Fraud

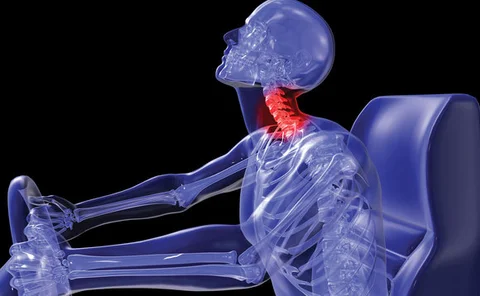

View from the Top: Whiplash reform needs green light

With the current dysfunctional system playing into fraudsters’ hands, the government must take action.

UK regulator warns on Axa clone

The Financial Conduct Authority has warned that a firm branding itself as Axa Isle of Man Limited has no ties with the French insurer.

Broker develops motor fraud reduction service

DNA Insurance Services has launched a motor trade tracker service designed to reduce insurance fraud, insurer claims exposure and uninsured vehicles.

Hill Dickinson increases access to fraud intelligence

Hill Dickinson Fraud Unit has boosted its access to fraud intelligence by becoming a member of UK fraud prevention service CIFAS giving it access to the National Fraud Database.

Claims handler sentenced for €45 000 fraud

A Welsh insurance claims handler was jailed for 17 months on Friday after stealing €45 000 from his employer to settle pay-day loans and drug debts.

Claims handler jailed for £39 000 fraud

A Welsh insurance claims handler was jailed for 17 months on Friday 2 August 2013 after stealing £39 000 from his employer to settle pay-day loans and drug debts.

Whiplash claims doctor suspended for 12 months

The Yorkshire doctor who assisted motorists in making bogus whiplash claims has been suspended from practice for 12 months effective immediately.

Whiplash claims doctor found unfit to practice

The Yorkshire doctor accused of assisting motorists in making bogus whiplash claims has been found unfit to practice by a medical disciplinary panel.

Fraud unit defends insurers following whiplash report

Hill Dickinson Fraud Unit has defended insurers following the publication of the Transport Select Committee’s whiplash report saying it is unfair to criticise them for paying potentially fraudulent claims due to a lack of medical evidence.

Interview: Biba's Steve White: Bold beginnings

From ‘shouting’ at the regulator to outlining a new segmentation strategy, new Biba chief executive Steve White has already ruffled more than a few feathers in his first 100 days in the hot seat. He tells Post he’s started as he means to go on...

Insurers to start using IFR in coming months says ABI

The first insurers to sign up to the Insurance Fraud Register will begin using it in the next few months, the Association of British Insurers said today.

Yorkshire doctor in hearing over bogus whiplash claims

A Yorkshire doctor is appearing before a Medical Practitioners Tribunal Service disciplinary panel this week after assisting motorists in making bogus whiplash claims.

Fraud could drop by £100m by asking for honesty

Asking insurance customers to be honest could help reduce fraud by £100m, according to a research by Consumer Intelligence.

Open GI and Experian launch fraud-check service

Software provider Open GI and information services firm Experian have launched a service to help brokers and insurers combat fraud.

Allianz warns on undetected fraud

The insurance industry should take the fight against fraud to other business lines in order to tackle undetected fraud, Allianz has warned.

Fraud costs the industry £1.1bn a year

Fraudulent insurance claims uncovered by insurers have topped £1.1bn a year as the industry’s clampdown on insurance cheats intensifies, according to a figures by the Association of British Insurers.

Keoghs increases fraud savings by 26%

Counter-fraud legal services provider Keoghs said today it helped insurers avoid paying £156m on suspected fraudulent claims in its last financial year – a 26% increase on 2012.

Zurich launches policy validation unit for brokers to help tackle fraud

Zurich has launched a dedicated policy validation unit in a bid to help personal lines brokers tackle fraud at the quote stage.

The Insurance Fraud Awards shortlist 2013

Growing once again in popularity, the fifth annual Insurance Fraud Awards received a record number of entries and we are delighted to announce the shortlist.

Ghost broking battle gains impetus as Gumtree closes insurance platform

Brokers welcome the decision to dispense with the category

Penny Black's Insurance Week - 25 July 2013

Preventing a breach of data is high on the agenda for most companies in the insurance industry, but it seems London’s cabbies are the real protectors of sensitive information.

Household: On shaky ground

With cracks beginning to show in the profitability of the household insurance market, is the sector set to crumble or are its foundations solid enough to see it through?

Post Blog: The anatomy of an opportunist

What does the typical non-organised household insurance fraudster look like and what steps should the industry be taking to stop them? Sally Griffiths investigates.

Slough top fraud spot in UK – Keoghs

Slough has been identified by law firm Keoghs as the top UK spot of fraud activity based on claimant location.