Motor

Lamppost liar loses £600K claim

HF and Hastings Direct have successfully contested a £600,000 claim based on conflicting passenger references and no evidence of vehicle damage.

Insurance Post’s Top 90 MGAs revealed

Ardonagh Group, Brown & Brown, Gallagher, Markerstudy and Policy Expert are the UK’s five biggest MGAs.

Big Interview: Sten Saar, Zego

Sten Saar, co-founder and CEO of Zego, speaks to Damisola Sulaiman about the challenges of building an insurtech in an evolving landscape, the lessons he learned entering the complex world of insurance as an outsider, plus his plans for growing the…

Zego CEO outlines plan to become household name in motor

Zego CEO Sten Saar plans to focus on UK consumer and telematics for the next phase of the insurtech’s growth.

Diary of an Insurer: Axa Partners’ Beth Buckland

Beth Buckland, operations director of Axa Partners, manages to squeeze in some Pilates to a packed working week, which includes a sensitive case review meeting, encouraging colleagues to think more creatively, and handling a media query about a declined…

Ogden Rate shift hailed as ‘sensible and fair’

The personal injury discount rates in Scotland and Northern Ireland have been positively updated, prompting welcoming reactions from across the industry.

ABI’s Gurga on why the regulator should follow the Chancellor’s positive lead

Hannah Gurga, director general of the Association of British Insurers, says regulators should take note of Chancellor Rachel Reeves’s optimism at this week’s Labour Party conference.

Sir Trevor Phillips warns insurers face a ‘reckoning’

Sir Trevor Phillips, former head of the Commission for Racial Equality, has revealed that “more than any other industry,” the insurance sector needs to tackle the disparate way it treats customers.

Is it time the ABI GTA had specific rates for Electric Vehicles?

With the number of electric vehicles on the UK roads well in excess of one million they are becoming an ever more important factor for motor insurers when planning how to grow, service their portfolio and manage claims costs.

Insurance sector ready to shake off ‘elitist’ tag over fraud data-sharing

The insurance industry could be less elitist around data and intelligence sharing to help combat fraud, according to leading market practitioners.

MIB holds ‘initial’ talks with stakeholders about modernising CUE

The Motor Insurers’ Bureau has held initial talks with stakeholders about the possibility of modernising its claims database, CUE.

Admiral to become ‘technology company selling insurance’

As Admiral celebrates the 20th anniversary of listing on the London Stock Exchange, one of the provider’s technology leaders has revealed: “Years ago, we were an insurance company. We want to be a technology company that sells insurance. That’s the shift…

Thatcham urges car makers to design with insurance in mind

Thatcham Research's CEO Jonathan Hewett has told Insurance Post that he hopes Thatcham's new vehicle rating system will ensure that car manufacturers see insurability as a design attribute.

GoCompare’s partnership; Axa’s claims service; Davies’ chief AI officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Biba calls for larger SMEs to be exempt from Consumer Duty rules

The British Insurance Brokers’ Association has called for larger SME commercial customers to be removed from the scope of the Consumer Duty requirements.

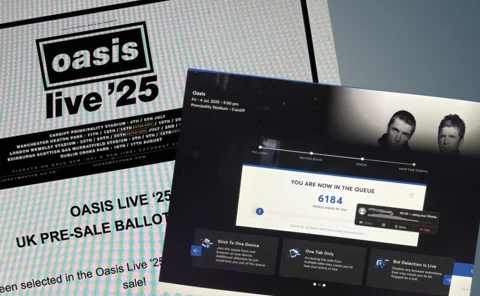

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

Q&A: Paul Baxter, The Green Insurer

Paul Baxter, CEO of The Green Insurer, discusses the company's approach to eco-friendly car insurance, mission to make driving greener, and plans for future growth.

Fraudster given jail time after faking driving documents and hiding offences

A man has been given jail time after he sold invalid insurance policies and tried to take out car insurance for himself by covering up his driving offences and using a fake no-claims discount certificate.

Top 30 European Insurers of 2024 revealed

The top 30 European non-life insurers achieved another year of solid top line growth in 2023 with the average growth rate of the companies being 9.8%.

CII criticises insurers’ profiting from premium finance

The Chartered Insurance Institute has questioned the ethics of making money from customers who pay monthly for insurance after Which? found several motor and home insurers were charging what the consumer watchdog called “excessively high levels of…

Big Interview: Mark Bailie, Compare the Market

Mark Bailie, CEO of BGL Group, the owner of Compare the Market, sits down with Scott McGee to talk about the 'bad bank' at RBS, achieving ‘perfect’ price and product comparison, and his plans for the business moving forward.

Compare the Market utilising AI to ‘perfect’ product comparison

Compare the Market CEO Mark Bailie has labelled artificial intelligence a “godsend” as he pledges to use the technology to achieve perfect price comparison.

Claims service continues to improve

The trend of overall improvement in claims service seen in the UK market continued in the second quarter of 2024.

Which? reveals insurer premium finance APRs

Research conducted by Which? has found that several motor and home insurers are charging what the consumer watchdog called “excessively high levels of interest on monthly payments.”