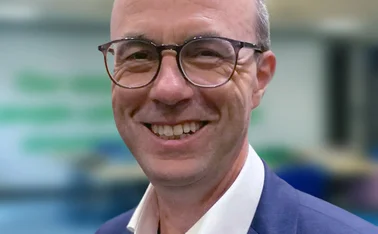

Diary of an Insurer: Prestige’s Tim Baxter

Tim Baxter, business development and relationship director at Prestige Underwriting, navigates a week of strategy sessions in Belfast, broker visits in Manchester and London, and home-office conference calls – all in the name of expanding the MGA’s non-standard household and motor book of business.

Monday

It’s wheels-up at dawn for a flight to Belfast. Monday mornings often mean a distribution strategy meeting with the team, mapping out our broker engagement priorities across Great Britain and Ireland.

We review growth plans for our specialist lines – non-standard household and motor – ensuring we’re on track with new initiatives and a new home insurance proposition in the pipeline.

It’s a lot to cover in one sitting, but the focus is shared and understood by us all – deepen partnerships, enhance broker experience, and support sustainable growth.

By mid-afternoon I’m on calls with a couple of key brokers. With more than 1,300 brokers in our network, there’s always someone to speak with.

One long-time partner jokes that I must have a season ticket for the Belfast City Airport lounge. I laugh – they’re not far wrong.

Before I canter back to the airport, I shoot a quick text to my wife about the kids’ after-school pickup (yes, I remembered to arrange it this time).

Tuesday

After an early start and a strong coffee, I’m on the first train to Manchester. The rain is predictably Mancunian, but the warm welcome at a brokerage makes up for the weather.

I spend the morning with a broker firm that’s big on non-standard household cover. They’ve had success placing tricky home risks (think thatched cottages and flood-zone properties) through Prestige.

Over lunch, talk turns to motor trade gossip and our multi-vehicle product. Eighteen months on from its refresh, our UK multi-vehicle policy (which caters to family fleets) is gaining great traction.

The broker mentions they appreciate how we accommodate both standard cars and quirkier vehicles under one policy, including the client who insures a sports car and a dog-grooming van on the same plan!

Hearing that brokers are responding well to this feature confirms we’re on the right track.

Wednesday

Today is a home working day, which means I trade my usual commute for the school run. After seeing my daughter and son off to school, I set up shop in my home office (the kettle working overtime).

By 9am I’m on a Teams call with colleagues, debriefing them on insights gathered from yesterday’s broker visit. It’s all about fine-tuning our offerings so brokers can place those complex risks confidently.

Midday, I join a virtual catch-up with our underwriting and pricing teams to check progress on our peril-level rating project and Covernet extranet refresh projects. We’re always looking to innovate quickly based on broker needs.

The team’s enthusiasm is infectious – even through a screen – and I’m reminded how much I enjoy this collaborative aspect of my role. In between calls, I even manage to grab lunch in the kitchen with my wife, a nice perk of home-working.

By late afternoon, I’ve cleared the inbox, followed up on a colleague’s query about last month’s numbers, and prepared briefing notes for tomorrow’s trip.

Thursday

Another day, another early train, this time to London Liverpool Street. I have back-to-back meetings in the City, starting with one of our key broker partners.

Over coffee near Lloyd’s, we review our joint performance year-to-date. I walk them through how our non-standard motor portfolio could help his team further and update them on new product developments.

In the afternoon, I head across town to meet another national broker network’s distribution head. We discuss broker market trends and how Prestige can help brokers win more business in specialist niches. It’s exactly the kind of collaboration I thrive on – sharing ideas and brainstorming niche products.

London always supercharges my day (along with a fair amount of caffeine) and I catch the train home, a bit tired but energized by the day’s conversations.

Friday

Fridays are for tying up loose ends. I review the week’s outcomes with my team and we make sure all broker requests are handled. It’s also my chance to check in with our head of underwriting about any emerging issues.

This week I flag a trend noted in one of the Manchester conversations. They’re seeing a jump in clients with imports and modified vehicles, an area we’re well-known for covering, alongside an increase in demand for our high excess proposition.

Sharing such intel internally helps us stay ahead and helps the pricing and underwriting teams prepare for what’s coming down the line.

By mid-afternoon, I’ve compiled a brief report for our managing director on distribution insights gathered this week. I fire that off and glance at my calendar for next week – it’s filling up fast with more travel and meetings.

Before I sign off, I ring a long-standing broker partner for a quick catch-up; we’ve worked together since my first year at Prestige in 2014, and a quick personal call goes a long way in maintaining that relationship.

With the workweek wrapped, I transition to family mode. Friday evening is reserved for my daughter’s dance recital and my son’s enthusiastic rundown of his football practice.

It’s a hectic life, but as I watch them and feel myself finally relax, I’m grateful – for both a career that excites me and a family that keeps me grounded until Monday rolls around again.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk