News

Ex-RSA employee sentenced after submitting £270,000 in fraudulent claims

An ex-RSA employee has been sentenced after pleading guilty to a number of fraud offences totalling to £270,000.

Am Trust applies to combine three syndicates

Am Trust has applied to Lloyd’s for approval to combine its three fully aligned non-life syndicates under one management.

UK General appoints Vicky Hodgson as COO

UK General has appointed Vicky Hodgson as chief operating officer.

Confused announces Louise O'Shea as CEO following Coriat's departure

Confused has hired Louise O’Shea as its new CEO, taking over from Martin Coriat following his departure from the company in July this year.

Insurers must rethink risk management: Aon

The insurance sector needs to rethink its approach to risk management in order to drive innovation and take advantage of technological change, said Aon's global CEO of analytics.

Home and motor insurers face £100m bill from GDPR

Home and motor insurers are facing an estimated bill of £100m due to not being able to contact historic customers after the General Data Protection Regulation comes into effect next year.

Three motor service providers acquired under new holding group AGL

Three brands in the vehicle repair, claims and technology sectors have been acquired under holding group AGL, which launched today.

Sciemus to rebrand after securing investing partnership

Specialty Lloyd’s managing general agent Sciemus is set to rebrand after securing an investing partnership with HSCM Bermuda.

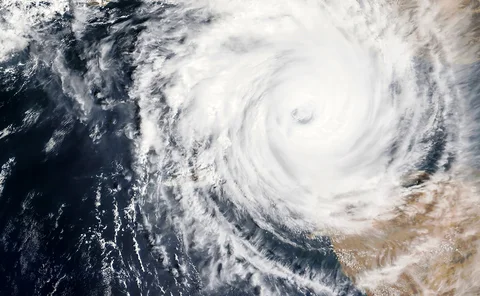

Beale calls for ‘urgent’ flood insurance reform

Hurricane Harvey and Irma both highlight the problem of inadequate flood insurance and need for reform in the United States, Inga Beale has said.

Report: Zhong An wins IPO approval in Hong Kong

Shanghai-headquartered Zhong An, China's largest internet general insurer, has gained approval for a listing on the Hong Kong Stock Exchange.

Lloyd’s catastrophe exposure driving ratings downgrade

The current catastrophe exposure of Lloyd’s has left the market vulnerable, Fitch Ratings has said.

ILS reform could be 'too little too late' for UK, says AM Best

The London Market may have missed its chance to become a centre for insurance-linked securities despite a working structure expected in the next few weeks, said AM Best’s head of Europe.

AIR pegs Irma insured losses at $20bn-$65bn

Hurricane Irma could result in insured losses of $20bn to $65bn, according to a preliminary estimate from AIR Worldwide.

150 jobs at risk in L&G's Hove office

As many as 150 jobs are reportedly at risk as Legal & General plans to move its GI unit from Hove to Birmingham.

Moorhouse appoints Asif John as group director of pricing

Moorhouse Group, which consists of online brokers Construct a Quote, Black & White and Xbroker, has hired Asif John as group director of pricing, actuarial and analytics.

Ogden decision to curb reinsurance pricing rises

Reinsurance pricing will only increase modestly at January renewals as a result of the government’s Ogden announcement.

Lloyd's report pegs Miami windstorm at $131bn as Irma heads for Florida

Hurricane Irma could see industry property losses of $131bn, according Lloyd's realistic disaster scenario analysis.

Government stands by level of broker regulation

The government has stood by the level of regulation levied on non-life insurance brokers in the UK.

Penny James succeeds John Reizenstein as Direct Line CFO

Direct Line has appointed Penny James to succeed John Reizenstein as chief financial officer.

This Month in Post: Discount, diversity and data

There was some good news and some bad news this week for the insurance industry.

LV commits to passing all Ogden savings onto motorists

LV has become the first insurer to commit to passing 100% of savings from the government’s Ogden legislation to motorists.

Aviva could see boost of up to £200m from Ogden discount rate reform

Aviva stands to make a one off gain of between £100m and £200m as a result of any future discount rate revision to 0-1%.

Legal & General partners with SSP to provide quoting platform for home insurance

Legal & General has partnered with SSP to develop a quoting process which uses big data to provide customers with a home insurance quote in 90 seconds.

Connected and autonomous vehicle testing hub receives £100m government investment

A co-ordination hub for connected autonomous vehicle testing has gained £100m in financial backing from the government's Connected Autonomous Vehicle investment programme in order to develop technology.