Modelling

Are you ready to be stress tested by the PRA?

The regulator’s 2026 dynamic stress test will plunge insurers into a real-time, three-week crisis simulation unlike anything the sector has faced before, forcing firms to prove not just their capital strength but their ability to make rapid, data-driven decisions under pressure.

Burning point: insurance and heat-driven perils

With a series of heatwaves dominating summer 2025, Fiona Nicolson looks how insurers are changing their approach to underwriting, modelling and climate-risk planning.

Q&A: Testudo’s George Lewin-Smith

George Lewin-Smith, CEO and co-founder of Testudo, shares his pioneering work to create a new category of insurance purpose-built for the generative artificial intelligence era by using real-time litigation data and working with Lloyd’s.

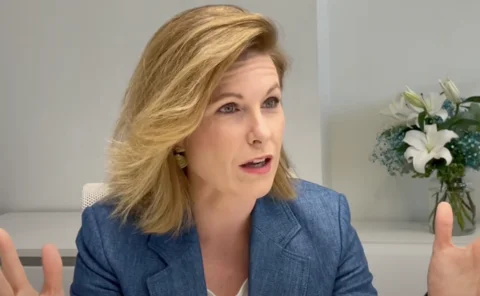

Big Interview: Blanca Berruguete, Descartes

Earlier this year Blanca Berruguete joined Descartes Underwriting as head of Europe, Middle East and Africa distribution and client management.

Can insurers harness the power of Generative AI?

Generative artificial intelligence has the market buzzing around its huge potential for business growth, but at this early stage, Rachel Gordon warns many factors need careful consideration.

Earnix CEO warns against ‘either/or’ AI strategy

Choosing between generative AI and traditional machine learning could prove limiting, says Earnix CEO Robin Gilthorpe, who is urging insurers to harness both to unlock a powerful springboard effect.

Mapfre Re x CyberCube; Specialist Risk Group buys broker; Hiscox’s chief auditor

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Thatcham and Elixirr partner; Lockton’s facility; Cowbell joins ABI

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurers Review of the Year 2024

Insurers share their highlights of 2024 and hopes for more economic stability, less regulatory tinkering and fewer storms in 2025.

Pace of general insurers’ race to net zero revealed

As the 2024 United Nations Climate Change Conference, known as Cop 29, begins in Baku, Azerbaijan, Insurance Post’s Emma Ann Hughes analyses the pace of providers racing to become net zero heroes.

Howden and Microsoft launch climate risk platform

Howden has collaborated with Microsoft on a platform aimed at enabling clients to manage climate risk and increase climate resilience.

Freedom’s car integration; Tradex joins IFB; DWF’s chair

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

How to become an underwriting trailblazer

Only 8% of insurers can consider themselves to be property and casualty underwriting trailblazers, according to a survey of the sector.

How generative AI is everything, everywhere in insurance all at once

How insurers have been able to swiftly pilot generative artificial intelligence, prove the value of embracing this technology and roll it out across the wider business is examined by Insurance Post Editor Emma Ann Hughes.

Zurich prioritises internal AI development over partnerships

Zurich is focusing on in-house expertise rather than external partnerships for artificial intelligence development, according to data science lead Jonathan Davies.

How generative AI can catapult insurance into the future

Graeme Howard, non-executive director at esynergy, explains how insurance companies that have traditionally been on the back foot can now surge ahead of technology-embracing banks by embracing generative artificial intelligence.

iCan founder launches broker; Chaucer enters weather market; RSA's property director

Thursday Round-Up: As tomorrow is Good Friday, Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week, a day early.

Lithium batteries causing fire-related home claims to surge

Prestige Underwriting has called for better collaboration between e-bike manufacturers and insurers, after the average cost of fire-related home insurance claims has quadrupled since 2007, to more than £24,000.

How women are smashing insurance’s glass ceilings

Ahead of International Women’s Day (8 March), Insurance Post Editor Emma Ann Hughes examines how glass ceilings in insurance are being smashed and whether presenteeism rearing its ugly head could stunt further female progress in the industry.

Could COP 28 leave insurers with more stranded assets?

As COP 28 kicks off on 30 November, Emma Ann Hughes examines how the race to net zero is creating stranded assets, affecting insureds and insurers.

How insurers dodged a bullet over storm Ciarán

Tegwen Gabb, senior weather and climate analyst at Eurotempest, reveals how close the UK insurance industry came to sustaining one of its largest insured losses of all time from storm Ciarán.