News

Dual’s McGinn outlines plan to accelerate MGA’s expansion

Simon McGinn, CEO of Dual UK, has revealed how he intends to accelerate the growth of the MGA business.

AIG cancels John Neal’s president appointment

AIG has announced John Neal will no longer be joining the insurer as president next month due to personal circumstances.

Jensten buys broker; Pen's renewables product; Zurich UK's head of compliance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

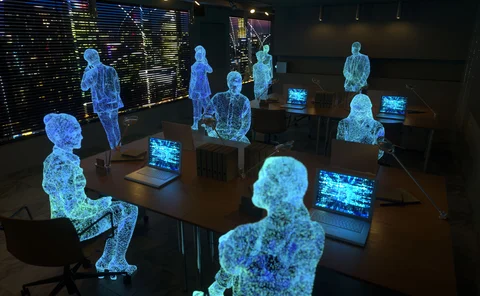

How Dual’s data capability is transforming the MGA

Simon McGinn, CEO of Dual, has shared how the MGA’s data capability has been transformed in recent years and is accelerating the growth of the business.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

ABI urges MPs to hardwire insurance into national resilience

The government must embed insurers at the heart of national resilience planning and involve the sector at the earliest stage of major policy decisions, Association of British Insurers director general Hannah Gurga told industry leaders.

Markel names MD for new London Market business

Markel Insurance has today named Rohan Davies as managing director of its newly created London Market business.

Proposals for simplified FCA commercial and bespoke rules imminent

Post understands the Financial Conduct Authority is aiming to publish proposals for simplified rules for commercial and bespoke insurance products before the end of the year.

Webinar: Learn about AI underwriting lessons from the front line

The conversation around AI in underwriting is shifting, from what’s possible to what’s already in play.

Laka raises £14.1m in series B round

Laka has raised £14.1m in its series B funding round, following the green mobility insurer securing a £6.5m venture debt facility from HSBC Innovation Banking.

Gallagher shifts retail structure following AssuredPartners deal

Gallagher has announced a new UK retail operating structure with the creation of two new trading divisions.

Government introduces Bill to bolster cyber resilience

The UK government has today (12 November) introduced a new Bill to parliament aimed at strengthening cyber security for the nation’s essential public services.

Motor premiums decrease for third straight quarter

Motor insurance premiums have dropped each quarter so far in 2025, according to the Association of British Insurers’ latest tracker.

MPs call for more clarity on leasehold insurance fees

During a recent parliamentary debate, MPs shared horror stories of constituents dealing with their property management firms and insurers.

Which? names and shames insurers with low claims acceptance rates

Which? has found continued hesitancy from home insurers when accepting claims.

Biba welcomes government’s signposting initiative

The British Insurance Brokers’ Association has welcomed the financial inclusion strategy from government which outlines a total signposting initiative to improve access to insurance.

Aon expects new AI tool to cut claims resolution time by up to 20%

Aon is targeting a 10 to 20% improvement in its claims resolution time in the first year of deployment of its new artificial intelligence claims tool.

‘Modular’ SME policies could be key to fighting underinsurance

Simplified and modular insurance policies could help abate underinsurance in SMEs, according to Hiscox’s group chief underwriting officer Joanne Musselle.

UK cyber insurance claims hit £197m in 2024

Insurers paid out £197m to the UK businesses hit by cyber incidents in 2024, according to data from the Association of British Insurers.

Mutual calls for cash from members following Grenfell fallout

Wren Insurance Association, which specialises in insuring architectural firms, has demanded more money from its members as it continues to struggle with claims relating to the Grenfell tragedy back in 2017.

Allianz to open four broker hubs

As a way to ‘stay relevant’ to brokers, Allianz Commercial’s chief distribution officer Nick Hobbs has revealed the measures the insurer has taken, including plans to open four new broker hubs.

IUA elects chair amid ‘challenging market conditions’

The International Underwriting Association has elected Theo Butt, UK CEO of Convex Insurance, as its next chair.

Alps' Gap product; Westfield partners with Insurwave; Gallagher’s NED

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Regulatory timeframe ‘biggest challenge’ for insurance startups

The regulatory timeframe is the “biggest challenge” for insurance startups, according to PwC partner and InsurStart chairperson Hannah Vaughan.