Property

Staysure acquires Rock, Esure joins forces with Minster Law, and Allianz invests in Heycar

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Parhelion co-CEO Richardson asserts insurers need to move on from a ‘piecemeal’ ESG approach

The co-CEO of the self-proclaimed ‘world’s first sustainable insurer’ has admitted that he regards Parhelion as a “pathfinder” for the industry and hopes others will follow it into fully committing to the environmental, social and governance space…

Intelligence: CSR is dead, long live ESG

Although environmental, social, and governance issues have been mentioned as far back as 2006 by the United Nations with other sectors seeing it incorporated into their financial evaluations, insurance is only recently picking up the buzzword. Post…

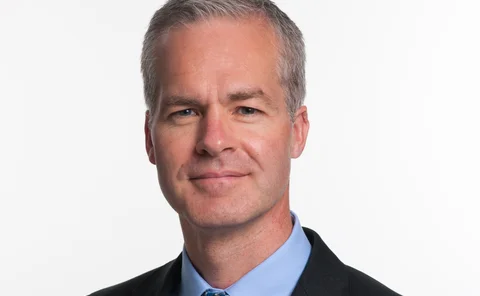

Intelligent AI appoints ex-RSA leader Neil Strickland as CCO

Insurtech Intelligent AI has appointed Neil Strickland, former customer experience director at RSA, as chief commercial officer.

Digital disruption in insurance – managing indemnity spend on escape of water claims

Insurers are grappling with rising escape of water claims costs. One of the most common types of domestic property damage claims, insurers are paying out an estimated 2.5 million every day, according to the Association of British Insurers.

Interview: David Bearman, Aventum

Aventum CEO David Bearman explains the growth of the broking and underwriting firm to Emmanuel Kenning, tracing its route from a start up focused on retail UK SME to a global specialist and niche player that has plans to be a decade defining business.

Competitors see opportunities as Aon-WTW delay risks leaving the brokers in 'no man’s land'

Further delays to the Aon-Willis Towers Watson merger caused by the decision by the US Department of Justice to file a civil antitrust lawsuit to block the transaction will lead to opportunities to snap up staff and clients, according to UK brokers.

Analysis: The CMCs out of scope

When the Financial Conduct Authority took over claims management company regulation in 2019, it fired warning shots at the sector. Should the regulator’s remit be widened to cover those firms that don’t come under its surveillance?

'Anomaly' Tractable becomes latest UK insurtech unicorn as it diversifies into property after $60m Series D raise

Motor accident and recovery artificial intelligence specialist Tractable is to diversify into property having become the latest UK-based insurtech to acquire unicorn status with a $60m (£43m) Series D raise jointly led by Insight Partners and Georgian…

EY: motor market to return to loss in 2021; Canopius unveils algorithmic MGA; Kitsune sold to XS Direct

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Q&A: John Fowle, Chaucer

John Fowle, CEO of Chaucer, tells Post all about growth, being owned by China Re and the plans for the next 12 months as well as why the business undertook its recent rebranding and the importance of diversity and inclusion.

Aviva faces leaseholder ire over mounting fire safety concerns

Aviva has drawn anger from leaseholders in residential properties owned by an investment fund over the management of fire safety issues.

Aston Lark's Peter Blanc on relevance and opportunity

Aston Lark group CEO Peter Blanc assesses why the market can’t just continue to offer the same old products, tweaked to be one step ahead of the next best, with cover for intangible assets coming to the fore along with the need to have challenging…

Q&A: Randall Goss and James Begley, Oxford Insurance Group

Post caught up with Randall Goss, chair and CEO of parent company US Risk, and James Begley, chief operating officer of Oxford Insurance Group, to track how the offering was formed, its growth, expansion and acquisition targets. The pair also share their…

Reich targeting £120m GWP within five years

Reich is on track to hit its £100m of gross written premium target for 2022 and will push on to £120m over the next five years, CEO Simon Taylor told Post.

Biba 2021: Key takeaways from John Glen's appearance

John Glen MP, Economic Secretary to the Treasury, tackled insurance premium tax, broker Financial Services Compensation Scheme levies, cladding, Brexit and more in his keynote address to the British Insurance Brokers’ Association’s 2021 conference…

Biba 2021: 'Knee jerk' silent cyber reaction led to unintended consequences

The clampdown on silent cyber exposure has had unintended consequences for customers with some alterations too “broad brush”, according to Axa UK managing director, underwriting and technical services David Williams.

Colonial Pipeline: Cyber attack must be a 'wake up call' for insurance sector

The ransomware cyber-attack on the Colonial Pipeline that led to a shutdown of the 5500-mile-long fuel pipeline in the US should be a “wake up call” for all businesses and the insurance market, according to experts.

Contractors call for Artemis directors to be 'struck off' from insurer networks

Contractors and suppliers of failed Artemis Recoveries have called for its directors to be “struck off” from insurer repair networks after the company entered liquidation owing more than £553,644 to unsecured creditors.

Carpenters adds Faye Fishlock from DAC as head of defendant insurance services

Carpenters Group has appointed Faye Fishlock to lead its legal defence services and strengthen its offering to insurers.

Allianz and LV appoint joint claims panel

Allianz and LV have appointed BLM, DWF and Keoghs to their claims legal panel and are considering joint panels across other areas, Post has learned.

Chubb and Marsh unveil Covid-19 vaccination solution; insurtech investment hits quarterly high; motor/home premiums fall; and Aviva offers cover to new customers affected by cladding crisis

Post wraps up the major insurance deals, launches, investments and strategic moves of the week not covered elsewhere on www.postonline.co.uk

Briefing: Tracking the Ardonagh Portfolio Solutions and Beazley deal

The recently announced tie-up between Ardonagh Portfolio Solutions and Beazley is most immediately of interest to those with a London Market leaning. However, there are potential future implications for the UK retail market.

Shepherd Compello promotes Steve Hart to chief broking officer

Shepherd Compello has named Steve Hart as chief broking officer, moving up from divisional director for the company’s US-focused property business.