United Kingdom (UK)

Zurich begins new initiative aimed at partnering with 'innovators'

Zurich has launched a new initiative in order to enter partnership with innovative companies and embed technology into its business.

Buzzvault announces long-term growth plans following Munich Re tie-up

Exclusive: Buzzvault Insurance has entered a five year strategic partnership with Munich Re Digital Partners with plans of releasing products to market by Q3 2018.

FCA calls for industry input on regtech

The Financial Conduct Authority has called for input on the use of technology to ease regulatory reporting.

Clear buys Robert Alexander and eyes further deals in 2018

Clear Insurance Management has bought New Malden-based broker Robert Alexander.

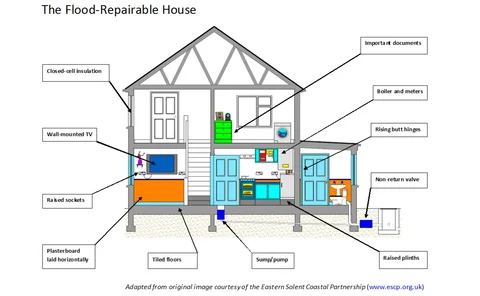

Blog: The 130 missed opportunities to make a flooded home resilient

Many opportunities are missed to make properties flood-resilient instead of just repairing them, write Dr Jessica Lamond and Dr Rotimi Joseph, respectively associate professor and visiting fellow at the University of the West of England Bristol. They…

Slice to launch on demand products in Q2 following partnership with Legal & General

US on demand insurtech firm Slice has said that its on demand home sharing insurance products will be available by Q2 this year, following its partnership with Legal and General.

FCA signs agreement with US regulator to promote insurtech innovation

The Financial Conduct Authority has signed an arrangement with the US Commodity Futures Trading Commission to support each other’s insurtech initiatives, Lab CFTC and FCA Innovate.

Whiplash fraudster given two month prison sentence

A whiplash fraudster has been handed a two month prison sentence and been ordered to pay £14,000 in costs.

68% of homeowners think it’s acceptable to omit application information

Over half of UK homeowners believe it is acceptable to omit or adjust information in their application to keep their insurance premiums low, according to survey findings.

Insurers could face claims worth millions following British Steel Pensions Scheme transfers

Insurers could face millions of pounds worth of professional indemnity claims arising from negligent financial advice given to those transferring out of the British Steel Pensions Scheme last year.

Hiscox to use real time cyber attack data in 'first' for awareness campaign

Hiscox will display real-time cyber attacks to raise awareness of the threat that cyber crime poses to SME businesses, as part of its new ad campaign.

Softbank reported to be eyeing up stake in Swiss Re

Japanese tech-to-financial conglomerate SoftBank is exploring the possibility of taking a $10bn stake in reinsurer Swiss Re, reports suggest.

R&Q completes reinsurance to close legacy deal

Randall and Quilter has completed a deal to become the capital backer of Syndicate 3334’s 2014 and prior years of account.

IFB appoints claims officers Nichols and Gibson to its board

The Insurance Fraud Bureau has appointed two claims officers from major insurers to its board.

Insurers to fund personal injury IT gateway

Exclusive: The government has accepted an offer in principle from the insurance industry to fund a new IT gateway to allow litigants in person access to the claims portal.

Saga appoints Patrick O’Sullivan as chairman

Saga has appointed Patrick O’Sullivan as chairman with effect from 1 May 2018.

Spotlight on ADAS: Why ADAS is not a fit and forget system

With more Advanced Driver Assistance Systems being installed on cars, Alistair Carlton, technical manager at National Windscreens, says insurers shouldn't underestimate the demand for ADAS calibration.

Spotlight on ADAS: Is everyone ready for ADAS?

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet

Hiscox found not guilty in ICO criminal prosecution

Hiscox has been found not guilty of breaching the Data Protection Act in a court case brought against it by the Information Commissioner’s Office.

Smartphone video insurtech sets its sights on Europe

Global insurtech Eviid is setting its sights on expansion across Europe following the successful partnerships with insurers across the UK, US and Australia.

Brit sees major losses of $250m

Brit saw its combined ratio rise to 112.4% last year following major loss claims of $250m (£177.8m).

This week in Post: Funding, fraud and finding life after Brexit

This week, the insurance industry received the news that the government’s controversial whiplash reforms are likely to be put into effect in April next year.

Blog: Mystery deepens as founder and funder of peer-to-peer insurtech Hey Guevara deny knowledge of relaunch

You can never keep a good revolutionary down.

Cigna Insurance Services pulls out of travel market

Exclusive: Cigna Insurance Services has pulled out of the travel insurance market.