Technology

Insurance Fraud Summit 2016: Fraud officers will be the first to use Blockchain technology

Fraud officers are likely to be the first within the insurance industry to use Blockchain technology as this is the part of the insurance chain that is most used to collaboration.

Insurance Fraud Summit 2016: Insurers must employ data analysts to tackle fraud

As well as embracing technology insurers of the future must employ data analysts to deal with the data it produces or fraud will continue according to RSA’s head of fraud.

Post November 2016: Start-ups, autonomous cars, future claims, and broker gossip

They look like rock stars but they're insurtech entrepreneurs.

Over half of traditional firms are developing in-house fintech capabilities

Global businesses now consider the investment in fintech as their highest priority and a necessity for development and market competition, a survey has found.

Women entrepreneurs: Insurance start-ups

Five female insurance entrepreneurs give Jonathan Swift the lowdown on the start-up sector

The question of liability for autonomous vehicle claims

Tesla’s recent hack has moved the liability spotlight onto software providers

Telematics providers push daylight saving time update to motorists

Telematics providers were forced to accommodate the change to daylight saving time on Sunday morning with a patched update to hundreds of thousands of motorists.

SSP posts £13m profit on back of ‘secure’ customer base

Software house SSP has made operating profits of £13m for 2015, and the company said its future growth prospects are “exciting”.

New insurtech enters the market to drive uptake in cyber policies

New insurtech start-up, Cyberfense, has been approved by the Financial Conduct Authority and can now operate as an MGA.

Government 'does not understand' cyber threat to driverless cars

The government does not fully understand the risk posed to driverless cars by hackers, Parliament heard.

State of the Broker Nation: Digitalisation and the future

Post has revisited its research into broking to find out how digitalisation and regulation are affecting the sector. In part one, Michèle Bacchus asks whether brokers can survive the digital age.

Blog: Think like a start-up or face digital insurance failure

Last week, Post gathered more than 150 people together at the Business Design Centre in Islington for the first ever Digital Insurance World.

The gig economy needs cover as flexible as it is

In the good old days, the point where work ended and leisure began was obvious. Home and office were clearly defined spaces, and uniforms, working hours and management structures all helped to reinforce these boundaries. But those days have gone and in…

Five insurers launch Blockchain pilot

Five of the largest insurers have joined forces in a pilot scheme to test the impact of Blockchain on the industry.

Blog: Bordereau is dead

In this tech-driven day and age, one of the most striking relics of days gone by is the bordereau system. Although they may be computerised, bordereau reports tend to be about as high-tech as an Excel spreadsheet.

Technology and driverless cars are not a threat to the industry, insurers say

Insurance revenues are being driven down by advances in technology that will disrupt the industry and change the ways in which customers choose their premiums.

Tesla to fit all new vehicles with self-driving capability

Tesla will fit the hardware needed for full self-driving capability into all new vehicles it produces, including the Tesla Model 3.

Augmented and virtual reality set to create billions in risk

Rising technologies such as augmented and virtual reality are expected to create billions of pounds worth of risk.

Telematics data disproves fraudulent claim and saves £50,000 in costs

Insure The Box has used telematics data to disprove a fraudulent claim and saved £50,000 in costs.

Startupbootcamp and Eos sign £1m investment deal

Startupbootcamp has signed an agreement with Eos Venture Partners that will see up to £1m of funding put into its cohort 2017 start-ups.

Bluefin's Kenny Hogg on why drones can't replace human contact

In the uniquely information-obsessed world we now inhabit, the personal transactional nature of an insurance broker has never been more in the spotlight.

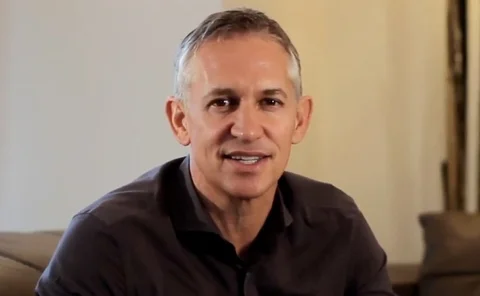

Gary Lineker among investors in insurtech firm Neos

Football legend Gary Lineker is among the investors contributing to £1m seed funding for smart home insurtech firm Neos.

Disrupter So-Sure launches with 80% money back claim

A new form of 'social insurance' has been launched today aimed at attracting mobile phone insurance buyers.

Digital Insurance World 2016: Connected home offers insurers huge opportunity to tap

There is a huge opportunity for connected home insurance with three-quarters of consumers being interested in monitoring their home via a mobile app, according to a survey by Consumer Intelligence.