Technology

Axa's Williams warns motor insurers against becoming obsolete

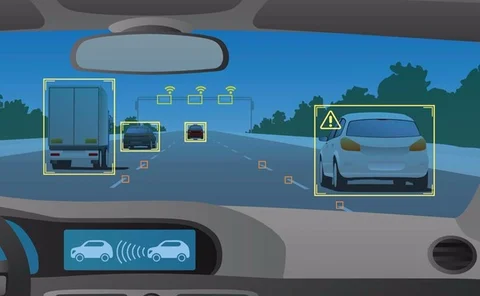

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.

Volvo to launch autonomous cars in 2021

Volvo is “fairly confident” it can start selling autonomous vehicles to individual drivers in 2021, a conference heard.

Urban Jungle develops API for home and contents insurance

Urban Jungle has developed an application programming interface which will be rolled out to partnering home insurers.

Cyber threat growing quicker than claims data: IUA

A rapid growth in cyber threats has posed a challenge to the industry in acquiring claims data, the International Underwriting Association has warned.

Blockchain-driven insurtech completes $1m funding round led by insurance executives

Insurtech firm Inzura has completed a $1 million funding round led by senior industry figures.

Interview: ABC Investors - Bunker, Cassidy, Castle, Horton and O’Roarke

With their restrictive covenants expiring at the end of 2017, the former LV general insurance management are now free to re-enter the market. Jonathan Swift speaks to the quintet about their new consortium ABC Investors, digital innovation and what it…

Former Aviva director develops broker customer data sharing platform

Broker Insights has developed a platform which uses broker customer data to help insurers identify business opportunities.

QBE's Phil Dodridge on navigating the digital tempest

Threatened with disruption, insurers need to augment their business model, argues Phil Dodridge, head of business intelligence and disruption at QBE European Operations.

Former AIG UK boss Jacqueline McNamee returns with insurtech MGA

Jacqueline McNamee, former managing director of AIG in the UK, is to return to the market fronting a new Insurtech start-up.

Underwriters urged to establish policy provisions for drone usage

Traditional aviation policies are unlikely to address the emerging risks presented by the increased use in drones.

Brexit has led to a drop in overseas business: PWC

Confidence in the market among general UK insurers dropped last year with Brexit set to impact business volumes, according to a survey.

Co-op insurance launches medical expenses travel insurance

Co-op Insurance has entered the travel insurance market with a product that offers cashless medical expenses.

Brokers informed: The perils of escape of water claims for HNW clients

Escape of water claims are reaching an all-time high and the risk can be even more prevalent in the high-net-worth sector. From bespoke wet rooms to expensive technology, with homeowners away for extended periods, the damage can prove complex and…

This week: Technology, treasury and trade credit

I'm not sure who was more excited about technology in our house this week, my son discovered that virtual pets in the form of Tamagotchi are making a comeback in the UK this year while I learnt a bar has opened where robots make you cocktails.

Das develops Alexa skill to provide assistance with legal issues

Legal expenses insurer Das Group has launched an Alexa 'skill' for the Amazon Echo Amazon’s virtual personal assistant.

Clyde & Co pilots online personal injury arbitration platform

Clyde & Co is piloting an online arbitration system for personal injury claims.

Alibaba invests in safe driving app start-up

Tel Aviv-headquartered motor technology firm Nexar has closed a $30m (£21.4m) round of financing.

Hastings to use automated fraud detection service

Hastings Direct has selected BAE Systems’ Net Reveal solution in order to detect and investigate claims and policy fraud.

Quindell auditor slapped with £700,000 fine

The company responsible for auditing Quindell has been fined £700,000 for failing to “exercise sufficient professional scepticism”.

Ten insurtech start-ups to watch in 2018 - part two

Today we feature a second quartet of businesses with their eye on the disruption prize, all of which will be worth watching out for as the year progresses.

In My Bag targets £500,000 in funding round

Gadget replacement insurtech In My Bag will begin a £500,000 funding round through crowdfunding platform Seedrs.

Ten insurtech start-ups to watch in 2018 - part one

There does not appear to be any slowdown in the number of insurtech start-ups that are aiming to mark their mark on the insurance sector.

Mobile app Honcho takes aim at price comparison websites

A mobile app is aiming to compete with price comparison websites by creating a ‘reverse auction’ market place for car insurance after raising £850k in investment.

Week in Post: Carillion collapse and the executive merry-go-round

It was oddly coincidental that it was Blue Monday, the most depressing day of the year, when Carillion collapsed – placing 20,000 jobs at risk.