Risk Management

Tamping down wildfire threats: How insurers can mitigate risks and losses

This Tamping down wildfire threats report discusses how insurers are poised to aid at-risk communities through pre-emptive mitigation leveraging advanced data technologies and data, and by offering community-based catastrophe insurance programs.

Tech trends #15: Web3

From "smart contracts" to compelling new forms of coverage, Web3 is already having a profound impact on P&C insurance. Watch this short video to discover where it's heading next.

Analysts report decrease in cyber attacks so far in 2022

Cyber analysts have reported seeing both the number of significant cyber attacks and the value extracted through ransomware attacks fall this year.

Top trends in property and casualty insurance 2023

In 2023 and into the foreseeable future, P&C insurers will strategically prioritise digital transformation initiatives to strengthen their capabilities and navigate challenging macroeconomic volatility.

Validating the ESG credentials of the insurance supply chain

Consumers, industry participants, civil society, regulators, and the media are all increasingly questioning the integrity of some of the ‘green’ claims made by companies and financial firms.

Insurance-associated GHG emissions: The PCAF measurement standard

November 2022 saw the Partnership for Carbon Accounting Financials (PCAF) launch the first global measurement standard for insurance-associated Greenhouse Gas (GHG) emissions.

SME perspectives: How fraudsters create fake identities

Insurers work hard to make sure they don’t write policies for individuals with fake identities, but bad actors work just as hard to avoid detection.

Driverless cars: How close are we?

UK roads could see self-driving vehicles rolled out by 2025 following the announcement of new government plans which will prioritise safety through new laws.

Trade Voice: ABI's Hannah Gurga reinforces the vital role insurance is playing in the midst of the permacrisis

Hannah Gurga, director general of the Association of British Insurers, says the industry needs to shout about the vital role it plays in society, and argues that regulatory reform could enable it to have an even greater impact.

LV reveals surge in flood claims where drains can’t cope

A report by LV General insurance has revealed there has been a 211% increase in the number of flood claims where drains were unable to cope over the last four years.

Webinar: How can insurance providers unlock the power of ‘smart data’?

Smart data management has never been more important as insurers strive to communicate the value of cover to retain policyholders and write profitable business.

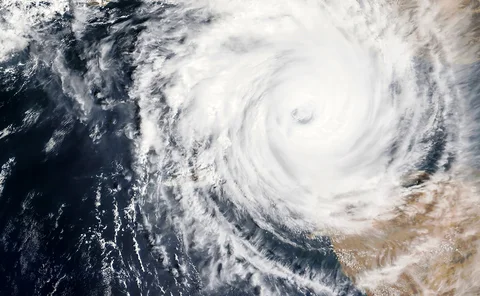

Stemming a rising tide: How insurers can close the flood protection gap

The role of insurers in closing the flood protection gap can be a crucial one, and the time to act is now.

Government sides with insurers over PRA

Chancellor Jeremy Hunt’s first Autumn Statement delivered the tax hikes and spending cuts that were widely expected as well as the Solvency II overhaul insurers had long hoped for.

Cop27: WTW collaborates with Unicef to provide climate protection to 15 million children

WTW has joined forces with The United Children’s Fund to protect millions of children and families from climate change

Get more accurate wildfire risk and fire protection scores

Comprising more than 1,400 property and casualty risk factors for any U.S. address, HazardHub is the most comprehensive P&C risk data set ever created by Guidewire.

Should business plans include a risk plan?

If the last two years taught us anything, it should be: prepare for the unexpected no less than the expected. This blog highlights the value of business risk plans and how insurers/reinsurers can help corporations to measure and rate specific risks.

Underwriting risk detection at critical decision points

The speed of digital insurance experience comes at a price: Almost 70% of insurers agree that increased digital activity leads to increased fraud.

Cop27: Three more insurers join Flood Re's 'Build Back Better' scheme

Flood Re CEO Andy Bord has announced that three more insurers have joined the Build Back Better Scheme, speaking at the COP27 climate summit in Sharm El-Sheikh on Monday.

Airmic tips parametrics for key role as members label traditional policies' nat cat coverage inadequate

Over three quarters of corporate insurance buyers think that traditional property damage and business interruption policies do not adequately cover natural perils, according to a survey by Airmic.

Cyber risk - The impact on financial health and reporting

Cyber security has an increasingly vital role and impact on businesses.

Hurricane Lisa causes first pay-out of Mesoamerican Reef Insurance Programme

The first pay-out has been made by the Mesoamerican Reef Insurance Programme when the Turneffe Atoll, off the coast of Belize, was hit by Hurricane Lisa on 2 November.

Underwriters and brokers to face post-Protect Duty learning curve, says Aon's Bolton

Consensus on how to underwrite casualty programmes affected by the proposed counterterrorism Protect Duty will take time to develop, Aon’s director of GBC crisis solutions Scott Bolton has told Post.

Marketplaces and exchanges: Ten ways they are reshaping insurance

The insurance industry is going to have to confront the fact that there are and will continue to be a myriad of marketplaces – those already established plus new marketplaces using innovative approaches.

Post Learning: Terrorism: Indicative reading time: 25 minutes

Learning Objective: By the end of this module readers will be able to explain what Pool Re is and how it was established and be able to describe how terrorism cover has evolved over the last 25 years.