News

Katharine Braddick to succeed Woods at PRA

Katharine Braddick CB has been named the next deputy governor for Prudential Regulation at the Bank of England and CEO of the Prudential Regulation Authority.

Soft market tempers Axa UK’s personal lines gains

Axa Group has reported 5% growth in property and casualty gross written premiums to £58bn, driven by commercial lines and strong new business in personal lines globally, but softer pricing in UK & Ireland dragged down personal lines rates.

Average storm claim value more than doubles since 2017

Recent data has indicated the rising cost of covering storm damage, with the average cost in 2025 reaching £1,242.

Allianz CEO outlines strategy to manage expenses

Despite volumes remaining fairly stable in 2025, Allianz UK CEO Colm Holmes has outlined how the insurer managed to increase profitability by 30%, including the 650 redundancies it made last year.

Allianz UK CEO anticipates ‘difficult trading year’ ahead

Despite almost a 30% increase in operating profits, Allianz UK CEO Colm Holmes believes 2026 is going to be a “difficult trading year”.

Aviva’s Washington out as Probitas CEO

Aviva’s MD of global corporate and specialty at Aviva, and CEO of Probitas, Matt Washington is leaving the business to “pursue opportunities outside of Aviva”.

Threat actors showing dramatic shift in cyber-attack executions

Data has indicated a dramatic shift in how threat actors are executing prolonged attacks on organisations.

Ageas Group sees continued growth following Esure and Saga deals

Ageas Group has recorded a 9% growth in revenue, as well as a 33% increase in operating profit thanks to “transformative M&A”.

Centuries old Lloyd's entities join forces

The 290-year-old maritime risks partner for the London market, Lloyd’s List Intelligence, is set to evolve its ecosystem by moving the Lloyd’s Agency Network under its management.

Hiscox delivers record profit and plots next phase

Hiscox has delivered its third consecutive year of record profits and set out ambitions for further acceleration through to 2028.

Stanford replaces Thaker as Sompo UK CEO

Aspen UK CEO Sarah Stanford will lead all of Sompo UK’s property and casualty insurance operations, replacing outgoing CEO Bob Thaker.

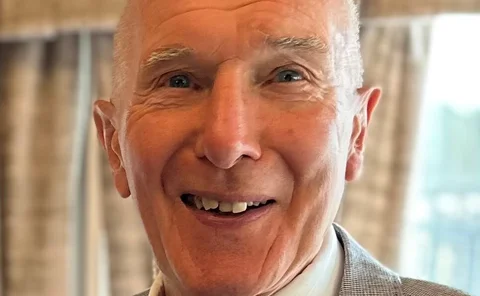

Caravan Guard founder Peter Wilby passes away

Peter Wilby, founder and chairman of caravan insurance firm Caravan Guard, has passed away at age 78, his family has announced.

Aviva appoints Chris Cochrane as group CIO

Aviva has appointed Chris Cochrane as group chief information officer with effect from summer 2026, replacing the retiring John Cummings.

Sign up for Claims Club to hear from London Fire Brigade and others

Fire risk in residential and mixed-use buildings is evolving in ways that are not always fully captured by data, models or regulation.

FCA outlines insurance regulation plans

The Financial Conduct Authority has promised to improve access to insurance, scrutinise claims handling, get to grips with artificial intelligence and cyber risks, plus slash red tape over the year ahead.

Phil Bayles confirmed as Everywhen’s broking CEO

Phil Bayles has been named as Everywhen’s general insurance broking CEO, after having served as chief commercial officer since 2021.

City of London launches rival to Biba conference

The City of London Corporation has announced the launch of their inaugural Global Risk Summit.

Ami North the latest to leave DLG

Ami North, Direct Line’s head of counter fraud, and chair of the Insurance Fraud Investigators’ Group, is leaving the insurer, Post can reveal.

Aviva targets financial lines expansion

Aviva is gearing up to for a number of financial lines launches across both its London and regions operations as it attempts to build scale in segment.

Wrisk and Kia; Hiscox's grad programme; Aviva's branch manager

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

MoneySuperMarket launches ChatGPT app

MoneySuperMarket has launched a ChatGPT app, allowing users to access services within conversations with the large language model.