Lloyd’s/London

Probitas reports ‘best-ever result’ after Aviva acquisition

Aviva’s Lloyd’s vehicle Probitas has reported its “best-ever result” for 2024, posting pre-tax profit of £62m.

New business drives Lloyd’s growth in 2024

Lloyd’s has trailed its 2024 results, revealing that gross written premiums across the market hit £55.5bn by the end of last year.

Carbon Underwriting’s Ferrier wants less conversation and more action

Jacqui Ferrier, founding partner and chief underwriting officer at Carbon Underwriting, observes while conversations around inclusivity have gained momentum, the real focus must be on accelerating progress and not just talking about it.

Beazley CEO says ‘it’s getting more difficult to grow’

Beazley has reported record pre-tax profits of $1.42bn (£1.12bn) for 2024, but is forecasting a slowdown in growth this year as market conditions turn.

Hannah Kate Smith leaves Lloyd’s for Guy Carpenter

Former Lloyd’s of London operations and engagement director Hannah Kate Smith joined Guy Carpenter last month as international head of distribution and market relations.

Lloyd’s predicts potential $2.4trn extreme space weather loss

The latest systemic risk scenario from Lloyd’s and the Cambridge Centre of Risk Studies has revealed that the global economy could be exposed to losses of $2.4trn over five years if a solar storm occurred.

Hiscox hits 2024 UK growth target

The growth of Hiscox’s UK retail business gathered momentum over the course of 2024, finishing the year just within the insurer’s 5% to 15% target range, according to its results announcement.

Throwback Thursday: Cue’s success and Lloyd’s IT puzzle

Insurance Post’s Throwback Thursday returns to February 1995, reminding you what happened this week in insurance history, when Cue was already spotting fraud, and Lloyd’s was struggling with IT.

Settlement reached in Covid event cancellation dispute

A $90m (£71.2m) reinsurance dispute involving several Lloyd’s syndicates over losses incurred by Covid-enforced event cancellations in the US and UK during 2020 and 2021 has been settled.

Big Interview: Consilium’s James Baird and Paul Richards

Scott McGee sits down with Consilium co-CEOs James Baird and Paul Richards to discuss the broker’s rapid growth over the last two years, and why they would need a cow to jump over the moon to consider an acquisition.

Lyons returns to UK as Gallagher specialty CEO

Gallagher has appointed Sarah Lyons as CEO of its London-based specialty division, succeeding Jonathan Turner, who is leaving the post after five years.

Atrium CIO backs AI for broker submission insights

The ability of generative artificial intelligence to provide insight from unstructured data in broker submissions is a key use case for underwriters, according to Atrium chief information officer Justin Emrich, who is soon retiring after 41 years in the…

What to expect from the London market in 2025

Trade Voice: From consolidation to the evolution of specialty lines, Paul Finn, technical author at the London Forum of Insurance Lawyers, runs down the trends we’re likely to see in the London market this year.

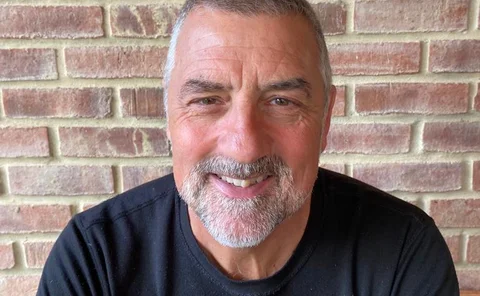

Big Interview: Steve Tooze, Extinction Rebellion

Steve Tooze, spokesperson for climate pressure group Extinction Rebellion, tells Damisola Sulaiman about the group’s motivations for targeting the insurance industry, responds to questions from the companies his organisation has targeted and shares plans…

Convex to launch Lloyd’s syndicate in April

Convex is set to launch a Lloyd’s syndicate later this year, bringing to an end years of speculation about whether the Stephen Catlin-founded insurer would return to the industry veteran’s old stomping ground.

Tackling flood risk: Expert insights to protect your future

In this podcast, Dr.

Enhanced underwriting to grow significantly at Lloyd’s in the next decade

Elizabeth Jenkin, underwriting director at the LMA, outlines why the Lloyd’s market could be on its way to bifurcating between strong leaders and automated followers.

Cliff to succeed Keese as Lloyd’s CFO

Lloyd’s chief financial officer Burkhard Keese is set to step down later this year, to be succeeded by his deputy Alexandra Cliff.

Extinction Rebellion identifies ‘wanted’ CEOs

Extinction Rebellion has targeted five insurance companies in the City of London this morning (30 January).

Two insurers fall short as Gracechurch hands out service awards

18 insurers across the UK regional and London markets have been awarded service quality marques by Gracechurch.

What insurers should do to stop sexual harassment

Analysis: Damisola Sulaiman reviews the progress of trade bodies in responding to the Financial Conduct Authority’s findings on sexual harassment in the industry and explores what steps insurers and brokers can take to prevent abusive incidents and the…

Fitch expects mixed fortunes for UK non-life insurers in 2025

Fitch Ratings has predicted that the UK non-life insurance sector will have mixed fortunes in 2025, with some parts of the market facing an uphill battle to turn a profit.

Ki ‘well on its way’ to using AI

Ki Insurance is “well on its way” to using artificial intelligence in its system, according to CEO Mark Allan.

Blueprint Two build on track for Q1 completion

Lloyd’s deputy chief financial officer Alexandra Cliff has said the technology build for the market’s Blueprint Two modernisation programme is set to complete by the end of Q1.