recognise these systems and are using terms like AEB. We hope this continues as we begin to see more lane support and auto steer systems.”

Insurers cannot shift all the blame for their hesitant responses to ADAS to the manufacturers, says Peter Marsden, managing director of National Windscreens: “There is a lack of development in insurers’ understanding of ADAS. There is a feeling in the insurance community that it is driverless vehicles they need to think about. But they are 10 to 20 years away. It is the here and now they need to think about.”

Marsden accepts that the lack of consistent information from manufacturers about what ADAS technology is being installed in the cars they sell doesn’t help insurers. He acknowledges the need for a coordinated database but challenges insurers to do more to create it.

“There is a lack of understanding of what features are in what models and there is frustration about the lack of information coming out of manufacturers.

“The insurers are not doing anything about it but the aftermarket is. It seems unlikely that anyone will create a central database but at National Windscreens we have been able to build up a comprehensive database of our own.”

The complexity and consequent cost of repairs and recalibration of ADAS is another feature of the new technology that is dampening insurers’ enthusiasm for offering premium reductions.

What was once the simple replacement of one piece of metal with another – for a damaged bumper for instance – can now involve several sensors and significant costs. Rear bumpers on some premium models can cost up to £8000. Even a pair of LED headlights with cameras can cost as much as £5000, according to repairers. Windscreen replacement too now requires cameras to be recalibrated, something that makes a quick and simple job potentially time-consuming, with that time costing money.

Consumers are often surprised when what they expected to be a quick repair takes longer. Car owners have come to expect windscreens to be replaced by the replacement firm coming to them and are surprised when their vehicle needs to be taken to a workshop for recalibration of the cameras, which they may not have even realised were integral to their windscreen and the safety systems.

This lack of awareness needs to be tackled, says Thomas Hudd, operations manager for Thatcham Research’s repair technology centre. “Many drivers are not aware that they have ADAS fitted to their cars, and in turn that the ADAS will require calibration. That they must wait longer for the repair of a system they didn’t know existed, can come as an unpleasant surprise and damage perception.

“It’s not only ADAS. Head-up displays can be impacted by windscreen replacement. By placing the wrong windscreen into the vehicle, the performance and visibility of the HUD can be negatively impacted. This is a focus for our research right now, starting with raising awareness of the issue for repairers and consumers.”

Keeping the repair process customer-friendly is important to insurers, says Williams, who is optimistic that the need for workshop recalibration will turn out to be a passing phase for less complex repairs.

“When you talk to manufacturers, they are aware of this. Many tell you that their sensors are already self-calibrating and I am hopeful, based on my direct communications with the people making the sensors and cameras, that they are very focused on the need to make repairing them cost-efficient and customer-friendly.”

The confusion over what vehicles and ADAS features require recalibration is reflected in the survey. In answer to the question “How likely is it that you will insist on repairers providing workshop calibration at the same time as windscreen replacement or another repair?” one-third of respondents said they didn’t know, a figure that has shifted very little from previous surveys.

Complex repairs

Williams says where workshop recalibration is necessary, then that is where it will be carried out. “If we are dealing with a claim, we make sure it is recalibrated exactly in line with the manufacturer’s instructions.”

He adds that a customer declining recalibration is not an option: “Our arrangements say the windscreen must be replaced in line with the manufacturer’s recommendations. We do not want ever to be put in a position where a car we have had repaired is in any way less safe than it should be because we haven’t completed the repair.”

Beyond windscreens, there are growing concerns that more complex repairs will only be capable of being carried out in manufacturer-approved repairers. Lee says: “Only manufacturers can decipher some of the complex data required to support ADAS. Insurers will have no choice but to send repairs through the car manufacturers’ networks. As we know, that is more expensive, so it will have a massive impact on claims costs.”

This need not happen if manufacturers provide more information about their systems, says Marsden. “The real frustration is the lack of information coming out of the manufacturers. The repair networks have had to learn all this themselves. It can be tricky because of the different requirements of the manufacturers but independent repairers have proved that they can do it to the required standards.”

Marlow says insurers have no desire to be drawn into being dependent on manufacturer-owned repairers: “As long as the knowledge, competence, equipment and skills are there and the repair can be certified, it does not matter whether it is a manufacturer repair or an independent repairer.”

This is high on Thatcham’s agenda, says Hudd: “The market for ADAS repair and recalibration should be as open as it is for standard repairs. As long as the work is carried out to the correct standard and specification, then there is no reason that this cannot be handled in the aftermarket, and this will help to keep the costs under control. Some vehicle manufacturers stipulate that ADAS repair and calibration must be carried by their own networks. However, the research we are doing will allow us to challenge those positions.”

This engagement with manufacturers will be very welcome to insurers and independent repairers and, ultimately, to consumers if it results in that elusive reduction in their premiums for having ADAS features in their new cars.

Several motor manufacturers were asked for comment for this feature but either declined or did not respond. Some said they co-operated fully with Euro NCAP and other testing bodies in providing information about their ADAS systems.

CPD Knowledge Centre learning outcomes for this article

By the end of this article, readers will:

• Be able to identify how and what new technologies will influence motor claims

• Be able to list the issues around the data produced by automated vehicles

Once you have read all the articles in this module you may start the corresponding assessment. You will receive a certificate if you score 80% or higher.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk