Regulation

FSA overhaul pencilled for Q1 2011

The Financial Services Authority expects to move to separate conduct and prudential regulation in shadow form in the first quarter of next year.

The Reinsurance Power List 2010: Who's the daddy?

After the usual team debates, tears and tantrums, once again the Reinsurance team presents its annual Power List. We give you our opinions on who is hot and who is not in the reinsurance world and why they are a force to be reckoned with

Run-off: Putting the pieces in place

Having an in-depth plan to implement a solvent scheme is just one part of a complex process that also includes convincing the stakeholders and the courts that to do so is a good idea, writes Daniel Schwarzmann

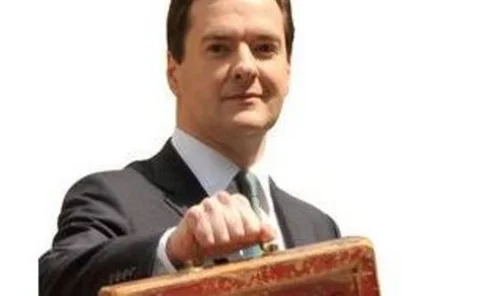

News analysis: Death knell sounds for the FSA

The Chancellor of the Exchequer has announced a radical shake-up of UK financial regulation, dispensing with the current watchdog by 2012, writes Katherine Blackler

News analysis: US reforms herald federal sector regulator

After a marathon 20-hour debate, the US Congress passed an amended version of the Dodd-Frank Bill that includes measures to create a federal insurance regulator. Katherine Blackler investigates

Hanks confirmed as CII president

Chris Hanks has been formally elected president of the Chartered Insurance Institute at its annual general meeting held in London on 21 July 2010.

FSCS says two thirds of £204m payouts are for PPI

In its annual report and accounts for 2009/10, published today (22 July), the Financial Services Compensation Scheme reports that it has paid more than £204m in compensation to over 21 000 claimants.

75 Northern Irish Quinn jobs saved

The Northern Ireland Executive has welcomed an announcement that 75 planned redundancies at Quinn Insurance in Enniskillen will not now be implemented.

Irish regulator spells out stance on client premiums

The Financial Regulator in Ireland has published the findings of an examination of compliance by insurance intermediaries, with the rules governing the handling of client premiums and the operation of client premium accounts.

Rims attacks Aon stance on contingent commissions

The Risk and Insurance Management Society has criticised Aon's decision to accept contingent commissions and reiterated its opposition to the practice.

Irish regulator spells out stance on client premiums

The Financial Regulator in Ireland has published the findings of an examination of compliance by insurance intermediaries, with the rules governing the handling of client premiums and the operation of client premium accounts.

Aon open to the idea of accepting contingent commissions again

Aon today announced it is working with markets to explore the various forms of alternative remuneration available to it which may include supplemental and/or contingent commissions.

Post Magazine – 22 July 2010

Subscribers to Post can now read the latest issue online as a digital e-book.

Editor's comment: ABI headhunt back on

There is no other way of looking at the Kerrie Kelly debacle than as a bit of an embarrassment for the Association of British Insurers.

Medical report highlights insurance market failure

The UK's midwifery associate bodies are poised to step up their bid to gain insurance cover for independent practitioners, following the publication of the Finlay Scott report on the issue.

German government voices opposition to Neal Bill

The German ambassador to the United States Klaus Scharioth has written to house ways and means committee chairman Sandy Levin registering the opposition of the German government to the Neal Bill.

RSA recruits former Benfield legal chief

RSA has today announced the appointment of Derek Walsh as its new general counsel.

Lloyd's faces 12 month Chinese deadline admits CIO

Lloyd’s has been set a testing 12 month deadline by the Chinese authorities to establish its underwriting platform.

New Indian insurer receives licence

Indian engineering giant Larsen & Toubro’s new general insurance company is due to start operations after receiving a licence from the regulatory authority for commencing its business operations.

Experian reveals drop in insolvencies

The latest Insolvency Index by Experian, has revealed a year-on-year decline in business insolvencies during June.

Insurance industry urged to take up the professionalism challenge

The insurance industry was challenged to embrace professionalism, and in particular to embrace the Aldermanbury Declaration at the British Insurance Awards 2010 last week.

Fitch: QIS5 unlikley to impact insurer ratings

Fitch Ratings said today that the final quantitative impact study QIS5 specifications do not materially alter Fitch's view on the likely impact of Solvency II on its insurance ratings.

Lloyd's welcomes US bill as step towards Solvency II harmonisation

Lloyd's welcomed the passage of the Dodd-Frank financial reform bill through the Senate yesterday.

SRA confirms tough new stance on Assigned Risks Pool

The board of the Solicitors’ Regulation Authority has approved a strategy for the enhanced control of the Assigned Risks Pool that provides indemnity for solicitors’ firms that struggle to obtain insurance in the market.