Motor

Claims - Indicative reading time: 50 minutes

A series of CPD knowledge learning opportunities that can be used to accrue reading time. The pass rate is 80%.

Week in Post: Are further Swinton branch closures a sign of the times?

I have never bought insurance from a high-street broker. In fact, I know very few people my age who have.

RSA UK commercial book sees COR deteriorate to 108%

RSA UK saw its combined operating ratio for commercial operations deteriorate to 108.1% over the course of 2017.

Analysis: Insurers torched on Twitter over Liverpool Fire

How social media influenced the response of insurers to the Liverpool fire

Ageas shakes off Ogden impact to return to profit

Ageas UK has seen a return to profit after a year of being hammered by the residual impact of the Ogden rate change.

Allianz UK CEO Dye declines to comment on XL acquisition rumours

Allianz UK CEO Jon Dye has declined to comment on recent speculation that the group is looking to acquire XL.

Insurers to fund personal injury IT gateway

Exclusive: The government has accepted an offer in principle from the insurance industry to fund a new IT gateway to allow litigants in person access to the claims portal.

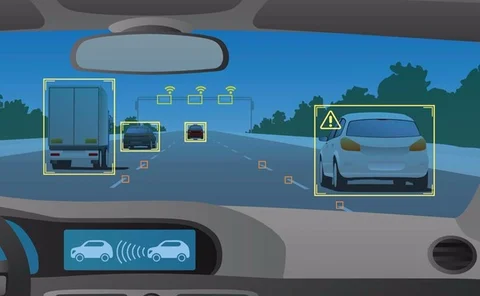

Spotlight on ADAS: Why ADAS is not a fit and forget system

With more Advanced Driver Assistance Systems being installed on cars, Alistair Carlton, technical manager at National Windscreens, says insurers shouldn't underestimate the demand for ADAS calibration.

Spotlight on ADAS: Is everyone ready for ADAS?

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet

Blog: Mystery deepens as founder and funder of peer-to-peer insurtech Hey Guevara deny knowledge of relaunch

You can never keep a good revolutionary down.

Q&A: DCI Andy Fyfe, Insurance Fraud Enforcement Department

Two months on from his appointment as head of the City of London Police’s Insurance Fraud Enforcement Department, Post sat down with detective chief inspector Andy Fyfe to discuss the ways Ifed is tackling insurance fraud.

Ageas's François-Xavier Boisseau on fake pricing scandals

Insurers do not quote racist premiums, writes François-Xavier Boisseau, CEO insurance at Ageas UK, urging the sector to better educate the public on how pricing works.

Argo Global launches Lloyd’s motor treaty consortium

Argo Global has launched of the first Lloyd’s market consortium for motor treaty business.

Emerging Asia fastest growing GI market in 2018

Emerging Asia is set to remain the world’s fastest growing general insurance market in 2018.

Blog: Personal and cyber - connecting the dots

James Tucker, smart technology manager at Allianz, explains why insurers should consider creating an all-encompassing personal cyber cover.

Ghost brokers defraud public of £631,000 over three years

Ghost brokers have defrauded the public of £631,000 over the past three years.

Analysis: Product recalls: Bringing it back

Whether it’s a tumble dryer that catches fire or baby milk that’s contaminated with salmonella, an increase in safety concerns is putting product recall insurance in the spotlight. With the frequency and severity of claims on the up, there are concerns…

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.

Clearer definition of autonomous driving needed: Thatcham

The government needs to clearly define what constitutes autonomous driving in order that insurers can properly determine liability, a conference heard.

MIB could help OEMs share accident data with insurers

The Motor Insurers’ Bureau could act as a platform for car manufacturers to share with insurers accident data generated by autonomous vehicles, a conference heard.

Axa's Williams warns motor insurers against becoming obsolete

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.

Volvo to launch autonomous cars in 2021

Volvo is “fairly confident” it can start selling autonomous vehicles to individual drivers in 2021, a conference heard.

Interview: ABC Investors - Bunker, Cassidy, Castle, Horton and O’Roarke

With their restrictive covenants expiring at the end of 2017, the former LV general insurance management are now free to re-enter the market. Jonathan Swift speaks to the quintet about their new consortium ABC Investors, digital innovation and what it…

Liverpool fire response 'sets a dangerous precedent', says Axa's Blanc

Exclusive: Insurers who have waived the excess of policyholders affected by the Liverpool car park fire are setting "a dangerous precedent”, Axa UK and Ireland CEO Amanda Blanc has said.