Fraud

Ifed jails Direct Line’s staged accident fraudsters

Two men who attempted to claim £25 000 out of Direct Line after staging car crashes and sending repair bills from their own car workshops have been sent to prison.

Covéa uncovers Dudley driver's false claim

An Audi driver from Dudley who made a four-figure insurance claim for a fictitious crash has been ordered to undertake 120 hours unpaid work.

Post Claims Club: Claims forms need a rethink to obtain honest answers

Insurers’ claims forms encourage dishonest answers from policyholders, according to Consumer Intelligence chief executive Ian Hughes.

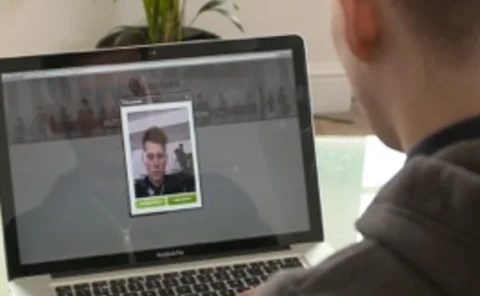

Video chat firm targets insurers with facial recognition software

The company behind a new online facial recognition technology has claimed insurers that sign up to use the software will make significant savings by reducing fraud and winning back market share from aggregators.

Interview: Frank Pinder: leading the fraud fight

With US investigation specialist Global Options seeking to bring its zero-tolerance approach to insurance fraud across the pond, its president explains why regulation and professionalism are key to better detection

LMA unveils plan to cut whiplash bill

The Lloyd’s Market Association has laid out a five-point plan for reducing the annual cost paid out of over £2bn for whiplash claims.

Insurance Insight Q+A: Frank Pinder, Global Options

Global Options president Frank Pinder speaks to Francesca Nyman about fraud, special investigative units and the US company’s European ambitions.

Law reports: Statement’s judicial immunity upheld

This law report was contributed by law firm Berrymans Lace Mawer

Mass: Britain’s ‘have a go’ culture must end

The Motor Accident Solicitors Society has called for an end to the ‘have a go’ culture endemic across Britain, which has contributed to an increase in fraudulent motor accident claims.

Hill Dickinson cements fraud partnership with police

Hill Dickinson has signed an information agreement with the Metropolitan Police, building upon their existing six-year counter-fraud partnership.

Ifed raid: Joining up with the front line

When it comes to the industry-funded Insurance Fraud Enforcement Department, market attention normally focuses on the severity of the sentences handed down to ghost brokers and crash-for-cash fraudsters. Callum Brodie joined the Ifed team for an early…

Motor Insurance: Claims, lies and videotape

Dashboard cameras are commonplace in Russia to prove road accidents to the courts and to protect against police corruption. But what impact do they have on the insurance sector? Anne-Louise Fogtmann explains.

Penny Black's insurance week

Penny donned her flak jacket and tucked her pepper spray into her handbag before joining a team of IFED police officers on a dawn raid in East London last week.

In Series: Personal Lines: Getting the balance right

Insurers are deploying fraud detection measures earlier, in an attempt to reduce exposure, while still providing a good customer experience. by Graham Odiam

In Series: Personal Lines: First line of defence

Insurers should embrace the power of data to detect and prevent fraud at an early stage.

Insurance fraud up 7% in 2012

Insurance fraud increased by seven per cent last year, with 12 in every 10 000 applications and claims in 2012 found to be fraudulent, according to Experian.

Couple who funded luxury lifestyle through ghost broking are jailed

A couple who funded a jet-set lifestyle having failed to pay tax on £920 000 of earnings pocketed as ghost brokers have been slapped with custodial sentences.

In Series: Balancing act

Personal lines insurers must be careful to ensure their desire to harness the power of data doesn’t get in the way of treating customers fairly.

Uninsured driver sentenced after motorist she crashes with refuses to lie to insurers

A woman who asked the motorist she had crashed into to lie on her behalf so she could cover up that she was driving without insurance was sentenced last Friday with a two year conditional discharge for fraud by false representation.

Broker warns of motor insurance fraudsters manipulating MID records

Specialist motor broker DNA Insurance Services has warned that fraudsters are avoiding paying the appropriate premium for their risk by buying motor trade road risks policies to ensure their vehicles appear on the Motor Insurance Database.

Tevez trial prompts MIB outcry on uninsured drivers

Carlos Tevez' trial for driving while disqualified and without insurance has prompted the Motor Insurers' Bureau chief executive to call on footballers to set a better example to young drivers.

Your say: Don’t tar all fraud staff with the same brush

I applaud the Financial Services Authority’s interest in how insurers use private investigators.

Third motor summit to be held on Monday

Whiplash, young drivers and the scourge of uninsured drivers are expected to top the agenda at a third motor insurance summit involving the insurance industry and government ministers to be held at Westminster on Monday.

Hastings boss Hoffman cools talk of IPO following year of 'strong growth'

Hastings chief executive Gary Hoffman has moved to dampen speculation that his firm is manoeuvring itself to launch an initial public offering in the months ahead, but has refused to rule out a float in the long-term.