Personal

Fully Comp 15: Insurance Internships and graduate programmes - keeping up in the race for new talent

For the fifteenth episode of Post’s video series Fully Comp, we gathered together a panel to discuss insurance internships and graduate programmes.

CII boss Sian Fisher addresses local institute concerns over grant scheme aimed at tackling seven figure deficit

Exclusive: The Chartered Insurance Institute’s 2020 deficit is no longer going to be of the “magnitude” of £7m, CEO Sian Fisher told Post as she addressed concerns around local institute grant schemes.

IPO inevitable for 'reluctant unicorn' Zego: CEO Sten Saar

Zego, now valued at $1.1bn (£792m), has become the UK's first insurtech 'unicorn' with an initial public offering "inevitable" but not on the immediate horizon, the insurtech's CEO and co-founder Sten Saar told Post.

Esure CEO says PCWs remain key to ambition to be UK's pre-eminent digital insurer

Price comparison websites remain integral to Esure’s plans to be the UK’s “pre-eminent digital insurer” despite fears their market share could shrink after regulatory intervention, CEO David McMillan told Post.

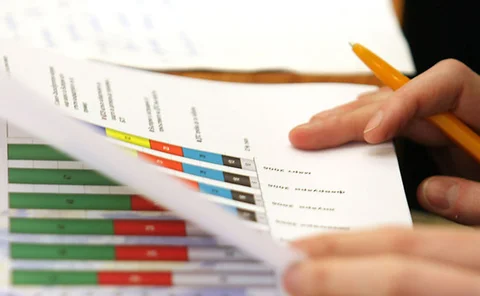

Insurer results directory 2020

Updated: Post tracks the 2020 insurer results season including gross written premium and combined operating ratio - detailing the impact of UK business interruption, weather, motor, home, non-business interruption Covid-19 claims, as well as mergers and…

Comparison sites’ growth fortunes mixed in pandemic year

Comparison sites had mixed fortunes in terms of growth in 2020, as a third-quarter bounce-back in car insurance sales offset some, but not all, of the initial impact of Covid-19.

Clear buys Luker Rowe and HIA International

Clear Group has bought Brokerbility members HIA International and Luker Rowe, Post can reveal.

Bought By Many adds ex MTV HR specialist Julia Ingall as chief people officer

Pet insurance insurtech Bought By Many has appointed Julia Ingall as its first global chief people officer ahead of a recruitment drive to help international expansion.

Covéa’s Graeme Howard on the need for innovation to drive a fundamental market shift

Graeme Howard, chief technology and information officer at Covéa Insurance, shares the three key ingredients of systems, agility and trust culture to succeed in innovating on a transformative scale.

Lockdown reins in 'Beast from the East Two' claims hit

At the beginning of February, national headlines warned of a ‘Beast from the East Two’ as snowy blizzards, heavy rain and gale-force winds were forecast to batter large parts of the country. But a repeat of the hefty claims dent left by its 2018 namesake…

Brightside buy first in a pipeline of deals, says Markerstudy's Humphreys

There will be no job losses from Markerstudy buying Brightside with the brand and Bristol office being kept, Gary Humphreys, group underwriting director at Markerstudy, told Post.

Scott Egan confirmed as RSA UK and International CEO post takeover

Intact Financial Corporation has confirmed that Scott Egan will stay as CEO of RSA’s UK and international business after its takeover of the insurer, which is scheduled to complete next quarter.

For the record: Brightside sold to Markerstudy; Aviva acquires Axa XL HNW team; Aston Lark buys Bruce Stevenson and Inflexion invests in broking again

Post wraps up the major insurance deals, launches and investments of the week

Covid curbs drive Admiral to record profits

Admiral has posted record pre-tax profits of £638m for 2020, reaping the benefit of fewer claims as a result of quieter roads during lockdown.

Aviva confirms £84m Covid hit as commercial lines book surpasses £2bn

Aviva has posted a combined operating ratio of 98.5% for its UK general insurance business in 2020, reporting growth across commercial lines and progress on its pledge to slash its available personal lines products by 80%.

Fully Comp 14: First reactions to the MoJ whiplash portal protocol and practice direction

For the fourteenth episode of Post’s video series Fully Comp we gathered together a group of experts to discuss the highly anticipated publication of the rules, tarriffs, pre-action protocol and practice direction linked with the whiplash portal.

IPT unscathed in Budget with corporation tax set to rise in 2023

Insurance premium tax went unmentioned in the Spring Budget announcement, with developments including additional apprenticeships funding, a furlough extension and a corporation tax hike from 2023.

MIB bombarded with whiplash questions by confused and frustrated claims sector

The Motor Insurers' Bureau's first update on the whiplash portal since critical rules were released by the government was met with difficult questions and consternation from the claims sector.

Consumers put IPT almost bottom of the list for Budget tax rise targets

Exclusive research by Consumer Intelligence for Post has revealed that the UK public would support increases in almost any other tax ahead of insurance premium tax if the Chancellor opts to bring in rises to help pay for the costs of battling the Covid…

Briefing: IPT – good news in the data but reasons for concern remain

The only doubt around the bill to pay for fighting the Covid-19 pandemic is just how big it is, considers Post senior reporter Emmanuel Kenning.

Spotlight: Technology - Moving towards digital learning in insurance

When lockdown was announced in March 2020, the scale of the adjustment required for remote working may have warranted insurance businesses pressing pause on recruitment and development. But, with lockdown accelerating the use of technology, it’s been…

Aviva targets net zero carbon emissions by 2040

Aviva has revealed its plan to become a net zero carbon emissions company by 2040.

Brokers urge push back on soaring contributions as FSCS levy total poised to break £1bn

Brokers have called for the insurance industry to kick back against the increase in their Financial Services Compensation Scheme levy with the sector’s bill set to more than triple to £146.8m in 2021/22.

Advertising feature: Are pet insurers doing enough to support pre-existing conditions?

Pre-existing medical conditions have long made the process of shopping around for pet insurance an often challenging endeavour. Ian Howie, managing director, life, health and travel at Verisk Underwriting, UK & Europe, asks how can insurers offer…