Liability

FSCS lifts lid on response to collapsed insurers

The Financial Services Compensation Scheme has helped compensate tens of thousands of policyholders following the collapse of five unrated insurers over the past three years. Chief operating officer Jimmy Barber talks to Post on efforts to recover cash…

Direct Line motor head warns of 'dangerous' autonomous vehicle tipping point

The tipping point between level two and level three automation is a potentially dangerous place, according to the head of motor at Direct Line.

Analysis: Cutting the costs and risks of employee benefits

Being able to offer attractive employee benefits is vital in terms of recruitment, retention and productivity, but they are both costly and risky

This week: All change

It’s all change for the country this morning as Prime Minister Theresa May confirmed she would step down from office after failing to unite MPs on the way the UK should leave the European Union.

Blog: Strict liability for animals: a dance with dragons

As the dust settles on the final season of HBO’s Game of Thrones, Michael Collins, an associate and solicitor advocate in BTO’s insurance team, answers the question we have all being asking: when a dragon burns down a property, can the property owner…

Analysis: Managing the M&A insurance risk

It was the Competition and Markets Authority that recently put paid to Sainsbury’s and Asda’s marriage plans, but there are plenty of other risks that also regularly threaten the success of mergers and acquistions – ranging from the uncovering of…

Clyde & Co establishes presence in Dublin ahead of Brexit

Clyde & Co has opened an office in Dublin to ensure its Irish law insurance practice can continue to operate seamlessly as the UK leaves the EU.

Spotlight on: Beazley's Birmingham office

Exclusive: Beazley opened its Birmingham office as part of a strategy to diversify away from its core US business. Fourteen months later, the office is likely to be held up as a model for the company's further expansion plans.

Insurers can 'breathe easier' as Supreme Court clarifies the use of compulsory motor insurance

Supreme Court has ruled against Axa in a landmark dispute between a property damage insurer and a motor insurer over £2m fire claim.

Analysis: The changing nature of festival risk

Festivals are growing in size, number and scope. They are rapidly becoming a more immersive experience, rather than solely about music. With these changes come wide-ranging additional requirements for cover and a need for the insurance sector to innovate

Opinion: SMEs: Emerging risks - Tackling the challenges facing SMEs

SMEs may be concerned about keeping a competitive advantage – but it’s the evolving workforce challenges that can have the greatest impact on their success

Drivers in autonomous vehicles 'shouldn't be held liable'

Drivers of fully automated vehicles should not be held liable for accidents involving their cars while technology is in charge, says the Association of British Insurers and Thatcham Research.

Rising Star: Marcus Hanson, Sedgwick

After getting a taste for adjusting, Marcus Hanson has progressed to Sedgwick’s complex liability team

Child sexual abuse claims on the rise

Exclusive: Insurers are identifying a rising trend in child sexual abuse claims.

Analysis: Will BA data breach open floodgates for future data group actions?

The British Airways data breach is the first major case since the General Data Protection Regulation became law. With the firm facing group legal action and the Information Commissioner’s Office testing its teeth for the first time, what might this mean…

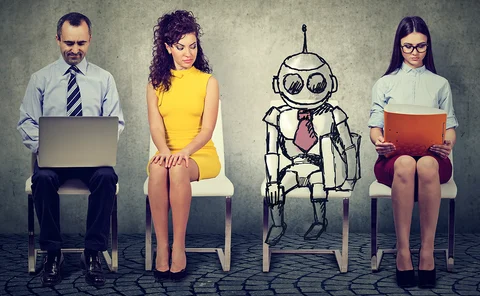

Blog: The future landscape for AI claims around the world

Governments around the world are looking to regulate artificial intelligence and as Lee Gluyas, partner, and Stefanie Day, associate with law firm CMS, explain those that get there first will be the ones to benefit.

Government pushes for further reforms following Grenfell Tower disaster

The government has outlined plans that will see it commit to reforms over the coming years, following the tragic Grenfell Tower fire.

Charles Taylor bolsters liability team by hiring senior sextet from Vericlaim

Charles Taylor Adjusting has bolstered its complex corporate liability function with the recruitment of six senior adjusters formerly with rival VRS Verclaim.

This month: That sinking feeling

We may have enjoyed plenty of sunshine this summer, but spare a thought for the insurers. The ABI this week reported a record-breaking surge in subsidence claims.

Blog: Why it’s time for standardised cyber policy terms

Cyber attacks are on the rise and as brokers and risk managers urge insurers to make policies clearer Cyber Decider CEO Neil Hare Brown explains where definitions need simplifying.

Legal consultation launched into driverless cars

A wide-ranging consultation has been launched into the legal reforms surrounding driverless cars.

Iprism chair declares turnaround complete after Gable fallout

The chair of underwriting agency Iprism has vowed that it will never work with unrated capacity again having only just got its house in order after the collapse of former partner Gable in 2016.

Analysis: Renovation fires - Learning from history

When extensive renovations are carried out on properties fire poses a risk. Rachel Gordon investigates what insurers are doing to mitigate this happening.

Analysis: Social media - Insuring influencers

As regulators are spelling out the rules for influencers advertising services and products, insurers and brokers are starting to adapt their policies to these social media personalities making a living out of their online fame.