News

Penny Black's Social World - April 2017

Hockey, helmets, cakes and pancakes

Lloyd’s faces 'structural revolution' as market challenges drive change, says Macquarie

Lloyd’s will undergo a “structural revolution” as digital innovation and alternative capital sources impact the market, according to Macquarie Research.

CNA Hardy appoints David Legassick as head of life sciences

CNA Hardy has appointed David Legassick as head of life sciences, technology and cyber.

MS Amlin first to go live as Lloyd’s opens India platform

Lloyd’s has commenced operations in India with MS Amlin the first syndicate to begin underwriting from 1 April.

Trade credit claim rise 'no need for concern' experts say

The sharp rise in claims paid to businesses due to non-payment is “no need for concern”, experts have claimed.

Ecclesiastical appoints Andrew McIntyre as non-executive director

Ecclesiastical has appointed Andrew McIntyre as a non-executive director to chair the audit committee of Ecclesiastical Insurance Office and Ecclesiastical Insurance Group.

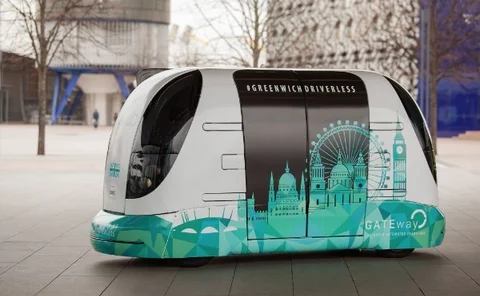

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

Stephen Catlin retires from XL Group

Executive deputy chairman of XL Group Stephen Catlin has retired, effective 31 December 2017.

Trade credit insurers paid equivalent of £4m a week in claims last year

Trade credit insurers paid businesses the equivalent of £4m in claims every week last year.

Cyclone Debbie moves to New Zealand; IAG estimates A$140m loss

As Cyclone Debbie reached New Zealand, Insurance Australia Group estimated A$140m (£85m) of losses while loss adjuster Crawford is using drones to help.

Beale warns on Lloyd's costs and commissions

Following a poor 2016 underwriting performance Lloyd's CEO Inga Beale has warned the market to improve its cost model.

Lloyd's celebrates 20th year in Hong Kong

Lloyd's CEO Inga Beale was in Hong Kong to celebrate 20 years of having an office in the Special Administrative Region.

Admiral drops van panel to sell direct

Admiral will underwrite van insurance directly rather than through its broker business Able and its panel of insurers, the group has revealed.

Willis Towers Watson and AIG launch cyber cover for global airlines

Willis Towers Watson and AIG have created a cyber insurance product designed to combat the emerging risks facing global airlines.

FM Global launches interactive global flood map

FM Global has launched its interactive global flood map for executives and risk managers.

Helios acquires Charmac Underwriting

Helios Underwriting has acquired the Lloyd's limited liability vehicle Charmac Underwriting for £2.24m in cash.

County Group saw 92% profit rise in 2016

The County Group saw a 92% increase in pre-tax profits in 2016, up to £1.1m from £588,041 in the previous year.

Applied Systems completes Biba software house review

Applied Systems has completed the British Insurance Brokers’ Association’s software house review.

Flood Re marks first birthday

Flood Re, the non-profit flood reinsurance scheme, marks its one year anniversary today.

In Depth: Using lie detectors to root out fraud

How broker Only Young Drivers is taking a novel approach to application fraud

Lemonade expands to Illinois six months after New York launch

Lemonade has expanded to Illinois as part of its plans to expand nationwide and reach 97% of the US population by 2017.

Lloyd’s fines Amlin £630,000 for premium trust deed breach

Lloyd’s has fined Amlin Underwriting £630,000 for breaches of the Lloyd’s premium trust deed.

HCML acquires Excell Medical, opens Bristol office

Rehabilitation firm HCML has acquired Excell Medical Reporting, a Medco-registered reporting company, and opened a new office in Bristol.

Reinsurance rate decline slows at April renewals

The 1 April reinsurance renewals saw rate reductions range from flat to mid-single digit reductions, an improvement compared to the low double digit range seen 12 months ago, according to Willis Re.