United Kingdom (UK)

Blog: What's stopping customers being given more choice for replacement mobility?

From vehicle size to type, motorists need to be given greater choice by insurers when their car is off the road. James Roberts of Europcar Mobility Group UK outlines some suggestions as to where flexibility could play a greater role.

Blog: When is a professional not a professional?

Many organisations seek to employ professionals assuming they have the characteristics to bring reputational premium to organisations. Jyoti Navare, chartered insurance practitioner and associate professor at the Department of Economics at Middlesex…

Seventeen Group buys Essex broker

Seventeen Group has bought Essex-based broker Graybrook, for an undisclosed sum.

ERS to launch underwriting academy in Swansea

Specialist motor insurer ERS will open an underwriting academy in its Swansea office.

Tokio Marine Kiln Insurance to enter run-off next month

Tokio Marine Kiln Insurance will enter run off, as the group refocuses its UK business on Lloyd’s.

Ecclesiastical warns of 27% surge in claims following £225,000 church roof theft

Ecclesiastical has warned of a surge in large-scale metal thefts from churches, following a major £225,000 theft from a church in Hertfordshire.

My other life: Stephen Ford, Masterchef finalist

When not working as business intelligence manager at Sedgwick, Stephen Ford is busy cooking for the rich and famous at his high-end catering brand Salt Kitchen after being a finalist in the BBC's Masterchef competition.

Ardonagh boss joins Nexus group

Marc van der Veer has joined Nexus Group as CEO of European Ventures.

Insurers must work with the repairer sector to keep it from 'dying on its feet'

Motor insurers, manufacturers and repairers must tackle their “dysfunctional relationship” and work together if the sector is to remain relevant with increased technology being added to vehicles.

Insurers need to raise awareness on keyless car thefts

Insurers and manufactures have to educate customers on the risks of keyless car thefts, a conference heard.

CII's Sian Fisher on how professionalism affects reputation in insurance

Good reputation takes time to build but Sian Fisher, CEO, Chartered Insurance Institute, explains how being transparent, diverse and having a commitment to professionalism can help the insurance industry achieve this.

Blog: To beat fraud, insurers have to tear down internal walls to future-proof their business

The insurance industry continues to treat cyber attacks and fraud as two independent problems. However, Dennis Toomey, global director of counter fraud analytics and operations at BAE Systems, argues they are in fact one and the same – and until the…

Insurers could face fines under plans to tackle dual pricing 'rip-off'

The Competition and Markets Authority could be given the power to impose fines on companies in breach of consumer law without going to court, under government proposals announced today.

Zego raises $42m in latest funding round

Zego has raised $42m (£33.52m) in a series B funding round led by Target Global, to fund its European expansion.

Axa XL appoints Christopher Read as COO

Christopher Read has been appointed as Axa XL’s UK chief operating officer, joining from EY, where he was an associate partner.

Blog: Building regulations - how can stricter changes present opportunities for the wider insurance industry?

As stricter building regulations for new buildings are set to come in force, insurers could see lower property damage costs and pay outs. However, Simon Ford, chairman of the British Damage Management Association, asks if this could be a challenge to…

Insurtech Trov to close its UK app

Exclusive: Trov will no longer provide its on demand gadget and single item insurance to UK customers, as of 1 October 2019.

Insurers respond to flood claims from Lincolnshire

Insurers have begun responding to claims following the flooding in Lincolnshire.

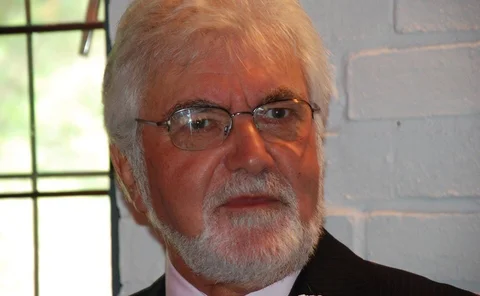

Industry pays tribute to former Lloyd’s executive Mike Wilson

Mike Wilson, the former head of Lloyd’s Policy Signing Office in Kent has died.

Three directors out as Policy Expert buys loss-making Sure Thing

Policy Expert has bought motor insurance business Sure Thing for an undisclosed sum.

GRP broker acquires Thomas Cook

GRP-owned broker Sagars has bought Lancashire-based engineering and entertainment broker Thomas Cook & Son.

Elite shoots for solvent scheme to avoid liquidation

Elite Insurance has proposed a solvent scheme of arrangement, in order to avoid a liquidator being appointed.

Analysis: Charity & CSR: Protect and survive

The insurance sector is one of the mainstays of the UK economy, contributing nearly £30bn and employing more than 300,000 people. Its sheer size and financial strength gives the industry the opportunity to do good for the people who rely on it

This week: Dual pricing and sexual harassment claims

For a while now the insurance industry has been under the spotlight for the sheer volume of sexual harassment allegations its faced. And after Post reported this week the suspension of a senior boss at Marsh sister company Guy Carpenter, following…