Fraud

SFO announces plan to build closer ties with the City

The Serious Fraud office has announced plans to forge stronger ties to the City of London and to the City of London Police.

Man pleads guilty to faking his death in insurance scam

A man has has pleaded guilty to faking his own death in Honduras to claim insurance benefits and claiming pensions relating to another person.

Law report: Disagreement over late changes must be resolved

This law report has been contributed by national law firm Berrymans Lace Mawer.

Airmic 2011: Intermediaries need to better understand fraud

Insurance fraud is one of the biggest challenges facing the industry, yet 32% of intermediaries are only “somewhat clear” on exactly what constitutes insurance fraud.

Post history - 30 years ago: US agents accused of $1m fraud

Looking back through Post's back catalogue paints a unique picture of more than 150 years of insurance news, as this article from 30 years ago reveals.

Property claims: Surveillance legislation should hold no fear for insurers

Insurers have been told to embrace surveillance and that they have nothing to fear from the legislation surrounding it.

IFB and Apil fraud tie-up

Discussions are underway between the Insurance Fraud Bureau and Association of Personal Injury Lawyers to establish a data-sharing agreement aimed at combating fraud.

Property claims: Businesses must be vigilant over arson threat

A range of effective measures can be used to identify and tackle arson in the UK, according to a claims expert at Crawford & Company.

Post history - five years ago: Broker guilty of selling illicit policies

Looking back through Post's back catalogue paints a unique picture of more than 150 years of insurance news, as this article from five years ago reveals.

Legal update - Social networking: Better connected

A landmark case in insurance fraud has established that information obtained from social networking sites can be lawfully used as evidence. Paul Hughes explains how they can be a valuable tool for insurers.

Exercise Watermark set for insurer-specific rerun - Insurance News Now – 2 June 2011

Post senior reporter Amy Ellis outlines this week's major general insurance stories including confirmation from the Association of British Insurers that the government’s emergency flood scenario will be re-enacted specifically for the insurance industry…

LV in second IFB senior staff swoop

LV's counter-fraud division is on target to be 100-strong by the year end, 10 times the size of the start-up team that launched four years ago.

Postbox: Respect for privacy vital in digital age

More than 30 million adults in the UK are signed up to Facebook, and the number of people using social media such as Twitter is growing at a phenomenal rate. Together with the increased use of e-mail and text, there is a real shift in the way we…

Greenwoods tackles fraud

Greenwoods Solicitors has become the first law firm to join the Telecommunications UK Fraud Forum, a body for the exchange of information and promotion of united efforts against such fraud.

Allianz front-end fraud focus helps save £50m

Allianz Insurance is on track to identify £50m of insurance fraud in 2011, according to UK chief executive Andrew Torrance — boosted by work undertaken by the insurer in private car application fraud.

Law report: An inflammatory judgment on findings of fire fraud

This law report has been contributed by national law firm Berrymans Lace Mawer.

Damage management - Surge: Surging ahead

Recent surge events have shown insurers are getting better at coping with large numbers of claims but there is still room for improvement. Sam Barrett finds out what could make a crucial difference the next time an extreme event occurs.

In series: first-party fraud: Indicator or prohibitor?

Insurers are increasingly looking at options to help prevent fraud at the front end. Credit checks are common when assessing the ability to pay but Jane Bernstein asks whether they could also help as a fraud indicator.

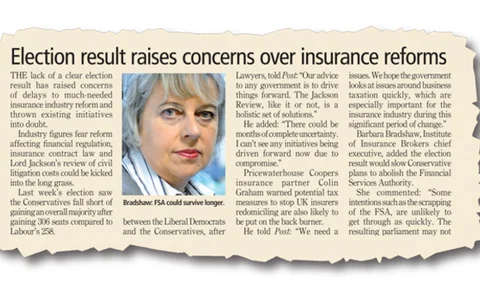

Coalition government: State of the nation: one year on

Last week's overwhelming 'no' vote in the referendum on the UK's voting system has only served to deepen divisions and highlight political polar positions within government, but how does the insurance industry rate the coalition's first 12 months in…

Postbox: time to up the ante in fight against fraud?

Graham Odiam's article on 'first-party fraud' touches on a moral dilemma. Insurers have a desire to retain policyholders by providing a good service — both at policy inception and at claim time — but also need to prevent and detect fraud efficiently.

In series: first-party fraud: Credit to the nation

Full credit data checks for insurance are common in the US. Graham Odiam looks at the likelihood UK insurers will wake up to the benefits and start using the practice here.

In series - first-party fraud: everyone's a loser

Few consumers see insurance fraud as the criminal offence it really is. Graham Odiam looks at research to find out why this is and explains how everyone will lose out until this perception is changed.

Legal update - motor fraud: overcoming the obstacles

Recent court guidance should help liability insurers overcome some of the hurdles in the fight against motor fraud. Roger Mackle reviews recent cases that have helped clarify matters.

In series - first-party fraud: banging the drum

The industry is slowly changing public perceptions that insurance fraud is a victimless crime. Jane Bernstein looks at recent initiatives and asks what more the market can do in terms of prevention?