United Kingdom (UK)

Intelligence: Greening the broking industry

Insurers are shouting loud and proud about the actions they are taking on environmental, social and governance issues, and this is moving down their supply chains too. Fiona Nicolson investigates how the broking sector is being affected by this, and how…

Blog: Importance of robust agency arrangements in insurance sales and supply chains

With Axa suing Santander for £624m over its payment protection insurance policies, Caroline Harbord, partner, and Charlie Paddock, trainee solicitor at law firm Forsters, discuss the importance of robust agency arrangements in insurance sales and supply…

DLG CEO Penny James appointed co-chair of FTSE Women Leaders Review

Direct Line Group CEO Penny James has been named co-chair of the FTSE Women Leaders Review.

FCA's broker survey puts property commissions under the microscope

The Financial Conduct Authority has placed broker commissions in multi-occupancy property under greater scrutiny with its latest survey.

Q&A: Mark Bower-Dyke and Crescens George, Wiser Academy

Insurance specialist learning provider Wiser Academy recently gained an ‘Outstanding’ award from Ofsted. Crescens George, CEO, and Mark Bower-Dyke, chairman, tell Post about the importance of formal qualifications to gain entry to the industry, and their…

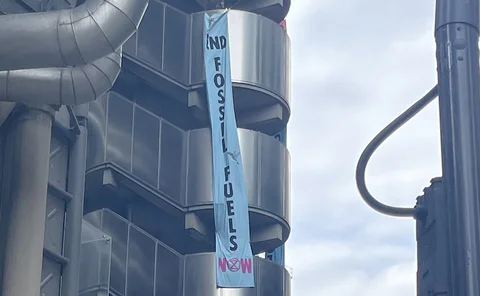

Lloyd’s HQ closed for day as Extinction Rebellion blocks entrances

Lloyd’s has closed its headquarters for the day as protesters from Extinction Rebellion blocked entrances into the building.

Blog: Ocean investment is critical to protect the welfare of ecosystems

As Axa and WTW join a new global finance ecosystem designed to channel funds into coastal and ocean natural capital by 2030, Chip Cunliffe, biodiversity director at Axa XL and co-chair of Ocean Risk and Resilience Action Alliance, takes a deep dive into…

Pen's Tom Downey says MGA sector's secret sauce is its recipe for success

Tom Downey, CEO Pen Underwriting, believes the managing general agents sector is in rude health and discusses what he believes could be its 'secret sauce'.

Fears OIC portal is not meeting objectives as unrepresented claimants make up less than 10% of users

Latest figures from the Ministry of Justice show that unrepresented claimants still make up less than 10% of those using the Official Injury Claim portal, as concerns grow that portal is not meeting objectives of being “consumer friendly”.

Start-up Peppercorn to launch this year with a customer-empowering motor solution

Exclusive: Insurtech start-up Peppercorn will launch later this year with a digital motor solution that will challenge the mechanics of traditional incumbents.

Intelligence: Our duty to protect must begin now

Protect Duty legislation has been touted as a way to reduce the potential for catastrophic events from terrorist attacks at publicly accessible locations, and it is likely to affect public and employers’ liability polices. But, as Edmund Tirbutt reports,…

Nikhil Rathi pledges to make the FCA more assertive and quicker in stamping out wrongdoing and consumer harm

The Financial Conduct Authority has launched a three-year strategy to improve outcomes, with the CEO Nikhil Rathi pledging to make the regulator more assertive and quicker in responding to changing financial services sector.

Insurers to save £2bn as Vnuk law set to be axed by the end of June

The controversial Vnuk law, which could have created an extra £2bn a year of costs for the insurance sector, is expected to be axed by the end of June as Motor Vehicles Bill passes through House of Lords’ committee stage with no amendments.

FCA regulatory reforms no ‘silver bullet’ but step towards more nimble regulator

Regulation experts have praised the Financial Conduct Authority’s steps towards tackling authorisation delays but have warned they will not be enough to tackle the problem on their own.

Lords Committee expresses concerns of ‘overly demanding’ and ‘burdensome’ regulation of London Market

The Industry and Regulators Committee has written to the Economic Secretary to the Treasury John Glen to outline concerns about lack of proportionality in the regulation of the London Market by the Financial Conduct Authority and the Prudential…

British Insurance Awards: 2022 shortlist revealed

This year the British Insurance Awards return back to their spiritual home at the Royal Albert Hall after a two year absence.

IBM ordered to pay another £80m after it unlawfully breached Co-op IT contract

The Court of Appeal has found that IBM must pay another £80.6m to the owner of Co-operative insurance due to breach of an IT contract in 2017.

Editor's comment: Walk the walk on ESG

Last August the Intergovernmental Panel on Climate Change report warned that ‘unless there are immediate, rapid and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach’.

Penny Black's Social World: April 2022

Getting pied, planting trees and Macmillan money

McPhail swaps Zurich for Keoghs

Calum McPhail, formerly head of liability claims at Zurich, has left the insurer to join Keoghs as strategy consultant on a part-time basis.

Interview: Kelly Ogley, A-Plan

Four months after stepping up to the role of CEO at A-Plan, Kelly Ogley tells Pamela Kokoszka about her three passions, discusses the growth plans for the broker, and reveals how it has managed to remain relevant for the past 58 years

FCA reforms authorisation process as it continues recruitment push

The Financial Conduct Authority has said it is committed to bring a more robust and efficient authorisation process and confirmed it has reformed its authorisation process with more decisions now taken by individual senior managers rather than by…

Citizens Advice ethnicity penalty campaign a ‘wake up call to FCA’

Citizens Advice ethnicity penalty report must be "a wake up call to the Financial Conduct Authority” to act on its promise to HM Treasury as insurers face warnings the fallout from this could be as far reaching as the Test Achats gender ruling.

Woodgate & Clark acquires media and entertainment adjuster Spotlite

Woodgate & Clark has acquired media and entertainment adjuster Spotlite as it continues to build specialist expertise.