Webinar: Learn about AI underwriting lessons from the front line

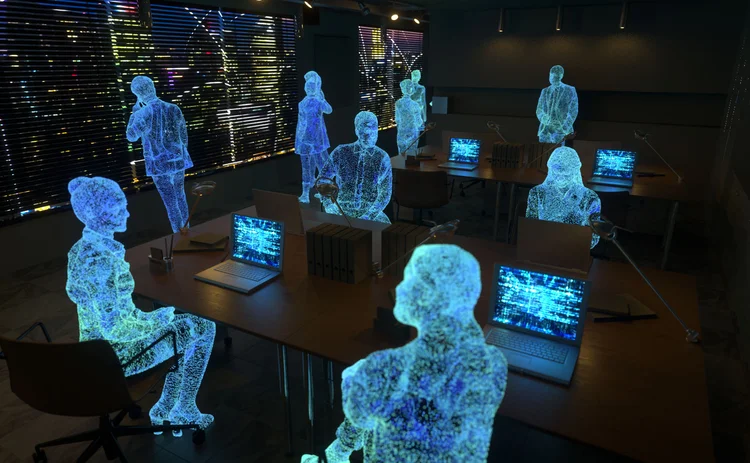

The conversation around AI in underwriting is shifting, from what’s possible to what’s already in play.

With this in mind, Insurance Post is hosting an upcoming webinar in which an expert panel will explore how underwriters can leverage AI to solve real world problems.

Held in association with Earnix, the panel including Iprism and C-quence will also take a practical look at how AI tools are embedded into underwriting environments, transforming how risks are assessed, decisions are supported, and data is utilised.

Featuring insights from underwriters who work with these systems daily, the webinar aims to explore what’s delivering value, where challenges persist, and how expectations around performance and capability are evolving.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk