Thatcham

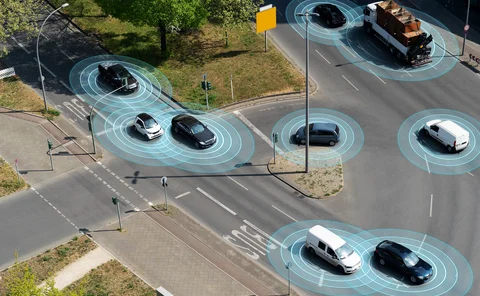

Government seeking insight to develop autonomous vehicles framework

The government yesterday (4 December) published a call for evidence on developing the autonomous vehicle regulatory framework.

Thatcham building closer ties with Chinese car makers

Thatcham Research is building closer relationships with new entrants including Chinese manufacturers since it introduced its new Vehicle Risk Rating system and insurability by design (IBD) proposition.

Hear from Thatcham, the FOS, Aviva, DLG and Allianz at Claims Club

The Claims Club 2025 programme kicks off on the morning of the 25 April at Events No6 in London and you can sign-up to attend now.

Graham Gibson steps down as Thatcham chair

Graham Gibson has stepped down as chairman of Thatcham Research’s board of directors after seven years, and has been replaced by Nick Caplan.

Q&A: Mike Brockman, ThingCo

ThingCo founder and CEO Mike Brockman sits down with Insurance Post to talk about why the business has recently been in 'stealth mode,' how he hopes telematics can appeal to a wider audience, and potentially new markets he hopes to expand into.

Post-pandemic supply-chain issues beginning to ‘stabilise’

Aviva's technical claims manager Martin Smith has told Insurance Post that supply-chain issues caused by the pandemic and the war in Ukraine have ‘stabilised.’

Thatcham urges car makers to design with insurance in mind

Thatcham Research's CEO Jonathan Hewett has told Insurance Post that he hopes Thatcham's new vehicle rating system will ensure that car manufacturers see insurability as a design attribute.

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?

Is it time to ditch lithium ion batteries?

News Editor's View: Scott McGee considers if government legislation to make lithium ion batteries safer is too little too late for electric vehicle insurers and whether providers’ appetites for covering such cars will only return when manufacturers…

LexisNexis accused of price increases despite limited product improvements

A source has told Insurance Post that they have seen prices for Thatcham's motor data increase by around 60% since the partnership with LexisNexis was announced earlier this year, despite very few of the promised improvements coming through.

Axa calls on Labour government to improve road safety

Alain Zweibrucker, retail CEO of Axa UK, has led calls for the new Labour government to follow the European Union’s lead and introduce vehicle safety regulation to slash the number of road accidents.

LexisNexis working on Jaguar Land Rover security solution

LexisNexis Risk Solutions is working on a way for Jaguar Land Rover to get its vehicle security data to insurers to address pricing issues, Insurance Post can reveal.

Q&A: Graham Gibson, Allianz

Allianz chief claims officer and Thatcham Research chairman Graham Gibson reveals how the provider is using artificial intelligence to crack down on fraud and believes we are at “an inflection point” when it comes to automated vehicles.

‘A lot of gaps’ to fill in Automated Vehicles Bill

There are still gaps left to fill regarding the use of automated vehicles, according to the Association of British Insurers’ manager for general insurance policy, Jonathan Fong.

What Labour’s Manifesto means for insurers

Labour leader Sir Keir Starmer aimed to woo insurers when he outlined his party’s blueprint for government just before lunchtime today (13 June).

Diary of an Insurer: Clear Group’s Neil Grimes

Neil Grimes, claims director of Clear Group, gets out on the track to experience a demonstration of autonomous driving and catches up with the claims team of a recent acquisition.

What is going on with electric vehicle insurance?

Post Podcast: What pushed up the price of electric vehicle insurance plus the steps providers are taking to ensure premiums are affordable is the topic of the latest Insurance Post Podcast.

Automated Vehicles Bill finally passes through Parliament

Insurers have stated the passing of the Automated Vehicle Bill today represents a "significant step forward" but warned they need "access to relevant data in order to support the adoption of this technology.

EV manufacturers to face competition from China

Allianz chief claims officer Graham Gibson has told Insurance Post that electric vehicle OEMs "have their work cut out for them" ahead of stiff competition from Chinese firms entering the market.

LexisNexis and Thatcham address concerns over motor data partnership

After complaints about price increases and the abrupt “cancelling of contracts”, bosses at Thatcham and LexisNexis have said their recently announced partnership is updating the “archaic” way in which the data is distributed.

Lithium batteries causing fire-related home claims to surge

Prestige Underwriting has called for better collaboration between e-bike manufacturers and insurers, after the average cost of fire-related home insurance claims has quadrupled since 2007, to more than £24,000.