Modelling

AIR considers business interruption following Boston bombings

A large section of Boston's Back Bay area remains off-limits to all but law enforcement officials and the FBI, following yesterday's fatal bomb blasts near the finish line of the city's marathon.

In Series: Personal Lines: First line of defence

Insurers should embrace the power of data to detect and prevent fraud at an early stage.

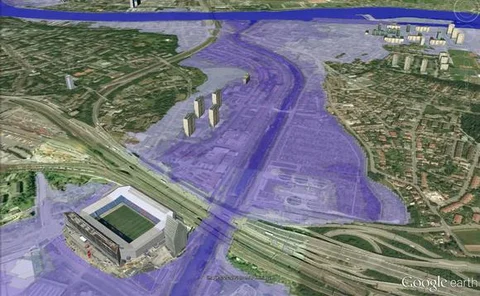

The Thai flood: Two years on

The size and scale of the floods in Thailand in 2011 came as a shock to many despite the fact it was a flood prone area. Andrew Tjaardstra discovers how shock waves are still being felt and how risks are being reassessed.

Eqecat appoints new president after Keogh exit

Paul Little has been appointed as president of catastrophe modelling firm Eqecat.

Middle East Blog: Inverted modus ponens

Most social science theories, including in economics, business and finance, are 'deductive theories' based on the modus ponens mechanism.

Limited damage after Japan quake

The magnitude 7.3 earthquake that struck off the northeast coast of Japan on Friday is not expected to have caused significant damage, according to catastrophe modelling firm AIR Worldwide.

Quake models to bridge gap in growing market

Aon Benfield has launched new Algeria and Morocco earthquake models, aimed at providing a more reliable estimation of losses insured properties face in these countries.

Model increases understanding of Swiss flood risk

Aon Benfield has launched a new flood model for Switzerland and Lichtenstein to help quantify financial losses caused by what is considered to be the country's most significant natural peril.

Sandy could cost insurers $15bn

Insured losses from storm Sandy to properties in the US are expected to be between $7bn and $15bn, according to catastrophe modeling firm AIR Worldwide.

"Largest Atlantic hurricane on record" could bring losses of up to $15bn, warns AIR

Insured losses from Sandy to onshore properties in the US will be between $7bn and $15bn, AIR Worldwide has estimated.

Top five Asian news stories

The top five Asian news stories on www.insuranceinsight.com over the past seven days.

Guy Carpenter probes causes of Thailand flood losses

Guy Carpenter has published an in-depth review of the meteorological and man-made factors that contributed to the 2011 Thailand flood catastrophe and resulting insured losses, estimated at between $15bn and $20bn.

Aon Benfield launches Thailand flood model

Global broker Aon Benfield has launched a flood model for Thailand to help global insurers better understand their exposures in the region.

Aon Benfield launches Thailand flood model

Reinsurance broker Aon Benfield has created a flood model for Thailand to help insurers better understand exposures.

Business Insight expands to new Warwick offices

Risk modelling firm Business Insight has moved to larger offices to boost plans for growth and product development.

Aspen Re enhances risk management in China

Aspen Reinsurance has licensed Air Worldwide's multiple peril crop insurance model for China to enhance its risk management capabilities in catastrophe-exposed agricultural regions of the country.

RMS and NMB in catastrophe modelling partnership

Catastrophe modelling firm RMS and independent Lloyd's broker Newman Martin and Buchan have entered into a long-term partnership for modelling and data analytics.

Air Worldwide expands in Asia-Pacific with Singapore office

Air Worldwide is opening an office in Singapore to meet the expanding needs of clients in the Asian insurance market.

Insured losses from China quakes very low

Two magnitude 5.6 earthquakes that struck southwest China on Friday caused little to no insured losses, according to catastrophe modelling firm Eqecat.

Probable maximum loss "a terrible metric", says Air Worldwide founder

PML figures play too great a role in modern catastrophe underwriting, according to modelling expert Karen Clark.

Malta hit by deluge after thunderstorms

Thunderstorms brought heavy rain and flash flooding to Malta, southern Europe between Sunday, September 2 and Monday, September 3.

Reinsurers take stock of Asia-Pacific risks

Reinsurers are bracing themselves for the next catastrophe in the Asia-Pacific region following the spate of catastrophes over the last two years, according to Fitch Ratings.

Ambiental joins forces with Aon-Benfield on flood mapping

Aon-Benfield has collaboration with Ambiental to enhance its flood model development capabilities.