SME

Liiba chief calls for greater role for brokers in provision of SME BI cover

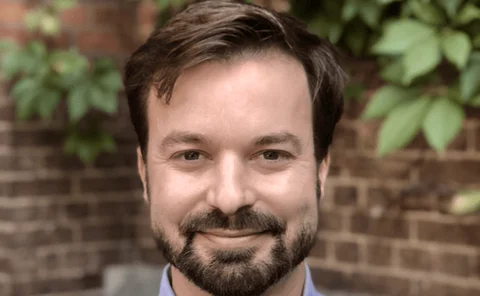

Christopher Croft, CEO of the London and International Insurance Brokers’ Association has called for brokers to play a more active role in the sale of business interruption insurance to small and medium businesses.

Digital Risks appoints Stewart Duncan as chief data officer

Insurtech start-up Digital Risks has recruited Stewart Duncan as chief data officer joining from insurance platform Wrisk.

Insurers' intent with regards pandemics 'not relevant or admissible', FCA will argue in High Court test case

Insurers’ contentions that wordings in business interruption policies are not designed to and do not provide cover in the event of pandemics will be disputed by the Financial Conduct Authority when it brings a test case before the High Court next month.

Insurance Covid-Cast: Insurtech 100 special – Distribution focus 2 with Next Insurance's Sofya Pogreb and Trov's Ian Sweeney

In the 24th episode of Post and Insurance Age’s video series we gathered together two start-ups featured in the Insurtech 100, both of which have pivoted from business-to-consumer distribution, to B2B2C.

Insurance Covid-Cast: Insurtech 100 special – 'Distribution Focus' with Hokodo, Kasko and Wrisk

In the 23rd episode of Post and Insurance Age’s video series we gathered together a trio of start-ups featured in the Insurtech 100, all of which are focused on the distribution of products through the business-to-business-to-consumer channel.

Blog: Covid-19 - why the insurance industry needs to act as one voice

The 1998 romantic comedy, Sliding Doors, starring Gwyneth Paltrow alternates between between two storylines, depending on whether or not she catches a train. It is essentially a ‘what if’ tale, like much of our lives at the present time, writes Ashwin…

HAG issues £52m claim against Hiscox as its lawyers draw up dentists' claim against QBE

The Hiscox Action Group has issued a £52m claim against Hiscox for unpaid business interruption claims related to losses incurred during the coronavirus lockdown.

Insurance Covid-Cast: Insurtech 100 special – 'AI/Data Analytics' with Concirrus’ Andrew Yeoman and Cytora’s Richard Hartley

In the 21st episode of Post and Insurance Age’s video series we gathered together a duo of start-ups featured in the Insurtech 100, both of which are focused on using artificial intelligence/data to make insurance companies more efficient.

FCA BI test case gives law firms and businesses pause for thought

The Financial Conduct Authority's test case may be driving some law firms to revise their roles in slated business interruption legal battles, but lawyers argue they will still have a part to play quantifying losses and settling disputes.

FCA names eight insurers to take part in BI test case

Eight insurers will participate in a High Court test case being prepared by the Financial Conduct Authority to rule on whether the wordings of business interruption policies provide cover to businesses hit by the coronavirus pandemic.

Businesses urged to wait for FCA test case to streamline BI legal storm

Action group members challenging insurers over rejected coronavirus-related business interruption claims would be better off waiting for the outcome of the Financial Conduct Authority's test case before embarking on proceedings, an expert advising…

Law firm names Hiscox and RSA as BI class action litigation targets

Law firm Edwin Coe has invited businesses that have been denied business interruption cover by Hiscox and RSA to join two group claims it is putting together, as litigation against insurers by rejected policyholders cover continues to proliferate.

Analysis: The parametrics push powers on

Parametrics has been around for a while but a slew of new entrants means it is now poised to make its mark on UK general insurance

Hospitality businesses gear up for group action against Aviva and QBE

Aviva and QBE face multimillion pound claims from a group of hospitality businesses that were denied cover when they sought to recoup pandemic-related losses.

Blog: The future role of insurers in a post Covid-19 society

Paradoxically, uncertainty is the one certainty in today’s pandemic regime - the insurance industry is facing a far more indeterminate present and future writes Paul Coleman, managing director of NPA Insurance.

Hiscox accused of confirming businesses' coronavirus cover then rejecting claims

Some businesses that have had coronavirus-related claims rejected by Hiscox were told in writing prior to lockdown that they would be covered, according to an action group challenging the insurer.

Hiscox Action Group to launch £40m arbitration claim 'within days'

An action group of 400 Hiscox business insurance policyholders is to launch an “expedited arbitration claim” against the insurer worth almost £40m.

FCA invites broker and policyholder input as it builds BI test case

The Financial Conduct Authority has invited policyholders and brokers with unresolved Covid-19-related disputes with insurers over business interruption polices to put forward their arguments for why claims should be paid.

Insurance Covid-Cast episode 11: Loss adjusting during lockdown - and what the sector might look like post-pandemic

In the latest episode of Insurance Post and Insurance Age’s new series of video casts brought to you while our journalists are working from home, we brought together a group of senior loss adjusters and experts to discuss how their employers have adapted…

Hackers Maze release four files of alleged Chubb data

Ransomware group Maze has published four sets of data labelled as “proof” of its hack of insurance giant Chubb.

RSA reports £25m hit after receiving 25,000 Covid-19 related claims

Insurer RSA has revealed it has received approximately 25,000 Covid-19 related claims, which will cost it an estimated £25m net of reinsurance.

Experts warn of potential broker insolvencies due to premium finance proposals

The British Insurance Brokers’ Association and premium finance providers have warned of a possible hit to broker solvency in the event of bad debts under the proposed guidance issued by the Financial Conduct Authority last week.

Iprism growth on track after restructure, says MD Ian Lloyd

Iprism Underwriting Agency is growing its underwriting and bottom line profits after its restructure last year despite the impact of the coronavirus pandemic, according to managing director Ian Lloyd.

Interview: Partners&'s Barton & Reid

The easy answer to the question “when is a consolidator not a consolidator” is when nobody is being bought. Phil Barton and Stuart Reid spoke to Post senior reporter Emmanuel Kenning about their latest venture Partners&.