Regulation

Blog: Insurance implications of the Uber Supreme Court ruling

In February the Supreme Court ruled that Uber drivers are considered to be workers rather than self-employed, with potentially serious implications for insurance, says Stuart Toal, Allianz casualty account manager, technical.

Insurers granted extra time for some pricing practices rule changes

The Financial Conduct Authority is set to grant firms until the end of 2021 to implement some of its pricing practices reforms.

Insurer test case BI claims payouts to March revealed

Data released by the Financial Conduct Authority shows that up to 3 March insurers had paid out £192m towards interim payments and £279m to settle Covid-19 related business interruption claims affected by the regulator’s test case, with Covéa leading the…

Government's understanding of how BI claims are calculated contains 'fundamental flaw'

The government’s understanding of insurance contracts is fundamentally flawed and endangers the chances of its expectations with respect to Covid-related business interruption claims being met, claims dispute expert Roger Flaxman has said.

Insurance trade associations and professional bodies survey 2021

Members of insurance trade associations and professional bodies were asked their views on different areas of their organisation’s proposition to find out how lobbying, qualifications and continuing professional development was achieved during the…

PRA chief pours cold water on ABI Solvency II review hopes

Prudential Regulation Authority CEO Sam Woods has sought to temper expectations that the ongoing review of Solvency II will free up significant amounts of capital held by the UK insurance sector.

Briefing: Covid BI claims and indemnity period clawbacks

Businesses due Covid payouts with longer indemnity periods must be aware of clawbacks – and why it is a gamble whether they accept a full and final settlement now or let their cover run.

BI claims deductions should not leave businesses at 'an overall financial disadvantage', says HMT

Exclusive: Insurers should not make deductions from business interruption claims because insureds received government support during the pandemic if doing so leaves businesses at “an overall financial disadvantage”, the Economic Secretary to the Treasury…

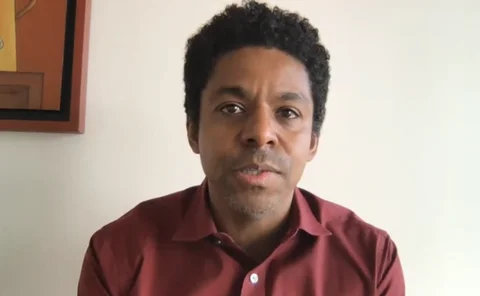

Q&A: Bill Pieroni, Acord

Bill Pieroni, CEO of global standards setting body Acord, discusses the findings of its research into UK personal lines websites and who is improving and why. He also tackles how the Covid-19 pandemic will change the market, reflects on his achievements…

Insurance lives in the Covid era – 12 months on from the first National Lockdown: Part One

On 23 March 2020 – as Covid-19 infection rates soared – Prime Minster Boris Johnson told us to “stay at home”, triggering the first National Lockdown. One year on, Post spoke to a host of insurance workers – the home schooling parent, the mental health…

LIP whiplash portal guide to 'hopefully' arrive by early April

The litigants in person guide for the whiplash portal will "hopefully" be published by early April, according to a Ministry of Justice update.

FOS CEO Caroline Wayman to step down in April

Caroline Wayman, chief ombudsman and CEO of the Financial Ombudsman Service, is set to step down after seven years at the helm.

Insurer results directory 2020

Updated: Post tracks the 2020 insurer results season including gross written premium and combined operating ratio - detailing the impact of UK business interruption, weather, motor, home, non-business interruption Covid-19 claims, as well as mergers and…

Editor's comment: PI breaking point

Spending most of the most recent half term indoors with nowhere to go, we turned to being creative and churned out paint pouring masterpieces, pottery-wheel egg cups (although eggs can’t fit in them) and designed our own t-shirts

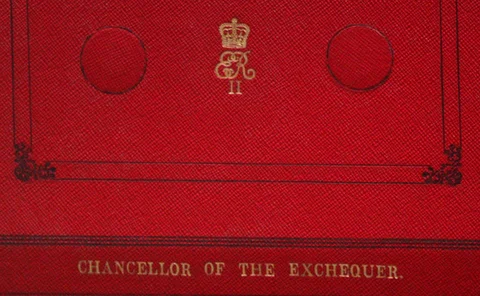

IPT unscathed in Budget with corporation tax set to rise in 2023

Insurance premium tax went unmentioned in the Spring Budget announcement, with developments including additional apprenticeships funding, a furlough extension and a corporation tax hike from 2023.

MIB bombarded with whiplash questions by confused and frustrated claims sector

The Motor Insurers' Bureau's first update on the whiplash portal since critical rules were released by the government was met with difficult questions and consternation from the claims sector.

Interview: Chris Croft, London & International Insurance Brokers’ Association

After a year dominated by the Covid-19 crisis and Brexit, Liiba leader Chris Croft discusses the future of the trade association and London Market with Emmanuel Kenning, his passion for the Americas and how he got into insurance after working on rail…

PI Analysis: Independent financial advisers count the cost of insurance red flags

Professional indemnity premiums for independent financial advisers have soared, driven by a perfect storm of legislative and claims change

MoJ publishes long awaited pre-action protocol as it confirms May debut for whiplash reforms

The Ministry of Justice has published vital rules for the whiplash portal, including the pre-action protocol and practice direction.

FCA adds four to exec team

The Financial Conduct Authority has recruited four people to its executive leadership team including its first chief data, information and intelligence officer.

Trade Voice: Biba's Steve White on why insurance-bashing headlines won't help small businesses

Steve White, CEO of the British Insurance Brokers' Association, argues that sweeping headlines in the wake of last month's Supreme Court business interruption test case judgment haven't helped anybody.

Industry urges rapid action on reforms as Solvency II and future of regulation reviews close

Following "data not dates" means there is no need to delay regulatory reforms where there is common ground, experts told the audience at the Association of British Insurers’ annual conference yesterday alongside calls for the watchdogs to have a…

FCA mulls timeline for dual pricing fix following consultation

The Financial Conduct Authority is reconsidering the implementation period for its dual pricing remedy proposals following consultation with the industry.

FCA calls for even more progress from insurers as number of vulnerable customers reaches 27.7 million

The Financial Conduct Authority has revealed there was a 15% increase in the number of customers with vulnerable characteristics between March and October last year.