News

Howden’s climate practice, Ecclesiastical and Iprism partner and WTW’s claims chief

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

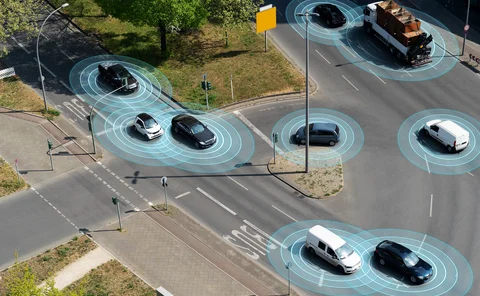

Industry calls for clarity on self-driving liability

The industry has called for legislation and clarity on self-driving vehicle liability in the upcoming King's Speech in order to be able to step up and provide cover.

Red Cross pleads insurers to back humanitarian insurance approach

During its London Summit, The International Federation of Red Cross and Red Crescent Societies has appealed for more insurers to support its insurance mechanism, as funding for humanitarian needs reaches an all time high.

Biba launches FVA framework after FCA scrutiny

The British Insurance Brokers’ Association has launched a new framework to help members better articulate fair value.

Protesters storm Lloyd’s insurer offices over fossil fuel projects

Hundreds of protesters have gathered outside the offices of 10 Lloyd’s of London insurers today, demanding they rule out insuring the West Cumbria coal mine and the East Africa Crude Oil Pipeline.

Tributes paid to London Market veteran Neville Hunt

Neville Hunt, a stalwart of the London Market who dedicated more than 50 years of his life to the industry, has passed away.

‘Writing on the wall’ for pet insurance if data isn’t utilised quicker

Data usage in pet insurance has “lagged behind” home and motor, according to Crif UK, and if the sector isn’t able to get a grasp of it soon, the writing could be on the wall.

FCA CEO responds to Financial Services and Markets Act requirements

Nikhil Rathi, CEO of the Financial Conduct Authority, has outlined five ingredients he feels are essential to support international competitiveness and growth over the medium to long term.

Aviva completes nine-month commercial digital transformation

Aviva’s Global Corporate & Specialty team has revealed how it has been able to develop 20 commercial lines pricing models in just nine months, cutting build time by 75%, after utilising Hyperexponential’s pricing decision intelligence platform, HX Renew.

‘Thousands’ of UK businesses yet to claim Covid BI compensation

UK law firm Stewarts has launched an online claims service to help the “thousands” of businesses heavily affected by Covid-19 that are yet to recover payment from their insurers.

Howden secures £500m to turn insurtechs into MGAs

Howden’s venture will support the development of innovative insurance solutions, as well as create investment opportunities for insurtech start-ups.

By Miles co-founder James Blackham leaves

By Miles’s co-founder and CEO James Blackham has announced on LinkedIn that today is his last day – and that he will be replaced by chief commercial officer Maddy Howlett.

PL insurers to face ‘double whammy’ to margins in 2024

A report from Bloomberg Intelligence has warned that the margins of UK insurers such as Admiral and Direct Line face a “double whammy” of claims inflation and regulation in 2024.

McLarens aims to become the go-to adjuster for hospitality claims

Rebecca Webster, McLaren’s broker development lead, shares why the claims services provider has launched its hospitality offering and what challenges lie ahead.

Lloyd’s risk tool; Pattern and Giggster partner; Howden’s driving offering

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Time for AI to take over Insurance Post

Editor’s View: Artificial intelligence is taking over Insurance Post from 13 to 17 November, causing Emma Ann Hughes to consider how generative AI is transforming the insurance sector and your favourite trade title.

Insurers ready for hundreds of Luton Airport fire claims

While the Association of British Insurers has claimed it is “too early” to estimate the insured cost of a fire at London Luton Airport. LV, Ageas and Aviva have confirmed how they will be handling motor insurance claims caused by the blaze.

APIL argues changes to RTA claims rules will erode justice

Proposals to change the way medical reports are sourced and disclosed in road traffic injury claims would be a “backwards step” for the process, according to the Association of Personal Injury Lawyers.

Labour pledges to tackle car insurance costs

In a speech to the Labour Party conference, Shadow Transport Secretary Louise Haigh promised a Labour government will ensure motorists aren't paying over the odds to insure their vehicles.

ABI tells insurers to up their game on apprenticeships

The Association of British Insurers has said more “tangible action” is needed to boost the numbers of apprenticeships being offered by the insurance sector.

Vote for winners of the European Insurance Technology Awards

The shortlist has been decided and now Insurance Post readers can vote to decide the winners of the European Insurance Technology Awards 2023.

Aviva catches out fraudster who claimed videos featured his twin

A Hampshire man seeking compensation from Aviva for alleged injuries claimed videos of him taking part in martial arts training during his recovery period actually showed his twin brother.

ABI warns insurers there is ‘no room for complacency’ on DEI

The Association of British Insurers has published an update on its progress towards becoming the “most diverse, equitable and inclusive sector” in the UK.

Ripe CEO rules out becoming another Markerstudy

Paul Williams, CEO of Ripe, has revealed plans to grow the leisure, lifestyle, and small businesses insurance provider by buying rivals won't result in the insurtech turning into another Markerstudy and going into generalist cover.