Legal Update: Driverless car policies don't preclude product liability

Need to know

- Compulsory motor insurance is to be extended to automated vehicles

- Car manufacturers will be more exposed to product liability claims

- In some cases, car manufacturers may use the state-of-the-art defence

- Manufacturers will need to be covered for the cyber risks associated with their products

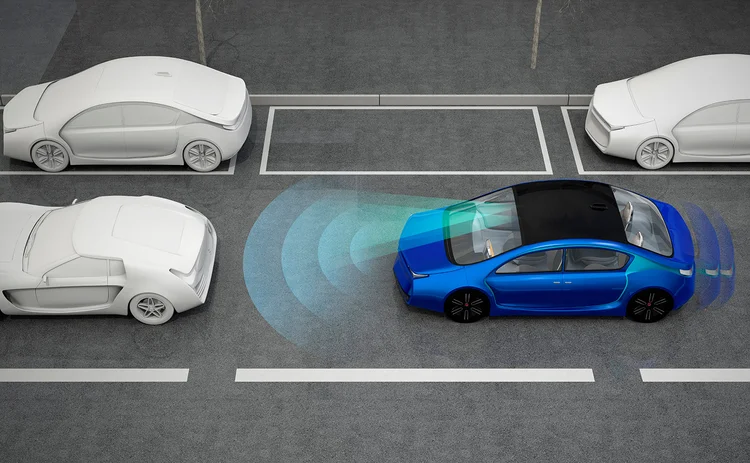

As automated vehicles take to the roads, the government is likely to focus on one motor insurer as the first port of call for any third-party claim to simplify the claims process. However, that will not preclude other proceedings based on product liability.

Earlier this year, the Department for Transport proposed to change the UK’s compulsory motor insurance framework to include the use of automated vehicles, which are expected to reach the UK market within five to 10 years. The government is proposing to extend compulsory motor insurance to automated vehicles and establish a single insurer model, where an insurance company covers both the driver’s use of the vehicle and the automated vehicle technology.

As a matter of public policy, the government is likely to focus on one motor insurer as the first port of call for any third-party claim to simplify the claims process. However, that will not preclude other proceedings based on product liability.

Liability shift

As the responsibility for avoiding accidents increasingly shifts from the driver to automated vehicle manufacturers, this will increase the manufacturers’ exposure to product liability claims. This will inevitably lead to a surge in demand for product liability insurance to tackle all of the risks associated with automated technology.

Where the manufacturer is found to be liable, the motor insurer will be able to recover against the manufacturer under existing common law and product liability laws. In England and Wales, a claimant is likely to bring an action against the manufacturer under the Consumer Protection Act 1987.

Section 2(2)(a) would impose strict liability on the producer of an automated vehicle, removing the need to prove the manufacturer’s negligence. A defect will exist if the automated vehicle was not as safe as “persons generally are entitled to expect”. The instructions/warnings provided with the cars are, therefore, crucial to the issue of product liability.

The state-of-the-art defence may come to the aid of manufacturers in design defect and failure to warn cases.

For warning defects, the manufacturer will be judged by what they could have reasonably foreseen based on current technology and scientific knowledge at the time of production.

For design defects, the state-of-the-art defence will involve the feasibility of adopting appropriate design measures to reduce or eliminate a risk of which the manufacturer is aware, for example the need to cater for an inattentive driver. A claimant can always argue that better technology would have prevented the accident, but the manufacturer may not have a reasonable design alternative, even with the latest technology.

Complexities

There are likely to be complexities in apportioning blame between the driver, who may have failed to take control when it was possible and reasonable to do so, and the automated technology itself. The driver may well be found to be contributorily negligent. Attempting to change the rules which are focused specifically around the consumer’s expectation test will be extremely complex and will require a much wider ongoing discussion.

In addition to technology failures, manufacturers of automated vehicles and their components may also face the risk of hackers launching cyber attacks to remotely control their automated vehicles, potentially causing personal injuries, fatalities and property damage. This in turn will increase the need for insurance coverage to protect the manufacturers from the cyber risks associated with their products.

Wait and see

The majority of insurers underwriting motor and product liability coverage are taking a wait-and-see approach before they underwrite policies for automated vehicles, where it is still difficult to assess the full potential risks exposure. However, as automated vehicles become increasingly popular, insurers will need to be able to meet these risks efficiently.

Overall, establishing fault in accidents involving automated vehicles will raise complex questions of liability shared by drivers, automated vehicle manufacturers and technology designers.

The insurance in place will obviously need to reflect this complex paradigm of potential fault and the associated risks.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk