Analysis

Renewable energy: evolving together

Investment in renewable energies is increasing at a rapid rate and the opportunities are plenty, however, as Ignacio Almazán explains insurers must evolve with this sector to ensure continued cover.

Renewable energy: evolving together

Investment in renewable energies is increasing at a rapid rate and the opportunities are plenty, however, as Ignacio Almazán explains insurers must evolve with this sector to ensure continued cover.

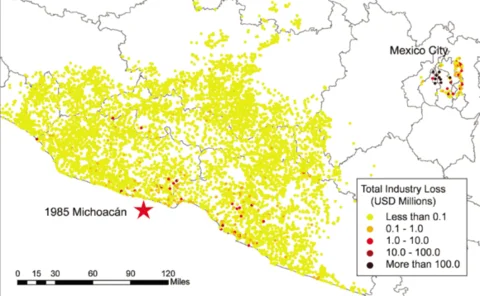

Country report: Mexico - An impact felt 25 years later

Though lessons have been learned since the Michoac√°n earthquake, many buildings in Mexico City remain at great risk, write Tao Lai, Khoshrow Shabestari and Vineet Katiyar.

Exposure management: Forewarned is forearmed

Suki Basi argues that further market transparency is necessary in order to deliver improved exposure management

Talent: Mind the gap

Gordon Vater highlights the need for (re)insurance to beware of a looming recruitment crisis as experienced industry personnel edge toward retirement and graduates stampede towards better-known areas in financial services.

Bermuda politics: Under starter's orders: Bermuda's leadership race

The confrontational bombast of Bermudan premier Ewart Brown is shortly to come to an end, much to the relief of international business on the island. Matthew Taylor reviews the candidates to succeed him.

Global business, hidden danger

The US and EU have new trade sanctions against Iran. (Re)insurers must be aware of both sets of regulations as well as potential for supra-national jurisdiction, argue Jamie Rogers and Pieter van Tol.

Talent: Shooting stars

Reinsurance uncovers the reasons behind the successes of some of the industry's brightest young things.

Monte Carlo roundtable: State of play

Mairi Mallon leads proceedings at the annual PricewaterhouseCoopers-sponsored Reinsurance roundtable at the Monte Carlo Rendezvous, where industry experts gathered to talk about the industry's hot topics.

Viewpoint: The Hitchhiker's Guide to Solvency II

Solvency II is looming large on the horizon but, argue Henry Sopher and Ann Duffy, despite the guidelines' complex language and detailed instructions, the run-off market can make it through this new universe by simply applying sound business sense and…

Exposure management in action - Munich Re

In 2009, Munich Re - which pursues an integrated business model consisting of both primary insurance and reinsurance - achieved a profit of €2.56bn on premium income of around €41bn. It operates in all lines of insurance, with around 47,000 employees…

Customer value management: Improving margins

Broker marketing skills have become ever more important in the personal lines market, with the growth of online aggregators. Tim Ham reports on the increased need for customer value management to optimise profit.

In series - Professionalism and CPD: The gold standard

Brokers have embraced the professional development mantra of producing highly skilled employees.

In series - Professionalism & CPD: Banging the drum

Lynn Richards-Cole extols the virtues of professionalism for brokers and details why technical skill development is essential in serving customers.

Broking focus - SME: Survival of the fittest

Are brokers right to see SME as a 'safe house' for commercial insurance, Jakki May asks if direct insurers can really have an impact on the sector and how intermediaries can counteract this threat.

Environmental liability - under-insurance: Clean up your act

Environmental insurance is regularly purchased by companies looking to cover historical liabilities rather than their day-to-day operational risks. Tony Lennon examines the reasons behind this decision.

Post Europe: Remedy sought for global compliance headache

International business must keep compliant with shifting insurance regulations and tax regimes across the world, and on the back of research by Ferma Peter den Dekker asks if a single database could help reduce cost bases within impairing competition.

Post Europe: All change for financial reporting?

The International Accounting Standards Board has released its exposure draft with the intention to create a single international financial standard. Evan Bogardus explains how for many insurers, meeting these challenges head on could transform their…

All change for financial reporting?

The International Accounting Standards Board has released its exposure draft with the intention to create a single international financial standard. Evan Bogardus explains how for many insurers, meeting these challenges head on could transform their…

Remedy sought for global compliance headache

International business must keep compliant with shifting insurance regulations and tax regimes across the world, and on the back of research by Ferma Peter den Dekker asks if a single database could help reduce cost bases within impairing competition.

Case managers: Servants of too many masters?

Andrew Underwood looks at the role played by clinical case managers in the claims process for seriously injured patients and suggests how the system could be improved to benefit claimants.

Household - pricing pressures: Put your house in order

Household insurance is entering a make or break phase and brokers and insurers need to be disciplined, yet flexible, to remain competitive, says Craig Allen.

News analysis - Fraud: Some distance to go

While fraud detection has increased over time, there is still much more the industry could be doing in its approach. Lorraine Carolan and Craig Dickson report on what is holding it back.

Brand analysis: A robust year for insurance brands

Despite the ongoing disruption in the financial services sector, the brand value of insurers has seen a healthy increase. James Park reports on the results and looks at the opportunities for the coming year.