United Kingdom (UK)

Allianz’s Catherine Dixon explains why we should all be on the path to Net Zero

Meeting environmental, social and governance targets should be a relay race, with each baton pass advancing the cause towards Net Zero, explains Catherine Dixon, chief underwriting officer at Allianz Commercial.

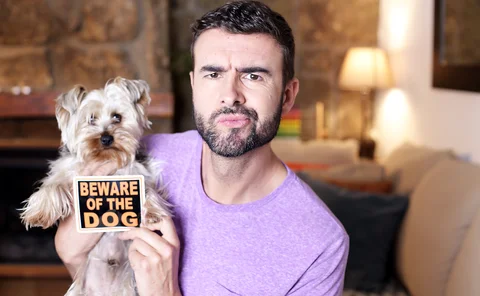

Blog: The curious incident of the dog and the bite crime

Rebecca Conway, chief legal officer at Arc Legal Assistance, reflects on the increase of pets in households in the UK during lockdown, and what route policyholders can pursue if they are bitten by a dog that has not been trained or socialised enough.

Analysis: How dual pricing reforms are shaking up insurance

Post investigates what changes the industry has seen following January’s dual pricing reforms, and if insurers are following the right path on price walking.

Robust e-scooter regulation needed at 'earliest opportunity', sector urges Shapps

Four insurance industry trade associations have called on the government to bring in 'robust' legislation around the use of e-scooters as soon as possible if they are to be permitted beyond current trials.

Judgment closing dental liability loophole could herald insurance step change

A Court of Appeal judgment has closed a legal loophole that meant dental practices were not liable for injuries caused by individual dentists during treatment, potentially further opening up the market to commercial insurers.

Axa will not appeal Corbin & King BI verdict

Axa has decided not to appeal a £4.36m Commercial Court business interruption judgment against it.

Blog: The lost art of underwriting

James Gerry, chairman of MX Underwriting, argues that the insurance industry is losing sight of the art of true underwriting, as technology continues at pace to replace the human interactions with brokers.

Data analysis: FOS insurance backlog tops 9000 cases

Freedom of information requests by Post and sister title Insurance Age have laid bare the scale of insurance case delays at the Financial Ombudsman Service.

GRP's Mike Bruce explains how trade sales with overseas buyers will boost the UK broking sector

Private equity has long reigned supreme in the UK broking market, but now with US broker Brown & Brown making its first acquisition in the UK, Mike Bruce, group CEO at Global Risk Partners, explains how this change in ownership could strengthen local and…

Blog: Effective innovation is driven by key initiatives, as well as visible leadership, clear direction and planning

Long-term thinking is key to business success, but as Harvey Wade, founder and managing director of Innovate 21, explains, more key ingredients are required to make innovation work.

Leaving IPT untouched in Spring Budget a 'missed opportunity' says Biba

The British Insurance Brokers' Association has warned leaving insurance premium tax at its current level will act as a disincentive to buy adequate insurance after the tax went unmentioned in the Spring Budget.

Ageas' Adam Clarke on inflation pushing up insurance prices

With inflation at front of mind for everyone, Adam Clarke, chief underwriting officer at Ageas Insurance, explains why its only a matter of time before insurance customers feel the pinch too.

Citizens Advice sounds alarm on car insurance 'ethnicity penalty'

Citizens Advice has accused the insurance sector of charging an 'ethnicity penalty' after finding that people from ethnic minority backgrounds pay hundreds of pounds a year more for their car insurance than white people.

Markerstudy rejoins Biba after 2017 split

Markerstudy has rejoined the British Insurance Brokers’ Association following its 2017 split from the trade body.

Briefing: Lloyd’s finally proves its mettle on harassment clampdown with record fine

Lloyd’s of London has now proved it is willing to walk the walk as it fined Atrium £1m over harassment and bullying charges.

Intelligence: What does the future hold for ESG chief officers?

With the growing importance of environmental, social and governance issues, companies are starting to recruit people to senior executive positions to oversee their strategies. Pamela Kokoszka investigates if the role of chief ESG officer is here to stay,…

ESG Blog: Follow the Green Claims Code

Andrew Waddelove, head of sustainability at LV general insurance, looks at substantiating ESG claims, and considers what the Green Claims Code means for the insurance industry.

Blog: An era of change for motor insurance - By Bits' CEO Rimmer on things to consider to avoid being overtaken

With the insurance industry facing an identity crisis in light of the Financial Conduct Authority's focus on price-walking, usage-based insurance has been suggested as one route to a brighter and more hopeful future for consumers and insurers alike…

Pricing equilibrium to settle within 'next few months': A-Plan CEO Kelly Ogley

A-Plan CEO Kelly Ogley told Post she expects the market will 'reach an equilibrium' on pricing in the next few months following Financial Conduct Authority reforms.

ESG Blog: On the trail of green regulation and reporting

With the new rules expected to come into force in 2022, which will make ESG reporting compulsory for big companies, Allianz's head of strategy and propositions Glen Clarke, considers what companies will need to do to account not just for their own…

Lloyd’s fines Atrium record £1m for harassment and bullying charges

Lloyd’s managing agent Atrium has been fined a record £1.05m after it accepted three charges of misconduct by its employees, including senior executives.

ESG Exchange Q&A 2: How are insurers enabling their employees and partners to be green?

As part of our ESG Exchange fortnight, Post spoke to Ageas, Aviva, LV and Zurich to find out how insurers are thinking beyond their own firms and helping their employees, partners and their supply chain to adopt environmental, social and governance…

Howden moves HX staff into its other businesses

Howden is integrating teams from its HX business into different areas of the group.

Blog: Insurtech – the power to make ESG happen

The Insurtech domain will be the driving force behind ESG for the insurance sector, writes Sam Evans, founding partner of Eos Venture Partners, a strategic insurtech venture capital fund.