Regulation

This Month In Post: Truth or dare on cyber

At the ABI annual dinner on Monday, as guests at my table predicted future insurance trends, I was struck by a suggestion. People will want to protect their most precious belongings and, in 10 years’ time, that will be their personal data, a KPMG partner…

PRA to look at Solvency II impact on insurers

The Prudential Regulation Authority will be working closely with the insurance industry to make sure that Solvency II requirements do not damage competition in the sector, the Association of British Insurers Annual Conference heard today.

Roundtable: The pre-action protocol at 20

Over two decades ago, a quintet sat down to formulate the pre-action protocols for personal injury claims. Post gathered four [Nigel Tomkins, then of Thompsons could not make it] back together to reflect on their influence, lessons learned and the…

Analysis: Does the One Call fine signal wider issues with client money?

John Radford, 53-year-old businessman and saviour of Mansfield Town Football Club, was fined £468,600 for a “lack of competence” in his handling of client money.

CBL Insurance goes into interim liquidation

The High Court of New Zealand has ordered CBL Insurance, the main subsidiary of CBL Corporation, be placed into interim liquidation.

The risks and regulations driving the Turkish insurance market's growth

Emerging risks as well as new and upcoming regulations are driving the growth of the Turkish insurance market, explain Pelin Paysal and Ilgaz Önder, partner and associate at Gün and Partners.

FCA calls for industry input on regtech

The Financial Conduct Authority has called for input on the use of technology to ease regulatory reporting.

Irish regulator forces CBL Insurance Europe to close shop

The Central Bank of Ireland has ordered CBL Insurance Europe to cease writing business with immediate effect, until further notice.

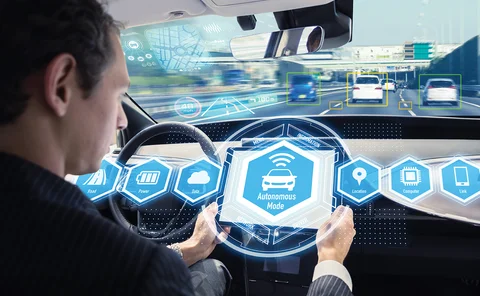

Spotlight on ADAS: Why ADAS is not a fit and forget system

With more Advanced Driver Assistance Systems being installed on cars, Alistair Carlton, technical manager at National Windscreens, says insurers shouldn't underestimate the demand for ADAS calibration.

Spotlight on ADAS: Is everyone ready for ADAS?

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet

Axa's Evan Waks on getting post-Brexit certainty

As UK insurers wonder how to continue trading in European Union countries after Brexit, Evan Waks, chief risk officer at Axa UK, argues a transition period would offer much needed certainty.

European Commission backs IDD delay

The European Commission has ratified proposals put forward by the Financial Conduct Authority to postpone the application date of the Insurance Distribution Directive.

FCA names Bailey incoming FSCS chair

The Financial Conduct Authority and the Prudential Regulation Authority have named Marshall Bailey as chair of the Financial Services Compensation Scheme with effect from 1 April 2018.

Central Bank of Ireland orders CBL Insurance to boost reserves

CBL Insurance Europe has been ordered by The Central Bank of Ireland to bolster its capital and reserves.

Lloyd’s to cut regulatory red tape, says Hancock

Lloyd’s plans to reduce the regulatory burden on market participants as the corporation focuses on a “risk-based” approach to oversight, performance director Jon Hancock said.

Government urged to publish Brexit financial services paper

The government must publish its Brexit position paper on financial services in order to assuage the “chronic state of uncertainty” at present, the chair of the Treasury Committee has warned.

CNA Hardy's Dave Brosnan on bumps in the road as businesses go global

Boards shouldn't turn their attention away from corporate, compliance and supply chain risks, warns Dave Brosnan, CEO of CNA Hardy Europe.

Analysis: Product recalls: Bringing it back

Whether it’s a tumble dryer that catches fire or baby milk that’s contaminated with salmonella, an increase in safety concerns is putting product recall insurance in the spotlight. With the frequency and severity of claims on the up, there are concerns…

Dual pricing hitting vulnerable customers, says consumer watchdog

Dual pricing is hitting vulnerable customers hardest and insurers are part of the problem, according to research from Consumer Advice.

Clearer definition of autonomous driving needed: Thatcham

The government needs to clearly define what constitutes autonomous driving in order that insurers can properly determine liability, a conference heard.

Liiba chair calls for contract continuity post-Brexit

Contract continuity and cross-border market access will be essential post-Brexit, the London & International Insurance Brokers' Association chair said in a speech in Europe.

EC report recommends adapting Solvency II

The European Commission and Insurance Europe have welcomed a report that suggests adapting Solvency II to facilitate sustainable investment.

Analysis: Sustainable insurance - in it for the long run

European insurers are gearing their investment strategies towards sustainable ventures.

Editor's comment: An explosive start to the year

I started this year in style watching the fireworks over Sleeping Beauty’s castle at Disneyland Paris. Looking at January’s headlines the insurance industry has also started this year with a bang.